The inevitable progression of any discussion about the cloud industry is first Amazon, then Microsoft and, invariably, Google. As a matter of fact, even Oracle Corp. recently hogged the limelight by throwing an open challenge – actually more of a dictum or prophecy – at No. 1 player Amazon saying their lead is over, and that Oracle would overtake them in the cloud infrastructure space.

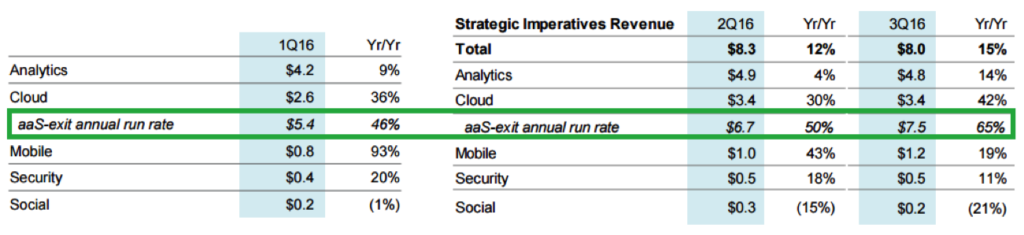

But rarely do people refer to IBM Cloud as being in the same league – and doing quite well, I might add. Why is that? Why is a company that made $3.4 billion this quarter from cloud not included in most cloud conversations?

Why is Everyone Picking on IBM but not Picking IBM?

Part of that blame goes right back to IBM’s messaging to the public at large. Amazon is vociferous enough about its cloud business, Microsoft has been dangling cloud in front of the media for long enough and even Google suddenly showed some energy on that front at the end of last year with Diane Greene taking over its cloud business. But why don’t we hear such things from IBM?

Yes, they religiously put out press release after press release talking about their accomplishments, but rarely do they put their senior-most executives under the media spotlight the way the other companies do. Elon Musk, for example, is practically the Tesla mascot when it comes to the media – even though a lot of major company announcements first come out as a Tweet from his account. Nadella has been a media darling of sorts in recent times, and even Oracle’s Larry Ellison knows how to make the news.

Granted, IBM is not what you would see as a “flashy” or “extrovert” company, but the lack of strong messaging is obviously costing them. How else would you explain the fact that a company that made nearly $10 billion from its Analytics division over the past six months alone slip through the media cracks? An annual Analytics revenue of $18 billion to $20 billion is about three times the size of Salesforce.com and nearly ten times bigger than Twitter.

The sad fact is, we spend more time talking about Twitter and Salesforce than we do about IBM. And that’s just from their analytics business alone. Throw in their cloud infrastructure revenues, Bluemix income and everything else that is delivered over the cloud, and you can see that their business is, in fact, growing.

Unfortunately, that organic growth is being overwhelmed by the fact that IBM is still showing negative growth overall. Now, one could argue that Salesforce is growing at double-digit rates, and that would be justified. But what about Analytics growing 14% in the third quarter over the year-ago period? And why does an as-a-Service revenue run rate growth of 65% YoY fail to impress?

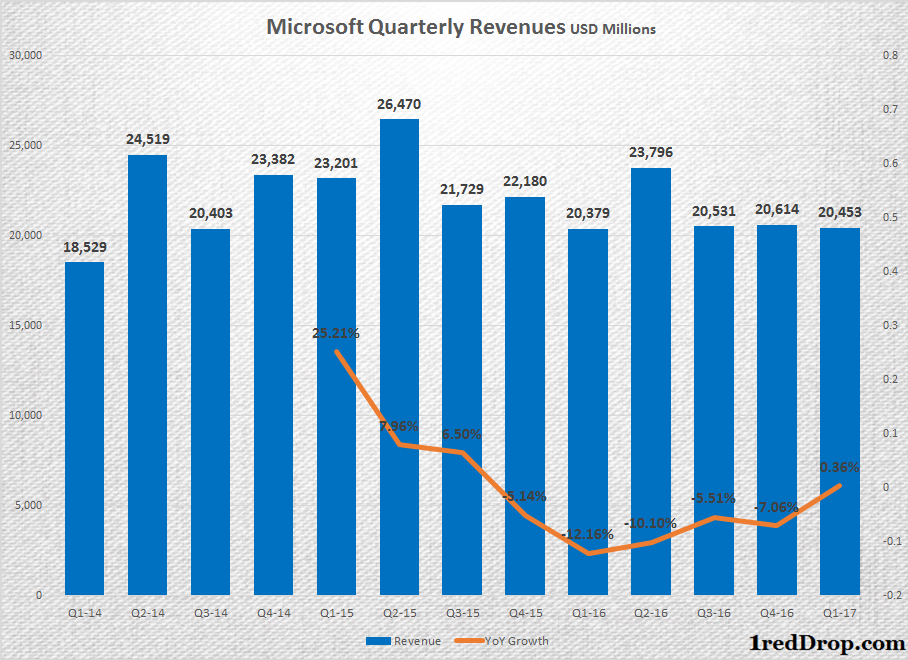

Perhaps it’s because, despite tremendous growth engines at the heart of their new business, their total sales numbers for the quarter barely reached what they netted a year ago. But that argument is shot down when you consider that Microsoft, at their recent earnings call, announced that they made $20.453 billion in Q1-17 over $20.379 the year before.

Microsoft Quarterly Revenue Growth from Q1-14 through Q1-17 – 13 quarters

That’s barely $74 million more than they made in Q1-16, but just look at the difference in the two companies’ stock movement before and after their respective earnings calls.

The dichotomy between how investors look at each company is clear from the way their stocks reacted to their respective earnings releases. Both companies are going through a very similar time of transformation, and both are very close to showing stable growth once again, but you can see how the market reacted to IBM’s earnings versus Microsoft’s earnings.

So, not only are their achievements not being adequately covered by popular media, but (possibly) as a result, investor sentiment is somewhere between merciless and ruthless. And one of the biggest reasons is that the company is unable to direct investor and media attention towards the growing parts of their business over declining parts.

And IBM, unfortunately, has no one but themselves to blame for this state of affairs.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.