2016 is shaping up to be the year that mobile payment and mobile wallet brands really take off. This year saw several tech majors – Apple, Google and Samsung – step up their digital wallet initiatives and take it to the next level, and the online payments segment leader PayPal seems to have made rapid strides in this area. Through acquisitions and by launching several new services on Venmo, it’s digital mobile payment platform, PayPal has further strengthened its presence in this domain.

Here are some interesting stats around how mobile payments are growing against total online payments. New data shows that mobile devices contributed to more than 30% of total payment volume on Thanksgiving as well as Black Friday, and that’s not a survey-based result. The data is from 192 online shoppers and 15 million merchant accounts that are on PayPal’s network.

But that’s not all: Thanksgiving shopping volume hit an amazing rate of $10,781 per second, the average consumer spending $58.51. The biggest single purchase on the day was close to $100,000, nearly 25% bigger than the biggest order on Black Friday. That means Thanksgiving is evolving into a special shopping day in its own right.

What Does Mobile Payments Growth Mean for PayPal?

This year had some record-breaking numbers on all the shopping days – Thanksgiving, Black Friday and Cyber Monday. What’s significant is that a third of this volume happened on mobile phones. That’s great news, not only for PayPal, but every digital wallet operator in the U.S. market. The fact that shopping volume grew from last year while mobile payments stayed at the 30%+ level means mobile wallets are also being used by more people this year.

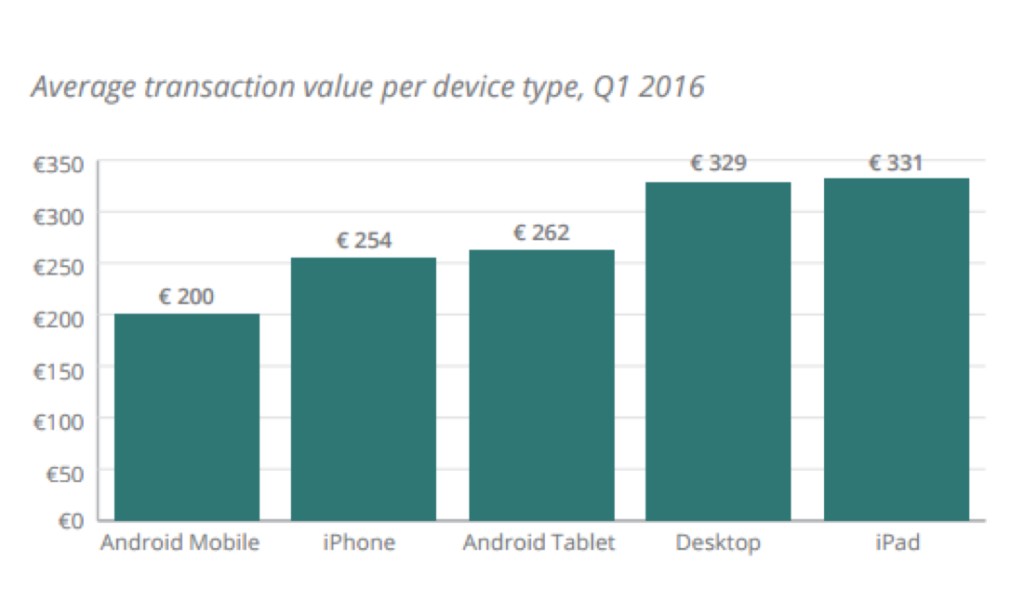

Global payments technology company Adyen tracks this using the Mobile Payments Index, and shows that the mobile share of payments grew from 30% last year to 34% this year.

All of this points to one outcome. If PayPal’s growth in merchant services keeps growing, and mobile transactions grow in tandem with it, in a few years PayPal could end up at the top of the payments world – above even major card companies. PayPal already has a head start over Apple, Google and Samsung in this space but, with the kind of growth they’ve been seeing over the last few quarters, it won’t be surprising to see them increase the lead they currently enjoy.

Source: Adyen

The second largest beneficiary of this development will be Apple. Its product positioning in the premium segment will give them a distinct advantage over other players, and we’ll see this play out as well over the next few years. Surprisingly, Android’s ecosystem is also generating significant transaction volume, but the problem for Google is that it is extremely fragmented.

In the final analysis, it looks like the mobile payments world will gradually evolve into a PayPal-Apple duopoly, with every other company fighting for scraps. That might take years to happen, but we should be able to see the signs in PayPal’s TPV and merchant services growth, and in Apple’s services segment growth year-over-year.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.