The cloud computing industry surged strongly in 2016, and if the last quarter of 2016 is anything to go by, 2017 holds a lot of promise for the segment as a whole, especially for the top three cloud service providers Amazon, Microsoft and IBM, as well as vertical SaaS players such as Salesforce.

First let’s take a closer look at the latest quarterly numbers from the triumvirate of cloud computing: Amazon, Microsoft and IBM.

Amazon and Microsoft continue their battle for supremacy, with both the companies posting annualized run rates in excess of $14 billion during the latest quarter.

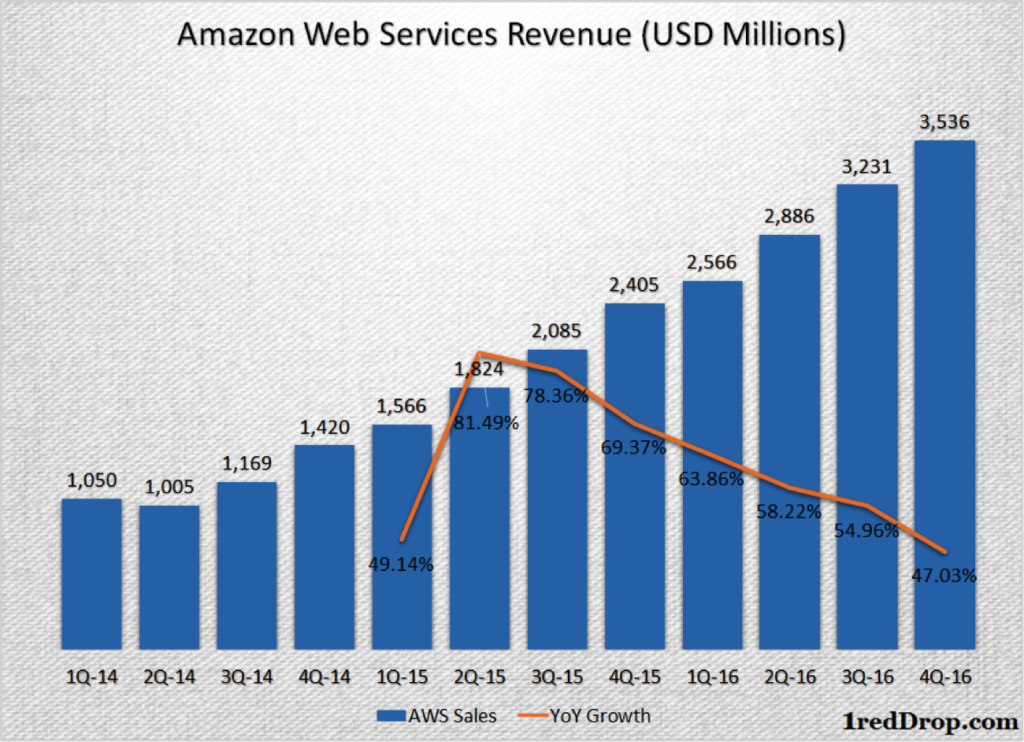

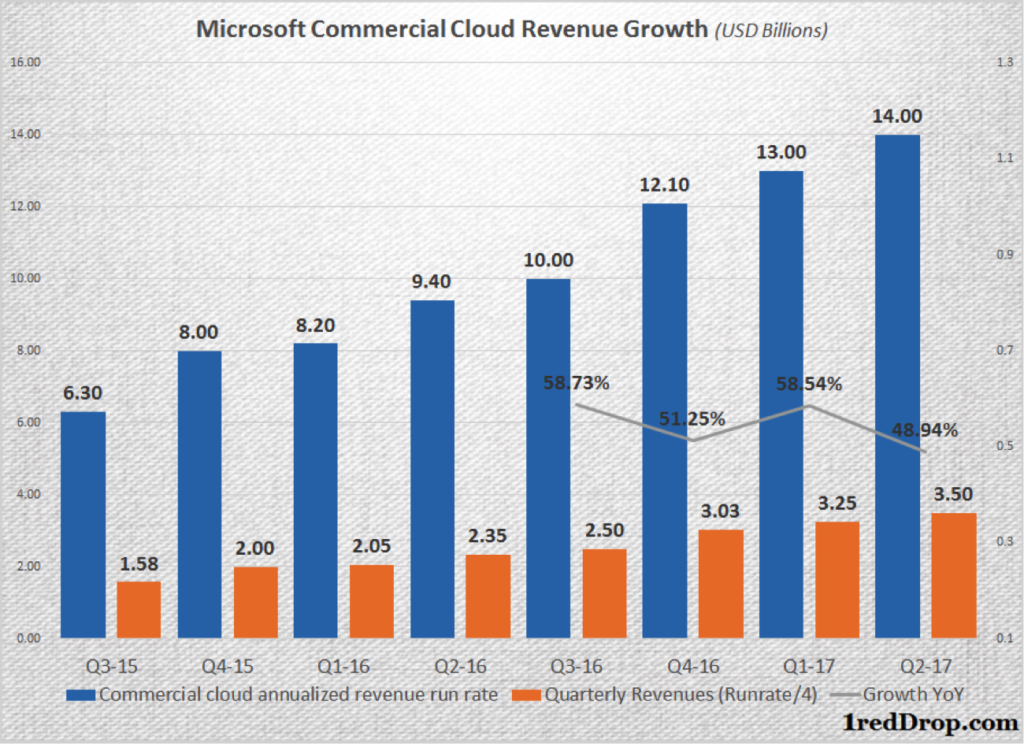

Amazon reported $3.536 billion in revenues during the fourth quarter of 2016 (October 2016-December 2016), while Microsoft – which does not break out its quarterly revenue collection from cloud products – reported that their annualized commercial cloud run rate exceeded $14 billion by the end of the second quarter 2017 (October 2016-December 2016).

Amazon and Microsoft seem to be running neck and neck when it comes to their earnings from cloud, and both of them have seen their cloud revenue streams grow sequentially throughout 2016.

Growth numbers are down a bit compared to what these companies were reporting in 2015. But to be fair, before 2015, quarterly revenues were less than $1.5 billion. And now they’ve edged past twice that amount. As they get bigger and bigger the rate of growth has to come down, but when?

The good news is, at near-50% year over year growth and strong sequential increase coming in throughout 2016, the days of mature, single digit growth seems light years away for Amazon and Microsoft at this point in time.

Both these companies stayed true to their strengths. Amazon pushed hard on the infrastructure segment. Microsoft added service after service to its lead SaaS product Office 365, doubled down on its enterprise software ambitions with Dynamics 365 and maintained triple digit growth speeds with Microsoft Azure in the first three quarters. It was only during the fourth quarter that Microsoft Azure only grew 93% compared to prior period, but that is still an impressive year over year number.

