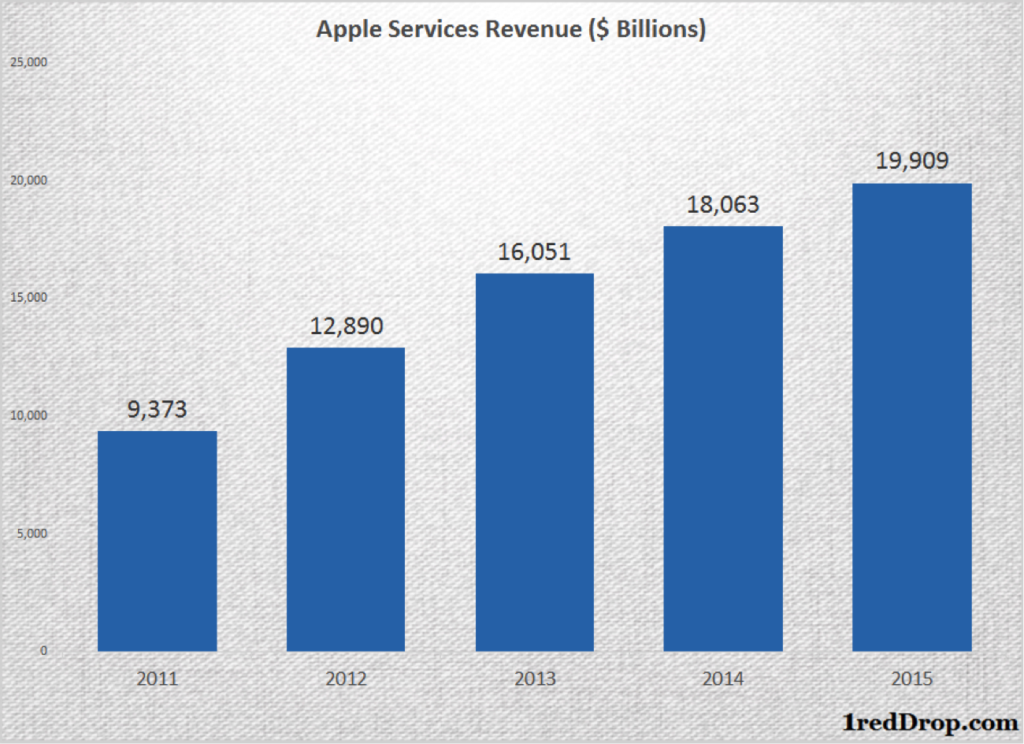

Apple’s services segment has been growing at a decent pace in the last five years, and the iPhone maker’s services portfolio is now worth nearly $20 billion in annual sales. That’s a number that would have made any company happy. Take Microsoft, for example: every discussion about Microsoft would invariably lead to how the company is planning to hit $20 billion in cloud revenues by 2020. But when we talk about Apple, most of our discussion will revolve around how much iPhone sales might decline next year.

Apple’s past success is its own enemy. iPhone unit sales have grown from a nothing to 231 million units in the last ten years, and Apple’s annual revenue hit $215 billion last year. Apple services account for a mere 10% of their overall sales numbers, and the pace of growth – 10.21% last year – is not something investors are going to cheer about because it is simply not big enough to cover for declining device sales.

Services can be the one segment that can help Apple gain more stability in the long term. Most of us know that smartphone sales cannot keep growing at double-digit rates forever. Apple either has to find new products to push into our hands, or find a way to monetize its millions of users worldwide.

How Many Users Does Apple Actually Have?

Though there are no clear estimates about how many Apple users are there around the world we can at least try and guesstimate that number. Apple this year announced that the company reached a huge milestone of one billion active devices, which includes iPhones, iPads, Macs and Apple Watch. If we assume each user to have at least two devices, that would put Apple’s user base above 500 million. Our estimate is somewhere between 700 million and 800 million users.

The Spending Power of Apple Users

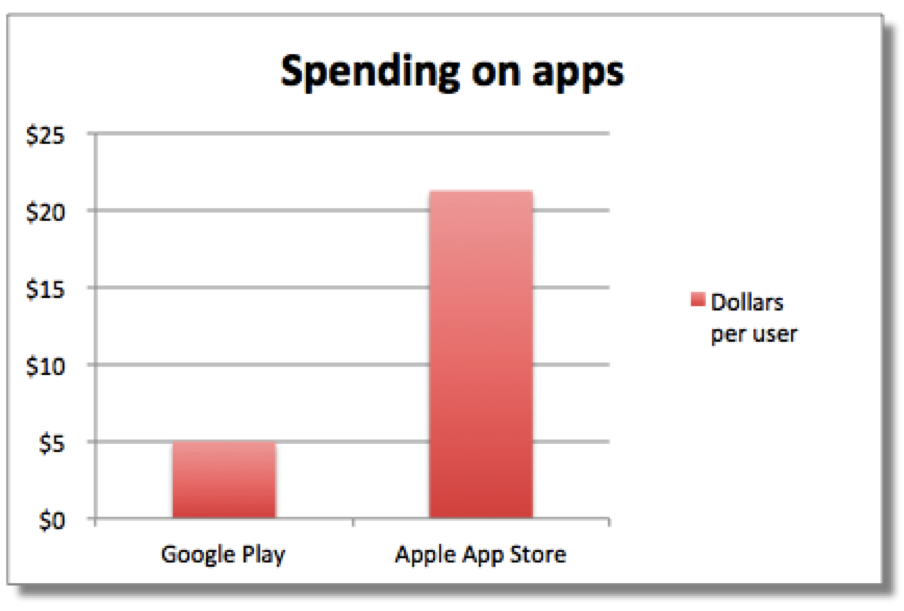

Being a luxury segment operator, Apple’s user base definitely has the spending power to take Apple to the next level. You can already see it in the way they spend on apps, compared to Android users.

