As the shift from desktop to smartphone usage continues, the payments industry is also evolving at a rapid pace. Over the last several years, internet growth, e-commerce expansion and smartphone penetration have colluded to force the payments industry to take on new directions.

While web-based payments have already made the transition from desktop to mobile, payment methods unique to mobile devices – the mobile wallet – is only now coming to the forefront of the payments industry. Companies like Apple, Samsung and Google are now pushing hard to get their respective mobile wallet products to be adopted by more people, and one of the key changes in the recent past is that all of them have decided to work with rather than against the major card companies of the world – Visa, MasterCard and American Express.

Why are they piggybacking on their competitors rather than evolving new systems independent of them?

One of the reasons is that these three companies have already thoroughly penetrated key markets over the past several decades. They have a ready infrastructure and a globally accepted system that’s just far more convenient and simpler than anything else.

For the technology majors, this represents the perfect opportunity to synergize. And for the card companies, the partnership gives them additional revenue channels, plus the means to fend off any disruption to their own core revenues.

This is truly a symbiotic relationship because each group depends on the strengths of the other to fill the gaps in their own reach and capability, and both groups benefit in the process. The technology of mobile wallets is certainly disruptive, and it would have affected both groups adversely if they had alienated each other.

Moreover, huge swathes of customers would have been offered a confusing choice of online payments – one set from card companies and another from tech companies.

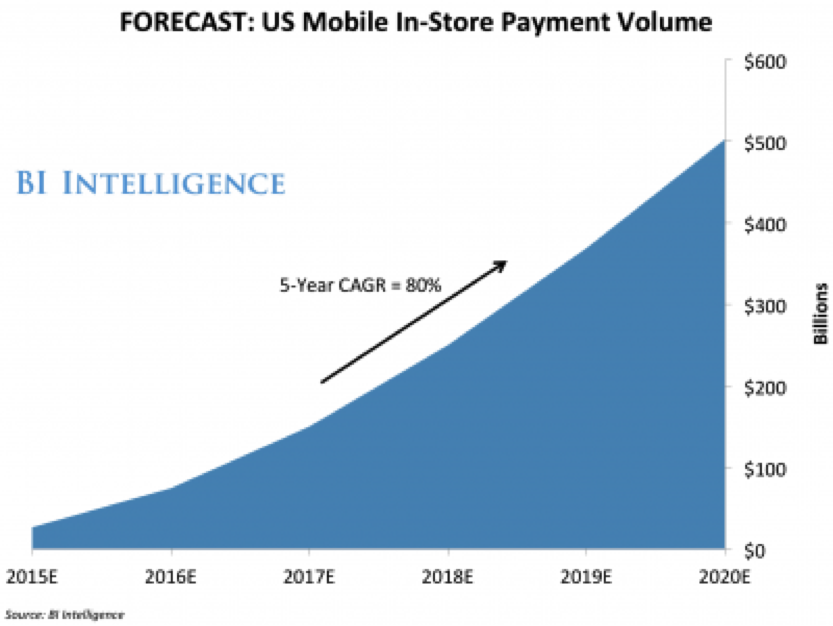

Another important factor to keep in mind is that, at an expected 5-year CAGR of 80%, there’s more than adequate room for several large companies in this space. This mobile wallet alliance between tech and card companies will ensure that all of them grow, preventing any sort of monopolization that could lead to antitrust issues down the road.

Moreover, each of them has a massive user base. The card companies, of course, have their issued card base; Apple has its device user base of one billion; same for Samsung; and Google can easily leverage its dominant Android mobile operating system.

This combined user base of device owners, cardholders and OS users essentially represents the entire mobile payments market potential.

For all these reasons, a close partnership between card companies and technology majors is an important driving factor for the payments industry as a whole.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.