The Internet plays a major role in our lives, there’s no doubt about it. It has irrevocably changed the way we live and the way we work. It has upended several industries and will upend even more in the future. The Internet made online payments possible, without which the massive e-commerce industry we take for granted today could never have existed. As the world moves away from desktops to mobile devices, we’re going to see several more sweeping changes in the next decade.

To start, with let’s take a closer look at our social media darlings, Facebook and Twitter, and how their sales are being impacted by the smartphone shift.

Sorry, Gone Fishing Mobile!

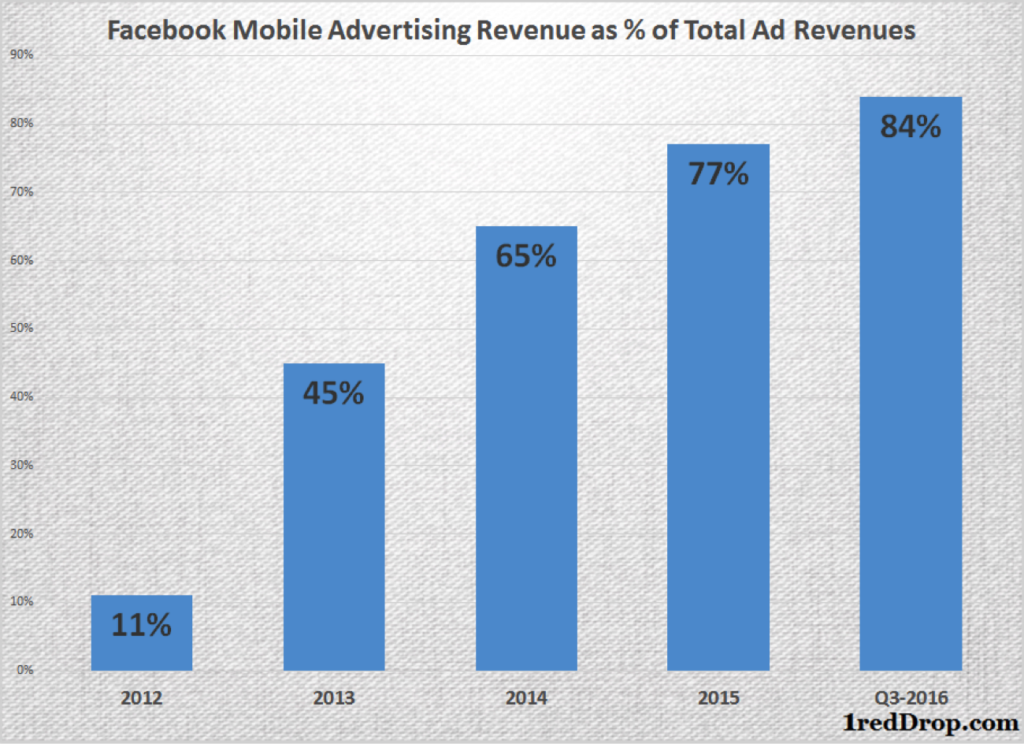

During the most recent quarter mobile advertising accounted for 84% of Facebook’s advertising revenues. In 2012, that same figure was at 11%. Facebook didn’t offer mobile advertising as an option prior to the first quarter of 2012, so one might argue that rapid growth was inevitable.

That argument might have been valid if mobile ad revenues surged, achieved parity with desktop-based revenues and then grew in lock-step for the rest of the period. No, what happened was that it surged, continued to surge and now nearly completely eclipses the revenue that Facebook gets from desktop ads.

In fact, the shift was so tectonic that it forced the company to prioritize mobile technologies instead of further developing their desktop application’s capabilities.

Twitter is pretty much the same now, with 90% of its revenue coming from mobile advertising as of the third quarter of the current fiscal.

As companies like Facebook and Twitter focus their spending towards mobile devices, technology is only going to further develop in that direction, dragging more and more businesses along with it. As businesses gravitate towards that model, it will start pulling even more consumers towards it.

But consumers are already there, and that’s the reason why mobile advertising is pulling so much revenue for Facebook. The big problem, however, is that consumers still aren’t comfortable enough taking their payments mobile. They want their shopping there, but not their payments, which is a strange predicament to be in.

According to Adyen, only one-third of all online payments were conducted over mobile devices. That’s odd, especially at a time of high smartphone penetration coupled with strong e-commerce growth.

What was missing – and still is, for most people – is a payment system that works seamlessly with their mobile experience. One that is as secure, as reliable and as convenient as pulling out a card and filling in the details online – but purely as a mobile endeavor. Why? Because typing your credit card details into a device with a keyboard smaller than your hand can’t be that much fun!

That brings us to the next question: Despite being around for several years, why haven’t mobile wallets taken off in a big way? The truth is, they are.