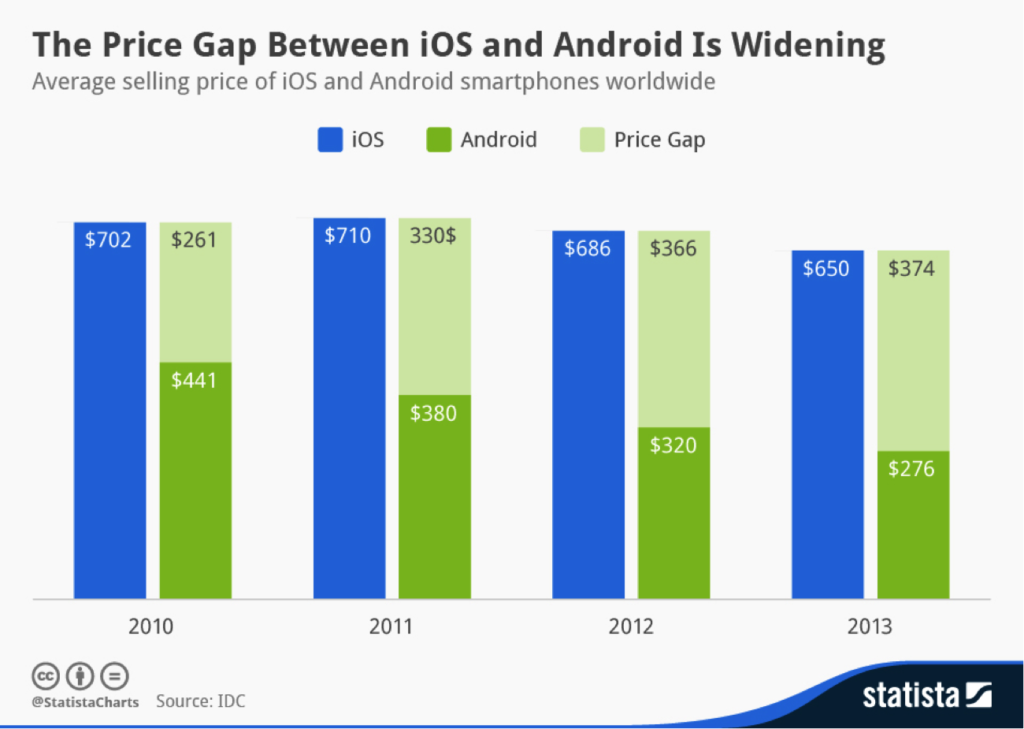

According to a report by Fortune, Apple users spend four times

more than Android’s, and it’s not really a surprise considering iPhones cost, on average between two and three times more than the average Android smartphone.

“Android phones average $250-$300 where iPhone average $600 – people who choose to spend the extra money are sending a signal about their intents” – Forbes

“In 2015, they estimate that the average iOS device generated $52 in Apple App Store “bookings,” or sales. The average Android phone only generated $5.70 for the Google Play store.

That means the average Apple device spent 9.1 times more on App Store apps and in-app purchases than the average Android user spent on the Google Play app store. That ratio is up from 2014, when the average Apple device spent 7.7 times more than Android devices on apps from the main app stores.” – AppleWorld

Can Apple Leverage This User Base Spending Power Somehow Through Apple Services?

This is obviously great news for Apple’s future in the services segment. As a luxury segment player in control of the “affluent minority”, Apple will be able to generate a lot more money than comparable services offered by other companies. But unfortunately, Apple has been very late to the ‘ecosystem game’ that Google has already mastered.

Let me elaborate…

Google has created a plethora of services and applications around its search and advertising businesses. From Google Maps to Gmail to YouTube to…you get the point. Everything they do points back either to their search engine or their advertising channels. That’s why they’re making nearly $20 billion in advertising revenues every quarter, and nothing else seems to matter.

Apple, however, has Apple Music, iTunes, Apple Maps and Apple Pay as the only notable efforts from Apple services. But not all of them represent significant earnings yet. So, there is plenty more that the company should be able to do. They have a long way to go to catch up on the software side of things, and really need to step up their game. If they create an ecosystem of Apple services that can keep feeding off of each other the way Google has successfully shown, then their services segment can easily grow many times over the current level.

The Hunt for an iPhone Revenue Replacement is On

As of today, of all Apple services, Apple Pay seems to be the only glimmer of hope that points towards that goal. Though the entire services segment only accounts for about a tenth of iPhone sales and a much smaller percentage of total device sales, it has the potential to grow into something huge. Apple Pay is now the fifth largest payments platform in the world, with only PayPal’s several services and one more company ahead of them. The market potential is massive and Apple Pay has the means to make it happen.

ALSO READ: Apple Pay is Now the 5th Largest Payments Platform

They’ve recently opened up to Japan, and have even adopted the local payments standard FeliCa in an attempt to woo their Japanese user base. We’ll have to see how far that can take them, but that’s just one country. If they can push harder on Apple Pay in more developed markets, they should be able to make significant gains in the next five to ten years.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.