The last time Microsoft reported positive quarterly revenue growth was way back in the third quarter of 2015. Nearly two years – and eight quarters – later, Microsoft announced that its revenue grew by 1.2% during the second quarter of 2017, posting $24.090 billion compared to $23.796 billion during the year-ago period.

From a revenue standpoint Microsoft’s results are nothing to boast about. But the way the company shifted its revenue streams from being Windows-dependent to cloud-dependent is something that the company must be immensely proud off.

In a short span of two years, Microsoft has succeeded in pushing Windows revenues to the background while bringing all of its cloud-related products lines to the front.

The objective was very clear from the time the company changed its financial reporting segments to have only three categories: Productivity and Business Processes, Intelligent Cloud and More Personal Computing.

The first two were clearly focused on SaaS and IaaS, respectively, while Windows was moved to the More Personal Computing segment, sharing space with device, gaming and search revenues.

The best part about the new-found growth, even if it’s merely 1.2%, is that it is coming from Microsoft’s forward-looking business lines – specifically, Office 365 and Microsoft Azure.

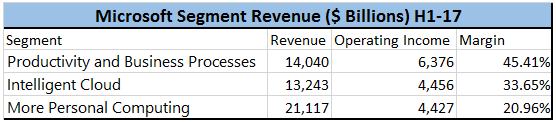

The Productivity and Business Process and Intelligent Cloud segments have brought in a combined revenues of $27.283 billion, but their combined operating incomes were a massive $6.405 billion more than what the More Personal Computing segment made.

These Segments are More Profitable

Microsoft’s enterprise software and infrastructure businesses, addressed by Productivity and Business processes and Intelligent Cloud segments, are both solid, high-margin businesses. One of the reasons why IBM wanted to move into the software segment was exactly this – the high-margin nature of the business. Amazon Web Services, the king of IaaS, has been above the 30% operating margin mark for the last two quarters despite aggressively cutting costs – again, because cloud is inherently a high-margin segment.

The fat margins these two segments are reporting give Microsoft a tremendous amount of leeway to further invest and expand these units . The further Microsoft’s Office 365 and other SaaS products grow along with its IaaS offerings, Microsoft’s revenue – along with bottom line profits – will increase at a faster rate.

Microsoft has already reached a point where, even if Windows revenues were to drop to zero, it can handle the shock. From an operating income perspective, More Personal Computing is now the third best unit for Microsoft despite being the highest revenue earner.

Let’s welcome the new Microsoft!

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.