The growth of Office 365 has completely changed the fortunes of Microsoft. Everyone knows that Office 365 adoption has been increasing, but nobody knows exactly how much money Microsoft is making from Office, except of the percentage growth figure Microsoft shares with us every quarter.

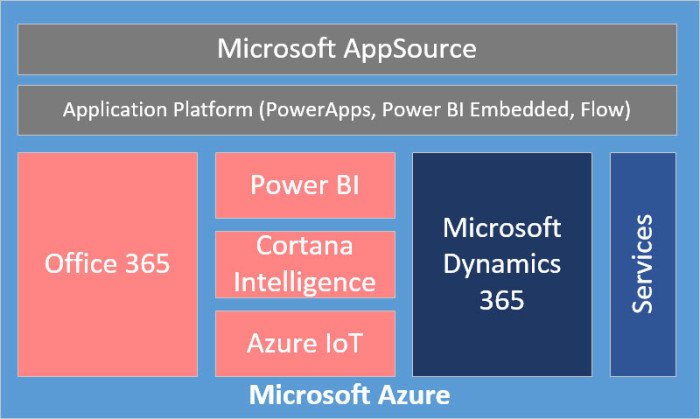

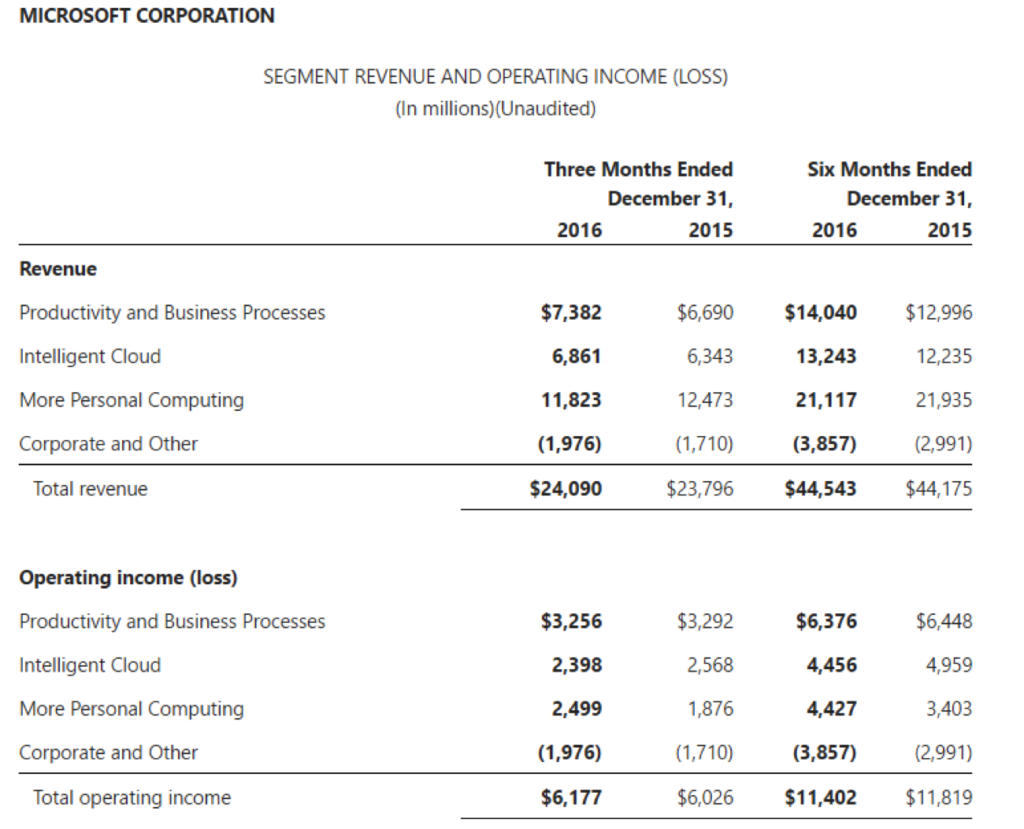

Microsoft’s has three reporting segments: Productivity and Business Processes, Intelligent Cloud and More Personal Computing. The Productivity segment hosts most of the company’s SaaS products, including its ever-growing 365 lineup; Intelligent Cloud is home to Microsoft’s Infrastructure as a Service (IaaS) product, Microsoft Azure; and More Personal Computing houses Windows and devices revenues.

Excerpt From Microsoft’s 2016 Annual Report:

Productivity and Business Processes segment consists of products and services in our portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. This segment primarily comprises:

- Office Commercial, including volume licensing and subscriptions to Office 365 commercial for products and services such as Office, Exchange, SharePoint, and Skype for Business, and related Client Access Licenses (“CALs”).

- Office Consumer, including Office sold through retail or through an Office 365 consumer subscription, and Office Consumer Services, including Skype, Outlook.com, and OneDrive.

- Dynamics business solutions, including Dynamics ERP products, Dynamics CRM on-premises, and Dynamics CRM Online

The Productivity segment is built around two products – Office 365 and Dynamics 365. In other words, it concentrates on two areas: collaboration software using Office products, and enterprise management software through its Dynamics lineup.

The Productivity segment’s operating profits during the first two quarters were $6.376 billion of the $14.040 billion in revenues, with an operating margin of nearly 45%. How often do you see a company get close to a 50% operating margin? Rarely.

This clearly shows the level of control Microsoft has in the collaboration software market. That’s as good an indicator as any that there isn’t enough competition in the market to give Office 365 a run for its money.

Microsoft’s commercial cloud annualized revenue run rate exceeded $14 billion dollars during the first quarter that ended in December 2016, and that’s including all their cloud-based revenues. According to a recent report by a Morgan Stanley analyst, Microsoft Azure made $2.7 billion in revenues during 2016, which means the rest of the money has come from its SaaS lineup. That means at least a major portion of ten billion dollars of its run rate is contributed to by SaaS products.

Office 365 consumer subscriptions have now reached 24.9 million, while Office 365 commercial revenue has been growing at strong double digit rates for the past two years. The transition from the old, standalone Office products to the cloud-delivered Office 365 has not only been swift but has been extremely profitable as well.

In terms of competition, Amazon has now entered the race in a slow but steady manner. Google has fallen a little behind, but is an established brand. Then there are Salesforce and Oracle to compete against Microsoft in the CRM and ERP markets. So far, however, Microsoft remains the company to beat when it comes to enterprise SaaS.

Despite any hurdles that the competition my throw in its path, it looks like Microsoft’s cloud-based enterprise software division has a clear runway for several years of sustained growth.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.