Amazon is flying high on international growth. With $35.418 billion coming from international retail sales in 2015, the overseas market represents a full one-third of their total revenue of approximately $107 billion for the same period. But is it growing fast enough? And what is the real revenue potential from emerging markets such as India considering that the U.S. market still gives Amazon 20% or more of growth each year?

Why not Amazon China?

A lot of people thought that China would be Amazon’s next big earner when they entered the People’s Republic over 10 years ago. But, unfortunately, their market share is still at a measly 1.1% compared to other e-commerce players. Foremost of those are Alibaba Group and Jingdong.com (JD.com), which practically control the entire electronic retail market in China. So, if Amazon hasn’t been able to penetrate deep into Chinese territory after 10 years in that market, what are their other options?

Enter Amazon India

At a time when India is only just waking up to the magic of online ordering, the industry is still at a fledgling $26 billion. Amazon’s share of that is just $152 million, despite which it is the number one ecommerce site in the Indian subcontinent after having ousted local operator Flipkart from that position earlier this year.

Snapdeal is another large operator with nationwide reach, but both Flipkart and Snapdeal are startups that cannot hope to compete with Amazon’s deep pockets. A recent downgrade on Flipkart by Morgan Stanley will make it even harder now for the company to keep raising funds. Besides, the real problem is that this is currently a loss-making industry because of last-mile delivery, which is the most expensive leg of shipping packages to individual customers.

But what is Amazon India’s real growth potential considering the edge it has over other players? The industry itself is expected to hit $106 billion in the next four years, and Amazon’s numbers reflect that rapid growth.

“We started with 100 seller’s three years ago and now we have over 85,000 sellers growing at 250 per cent year-on-year and adding over 90,000 products a day,” an Amazon India spokesperson told Economic Times

India’s Potential for Growth

Let’s take a look at some numbers behind why India hold so much potential for e-commerce.

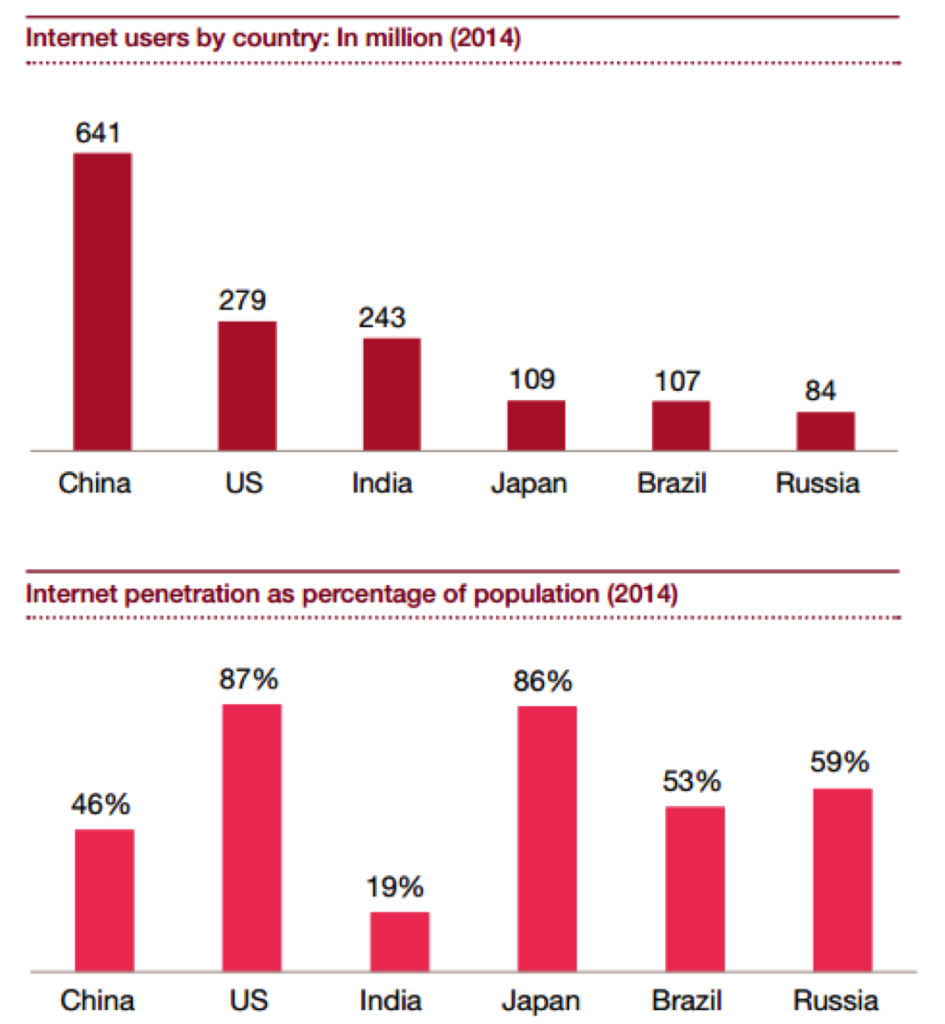

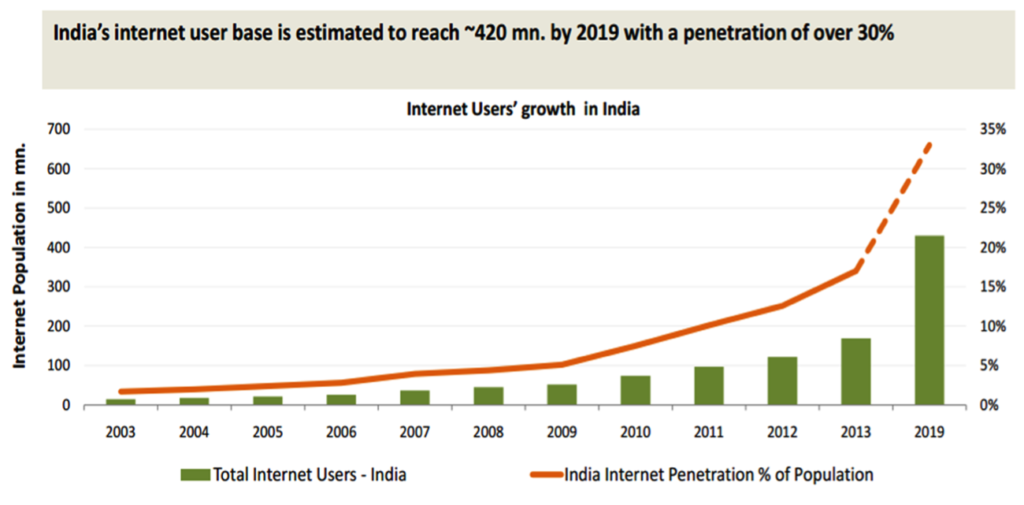

As you can see, internet penetration is extremely low when compared to other countries. However, despite the low penetration, the number of users is now well past the 250 million mark. India’s population is currently around 1.33 billion, so there’s potentially more than a billion people still sitting outside the reach of e-commerce.

Of course, penetration won’t go that high with the kind of disparity present in the Indian economy. However, it is estimated that there will be over 420 million internet users in the next three years.

And that’s exactly the opportunity that Amazon has in India. Reaching out to the nearly 200 million people as soon as they’re online is their ticket to dominating the market, in a sense. And they’re sparing no expense. Aside from launching Prime in India this month, they’re also currently running the Great India Sale. Unlike developed nations like the United States, e-commerce in India will have different peak months, and this is exactly the uncharted waters that Amazon wants to get a handle on for the future.

With such tremendous growth prospects for Amazon, it is clear that India is emerging as possibly the second largest market for the world’s most loved online retailer.