The Real Growth Story behind Mobile Wallets

The entry of digital wallets (mobile wallets) is slowly changing the equation, but it’s only over the past two years that big companies are throwing their money and their weight behind it. Apple, PayPal, Google and Samsung have only just gotten serious about mobile payment processing, and it’s not because the technologies were lacking. It’s primarily because it is now a fast-growing market, and each wants a lion’s share of it.

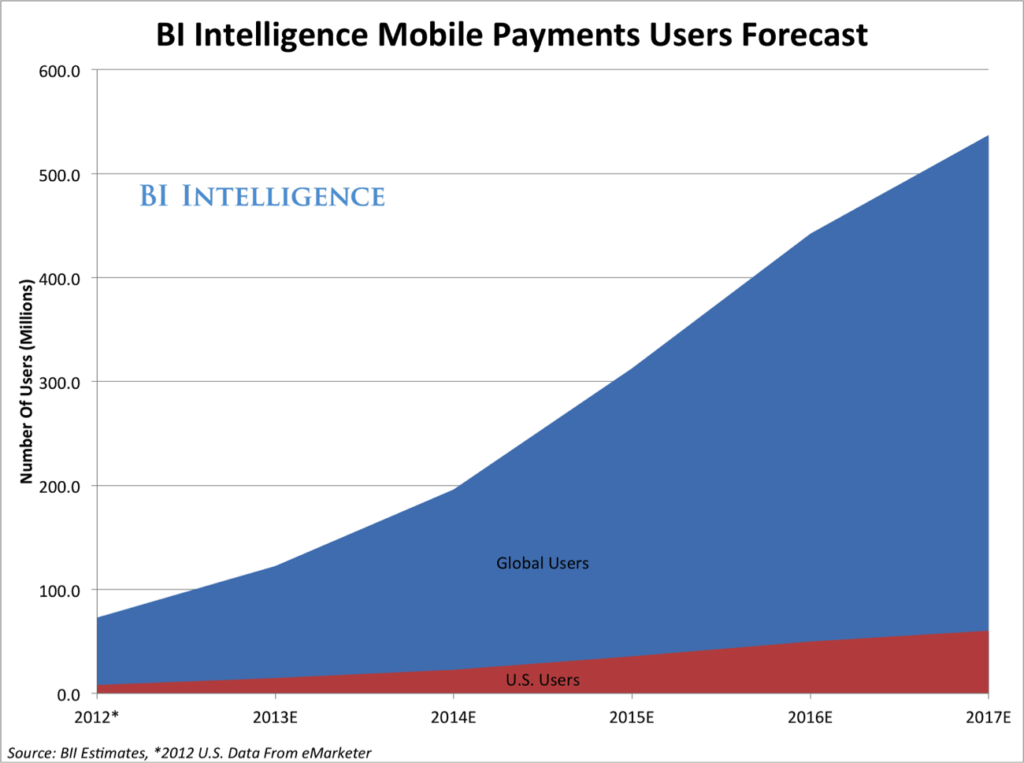

As you can see, the biggest growth is actually coming from outside the United States. As more advertising dollars are spent on mobile audiences, it will result in more engagement and more transactions, until mobile payments finally catch up with web payments – and, more importantly, surpass them.

It’s going to play out just like it did for Facebook. Once they opened the mobile floodgates, the revenue started gushing in, and soon inundated whatever they were making from desktop ads.

That’s exactly the way it will play out for mobile wallets, but over a longer time frame. The audience is already there, the technologies are now secure enough and robust enough to support reliable mobile payments, and the companies are now supporting it with all their resources.

What we will see now is a steady uptick in mobile payments versus web payments until mobile payments completely dominate the online payments space. That’s why Apple is in there with their billion users; that’s why PayPal is in there with mobile social payments platform Venmo; That’s why Samsung is there with its strength in mobile devices; and that’s also why Google is there with its Android dominance.

The One Hurdle that Still Remains

Users need to get more comfortable with mobile payments. They need to start pulling out their smartphones at the store, rather than their credit cards. It’s a cultural and psychological shift that isn’t going to happen overnight. But it will happen, because consumers are spending the bulk of their online time on mobile devices, anyway.

What remains to be done is for companies to keep promoting the technology as a better alternative to existing payment methods, and keep making it easier for merchants to start accepting it as a de facto payment method in-store as well as online.

A wave of the phone and a tap of the finger is all it should take. We’re already there, but the masses have to adopt it. It is only when tap and pay or wave and pay become second nature, like pulling out a card and handing it to the cashier, will that shift truly happen, further pushing desktop payments and PCs into an area reserved purely for commercial applications.

This is the last barrier to the growth of mobile wallets and, in many ways, the only barrier left standing.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.