Amazon will be reporting its fourth quarter earnings on Thursday, February 2, 2017, after the market close. Our cloud eyes will be firmly fixed on how much revenue Amazon Web Services – the most profitable unit of Amazon – makes during the quarter.

Microsoft, Amazon’s closest rival, announced during the recent second quarter 2017 earnings that their annualized commercial cloud revenue run rate has gone past $14 billion.

Microsoft calculates its cloud run rate by multiplying its cloud revenue for the latest month of the reported quarter into 12. Microsoft’s run rate at the end of first quarter 2017 (July-Aug-Sept 2016) was $13 billion, implying September commercialized cloud revenues of $1.08 billion, while run rate at the end of second quarter (Oct-Nov-Dec 2016) was $14 billion, or $1.16 billion in December.

If we take the midpoint of $1.08 and $1.16 billion and multiply that by three, Microsoft will have made approximately $3.3 billion in Q2.

IBM has already declared its cloud revenues for the quarter, and their numbers show strong growth in cloud but even more significant growth in analytics.

All that remains now is for cloud infrastructure segment leader AWS to throw its numbers into Amazon’s earnings announcement on February 2.

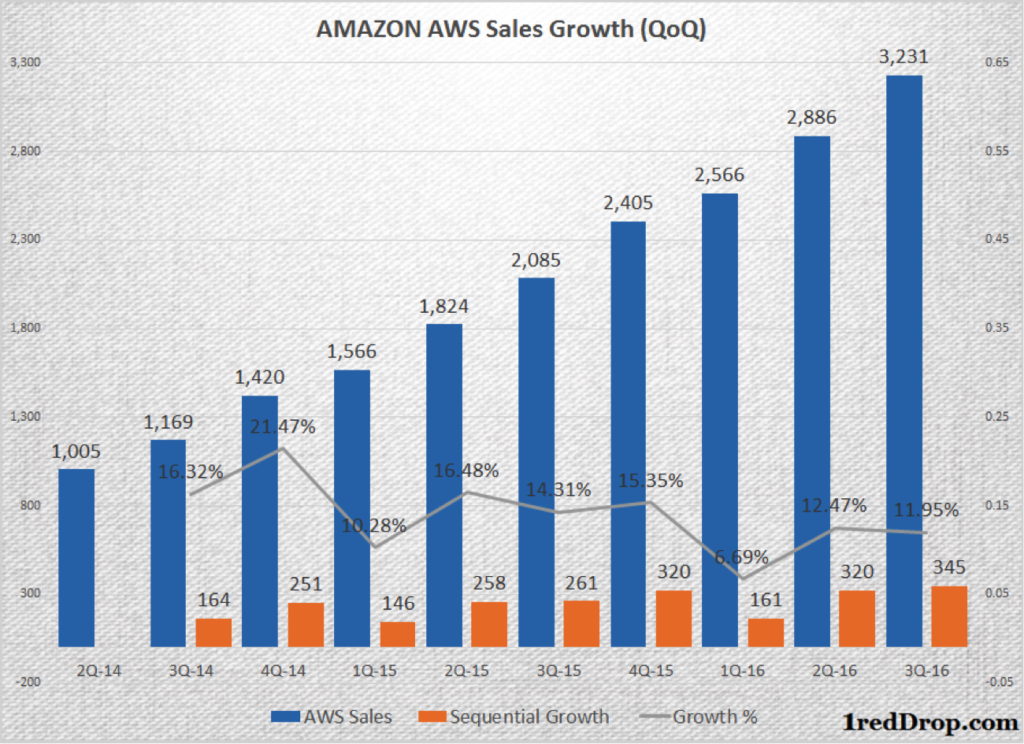

Amazon reported $3.231 billion from AWS during its third quarter 2016 (July-Aug-Sept), which means it leads Microsoft by a nose in the cloud race. I foresee things to be that way for a while longer, and there are several reasons why.

For starters, the Infrastructure as a Service (IaaS) industry is forecasted by IDC to grow more than 28% every year. It’s already estimated at $22 billion for 2016, and will continue to grow steadily through 2020. Amazon has always kept its focus laser-like on IaaS and has shown consistent growth above the industry average.

Amazon Web Services is growing so fast that even on a sequential basis – from one quarter to the next – their revenue is increasing in the order of a couple of hundred million dollars for more than two years now. If you look closely at the chart above you might notice that fourth quarter sequential increase has generally been higher than their third quarter one.

There’s every reason to believe Amazon will easily cross $3.5 billion in AWS cloud revenues when they announce their fourth quarter results.

That brings them to a run rate in excess of $14 billion, once again putting them a nose length ahead of Microsoft in terms of cloud earnings.

The unique nature of Amazon’s cloud business is that it is limited to the confines of cloud infrastructure. Of course, they have their PaaS and SaaS components as well, but they’ve unwaveringly stayed on the growth path when it comes to IaaS.

We do expect Microsoft to become a bigger cloud player than Amazon in the long term because, in addition to Azure infrastructure services, they have an actively growing SaaS portfolio that AWS will never be able to match.

But when it comes to IaaS, Amazon will continue to dominate the landscape for possibly a long time. And we’ll see strong evidence of that during their fourth quarter earnings call.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.