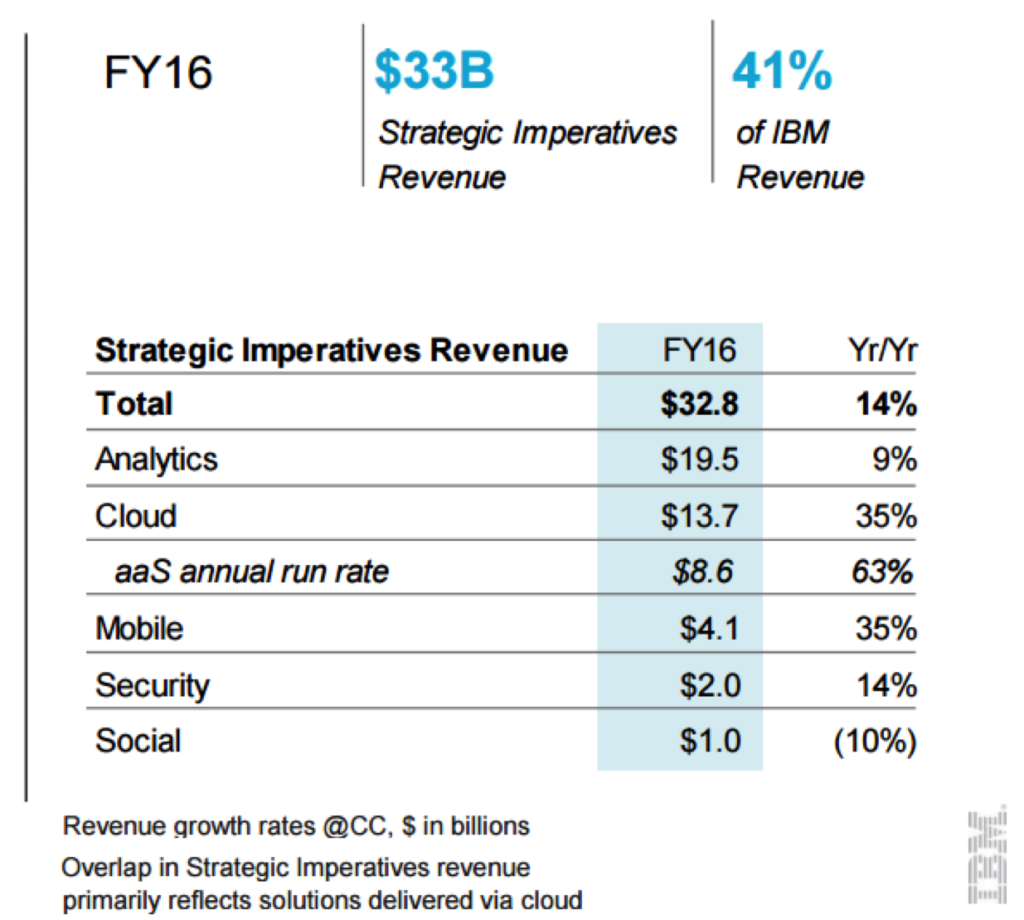

Meanwhile, the hybrid-cloud-focused IBM saw its analytics segment grow into a monster in its own right, reaching $19.5 billion in revenues by 2016. Big Blue kept pace with Amazon and Microsoft as well, growing its cloud as-a-service run rate from $5.3 billion at the end of the fourth quarter 2015 to $8.6 billion at the end of 2016, a near 63% growth. According to the company, their overall cloud revenue for full fiscal 2016 was $13.7 billion.

From a revenue standpoint there isn’t much to differentiate the top three cloud computing players. They all started 2016 strongly and finished 2016 even stronger, somehow managing to keep each other within touching distance yet ending up creating a huge gulf between them and the newer competitors.

The Top Three are Nowhere Near being Similar

But once you get past the revenue numbers, there is very little that is similar between these three. All three companies focus on different areas within the cloud industry, and the differentiation between them is stark.

Amazon is all about public cloud and IaaS, IaaS, IaaS. That’s their strength, and they excel at it. Though not fully entrenched in the enterprise space the way IBM and Microsoft are, AWS has a powerful presence in nearly every other market segment.

With Microsoft, it’s about public and hybrid cloud models, but the real focus is clearly on SaaS, specifically the enterprise SaaS market segment. It’s a massive opportunity that Microsoft isn’t letting slip past them.

IBM is clearly becoming a Watson-heavy company with each new cognitive product that comes out of its myriad foundries, but Big Blue is also a serious hybrid cloud player. They’ve found a cloud niche that fits, it’s a big niche and they wear it well.

Why the Top Three Will Dominate Their Respective Segments for a Long Time

Between them, these three cover the entire breadth of the cloud computing segment, leaving very little space for anyone to force their entry.

Niche SaaS players such as Salesforce will always be there, but to create a strong horizontal offering such as Microsoft’s mix of business-focused products covering IaaS to SaaS is to create more value than any one IaaS-exclusive or SaaS-exclusive company possibly can. And that value appeals to everything from one-man-shows to multinational corporations, which is where Microsoft excels.

As for Amazon, they are obsessed with and relentless in their pursuit of public cloud infrastructure excellence, adding no less than 1,000 services to their AWS menu this past year. IaaS is how they got into cloud, it’s what they disrupted and it’s what they’ll command for a long time. We do expect Amazon to strongly pivot into IoT, and there are already signs of that movement, but it will be a few more years before we can start counting the billions from that part of their business.

With IBM, their analytics business is already bigger than anything else in that space, with little to no competition and a high level of demand to cater to. IBM splits its attention between Analytics, Cloud and all overlapping functions that they collectively term ‘as-a-service.’ These three segments make up the bulk of their strategic imperatives, which have been their light at the end of the tunnel. They have a ways to go, but they’re only a few quarters away from a full recovery and a fresh growth phase.

These three champions of cloud are not only shaping the cloud computing industry, but setting the pace of its growth from the tens of billions to the hundreds of billions to the trillions.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.