Facebook’ third quarter results were a blowout in many ways. Revenue grew by more than 59% during the quarter, profits jumped by a whopping 166% and operating margin expanded to 45%. And the list can go on, but there was one key metric that I’d like to explore in some depth because it’s something that investors as well as the media seems to have missed from what Facebook warned about in 2014.

During the third quarter of the current fiscal Facebook’s mobile advertising revenues accounted for 84% of their advertising revenue. In FY 2014, mobile advertising revenues accounted for 65% of total advertising revenue, and that figure was 45% in 2013. Facebook now hardly makes any money from desktop views as the percentage of mobile advertising revenues towards overall revenue keeps getting bigger and bigger.

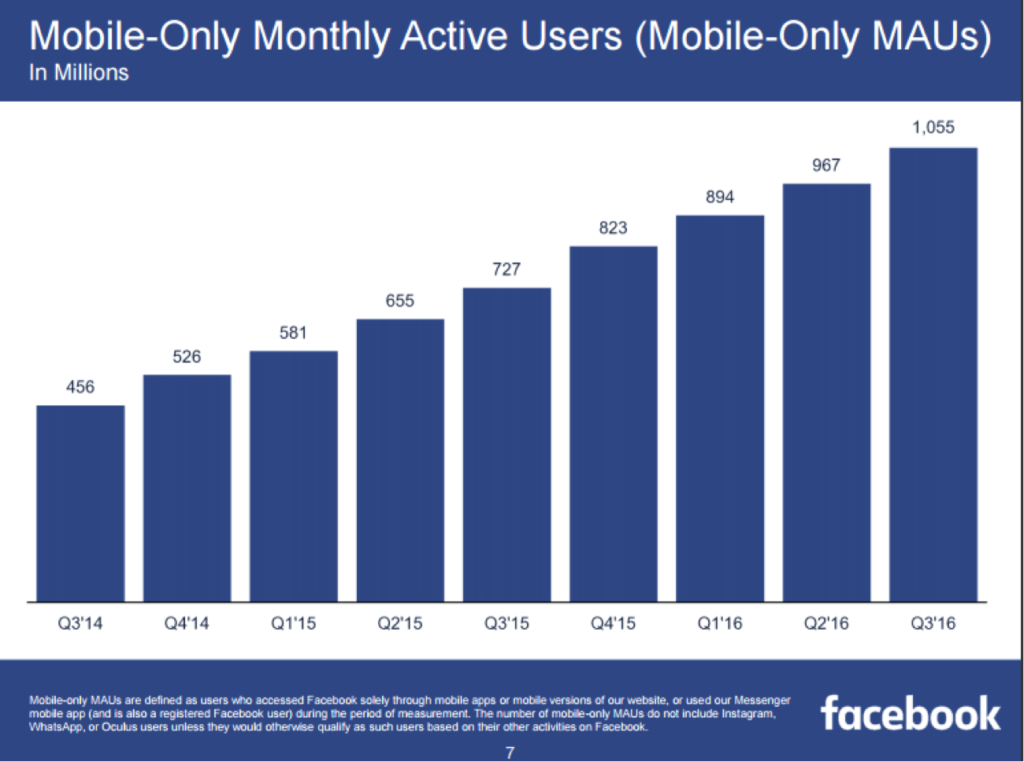

What’s more interesting is that Facebook’s mobile-only monthly active users – people who accessed Facebook exclusively through their mobile device – has now crossed one billion users. Facebook’s total MAUs for the third quarter were 1.788 billion, and if 1.055 billion of those users accessed the site exclusively on mobile, it’s fair to say that Facebook is rapidly becoming a mobile-focused application.

The word has irrevocably shifted towards mobile devices and, as a result, PC shipments around the world kept sliding year after year ever since they peaked in 2011.

That brings us to a very intriguing point that Facebook made back in 2014 that a lot of investors seem to have forgotten about because of the hectic growth that followed. But I’d like to take you back to that moment for a minute.

In their 2014 Annual Report, Facebook made this statement:

“While most of our mobile users also access Facebook through personal computers, we anticipate that growth in mobile users will continue to be the driver of our growth for the foreseeable future and that usage through personal computers will continue to decline worldwide, including in key markets such as the United States and other developed markets in Europe and Asia.

While our mobile advertising revenue continues to grow and comprised over half of our overall advertising revenue in the third quarter of 2014, the mobile advertising market remains an evolving market. In addition, we do not currently offer our Payments infrastructure to applications on mobile devices.

If users continue to access Facebook mobile products as a substitute for access through personal computers, and if we are unable to continue to grow mobile revenues or successfully monetize mobile users, or if we incur excessive expenses in these efforts, our financial performance and ability to grow revenue would be negatively affected.“

Facebook had cautioned investors then, saying that if the company is not able to monetize the shift to mobile than their earnings may suffer. But fortunately for the company, the exact opposite has happened since then. Its mobile user base kept growing while worldwide ARPU expanded massively, and all of this happened as mobile’s share of advertising revenues kept getting bigger and bigger.

The Case for Facebook’s Continued Growth

The question now is not about Facebook reaching their ad load peak. Rather, it’s about effective monetization of mobile usage. And that’s a completely different issue than the one investors – and the media, for that matter – are focusing on.

Facebook’s stock price dropped marginally after their earnings call because investors possibly though that Facebook’s growth era has come to an end, and some of them panicked. As you can see from their gains despite the shift to mobile, that might not be the case at all. What it does look like is that Facebook’s revenue growth is, to a great extent, resilient to the global shift to mobile. That’s a good thing for the company.

Don’t get me wrong; I’m not discounting the fact that the ad load peak will play a role in limited their ad revenues moving forward. But my opinion is that Facebook will find a way to better monetize its mobile views. And by creating more standalone apps, they increase user engagement, which is a critical driver of revenue growth. They’re already on that path in a very aggressive way, but it’s just beginning. For example, in September of this year they integrated payments on Facebook Messenger through chat bots, of which they now have a whopping 30,000.

Between getting better at mobile monetization and developing more standalone apps that can further be monetized, Facebook still has a significant upside.

And that’s the big angle most investors are missing, in my opinion. We may see some short to medium-term slowing down of ad revenue growth, but in the long run I strongly feel that this is a hurdle that Facebook can overcome.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.