Apple launched Apple Pay in Spain today, supporting cards from partner institutions Banco Santander, Carrefour, Ticket Restaurants and American Express. Apple Pay was first launched in the United States in October 2014, and in a little over two years the iPhone maker has steadily rolled out its mobile wallet out to 12 more countries. In Europe, Spain will be the fourth country after United Kingdom, Switzerland and France to get access to Apple Pay.

International roll out has gained a lot of momentum in the last twelve months. By the end of 2014 Apple Pay was available only in the United States and the United Kingdom, and Apple followed it up by adding Canada and China to the list in 2015. But in 2016, Apple Pay launched in 9 more countries. The speed up seems to be spurred by the sudden increase in competition in the mobile wallet space, as well as a slowdown in smartphone sales around the world.

Samsung Pay was launched in August 2015, while Google launched Android Pay in September 2015. PayPal, which was already in the space, did the unthinkable and joined hands with plastic card makers Visa and Mastercard even as all other mobile wallet providers decided to work with them instead of against them. The mobile wallet industry did see a lot action in 2016, and the fight for the top spot looks a bit more like a fight between these four companies.

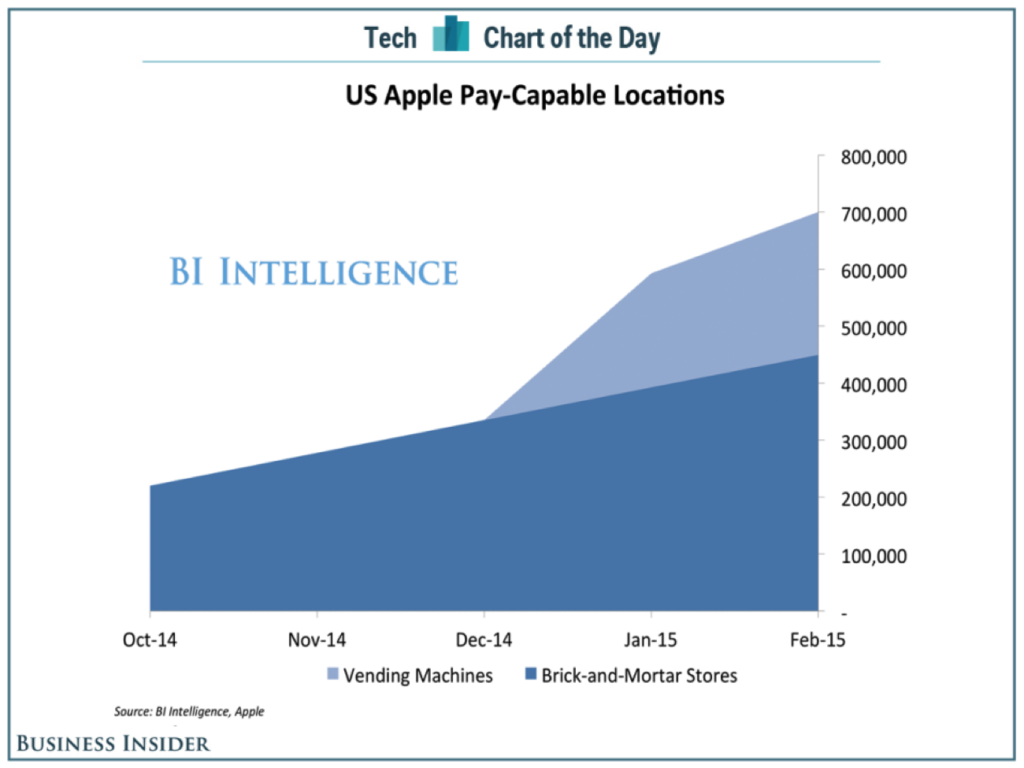

But there are plenty of reasons to believe that Apple Pay and PayPal to soon become the contenders for the top spot in the digital wallet race. Since its launch in the U.S., Apple Pay-capable locations have steadily been increasing.

But all’s not well in the Apple Pay international rollout plan…at least, not in Australia. Earlier this year the company faced difficulties in the continent nation. Three of the largest banks and a smaller bank applied to regulators that Apple’s policy was a violation of antitrust regulations, the reason being Apple Pay does not allow third party apps to access its devices’ NFC capability. That means if you install another mobile wallet app on the new iPhone 7, it won’t be able to process payments using NFC. The banks’ stand was that Apple allows other apps to access features like WiFi and Bluetooth, so why not NFC? They argued that this type of behavior was anticompetitive.

The issue is along the lines of what the EU is accusing Google of doing with Android in Europe, but there’s a big difference. In the case of Android phones, the user decides what apps to keep and which to discard/uninstall. The iPhone is very similar, but by locking up the NFC feature to other apps, Apple is being accused of favoring its own Apple Pay over other mobile wallet systems. Apple, on its part, argues that opening up the technology to third-party app makers will compromise their customers’ privacy and the security of their data.

The decision by regulators will only come in March, but whether right or wrong, this is an issue that Apple will have to dig deeper into and find a solution for.

Meanwhile, Apple Pay continues to roll out to new countries in an effort to expand its presence and boost its services revenues, under which segment Apple Pay income is recorded.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.