We all know how fast Microsoft Office 365 has been growing, and how competition from Google and Amazon is slowly building up the enterprise Productivity space. But, until now, we never knew exactly how many active users are on Office 365, nor how much money Microsoft could be making from its lead productivity application.

Until now.

In a blog post on enterprise mobility published yesterday, Microsoft let the world know that there are 85 million monthly active users of Office 365. It’s possible that the Microsoft Employee who wrote the post, Brad Anderson, let the information slip, but it looks like the cat is finally out of the bag. What’s more, it clues us in on Office 365 possibly being one of the top earning SaaS products in the world right now, if not the number one product.

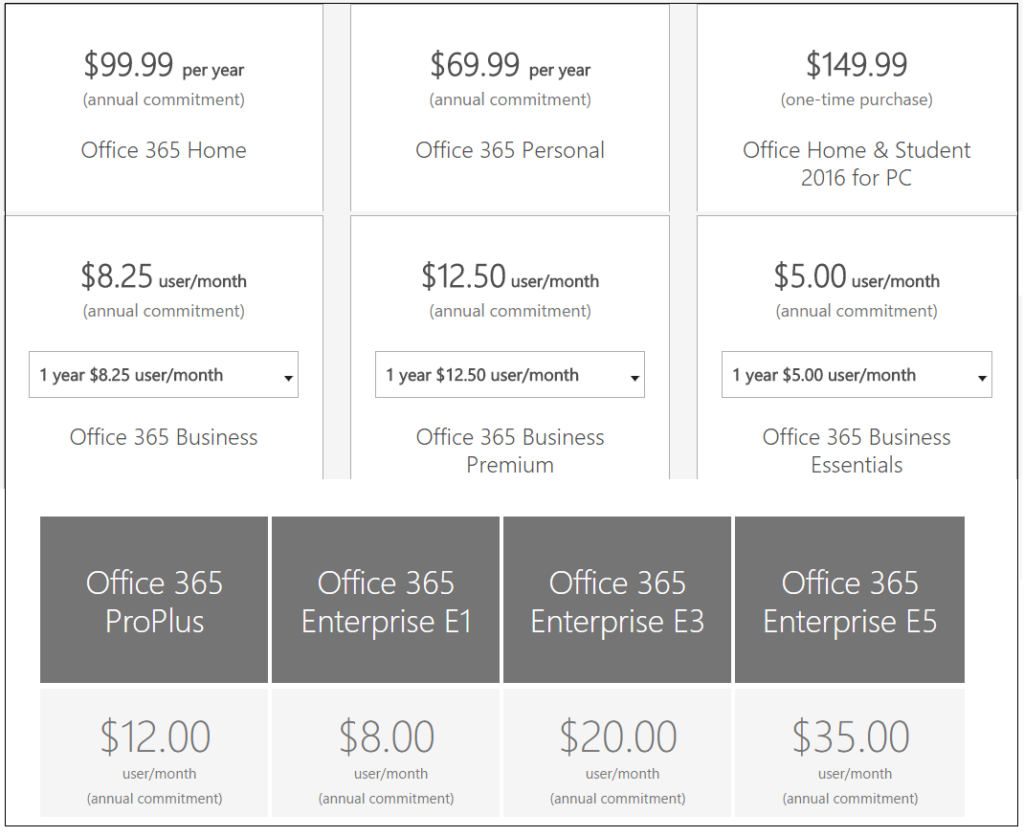

Let’s do a quick calculation based on the current pricing of some of Office 365’s variants.

For consumers, Office 365 Home Costs $99.99 per year and Office 365 Personal costs $69.99 per year. Business editions start from $5 a month and go up to $12.50 a month. Enterprise users pay anywhere between $8 a month and $35 a month. And all of this is chargeable per user.

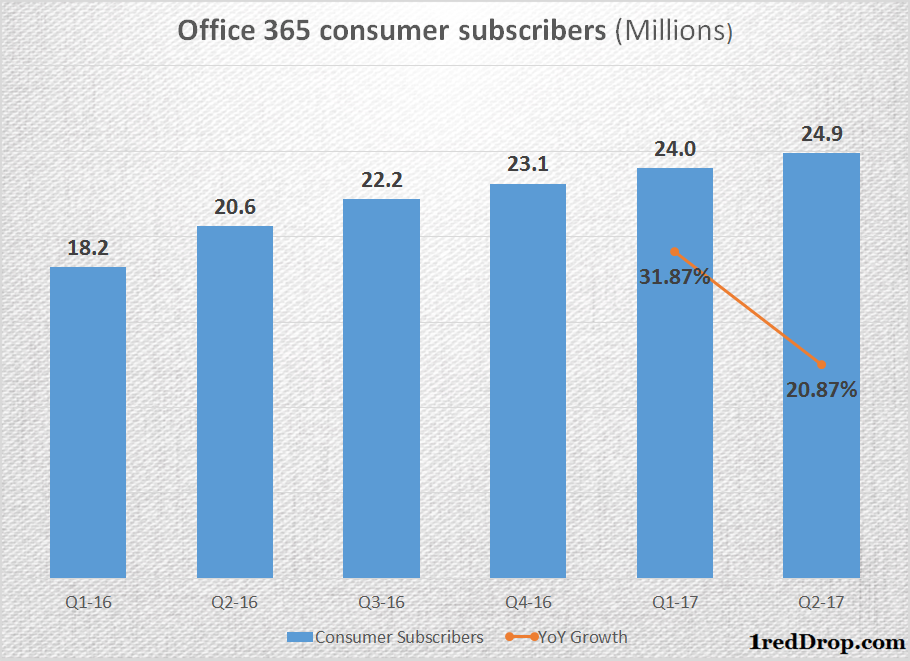

At the end of second quarter, Microsoft Office 365 consumer subscription count reached nearly 25 million users. Now, we know that there are 85 million monthly active users on Office 365. Of course, large-scale enterprises may have bulk pricing, but from this data, we can now loosely estimate Office 365 revenues.

From individual consumers, we estimate a lower limit of $1.7 billion annual revenue from 25 million users.

Now, we remove that 25 million and from the 85 million and calculate revenues for 60 million commercial users. Even using the lowest-priced business version of the software application suite bringing in $5 a month per user, that’s $300 million a month, translating into $3.6 billion per annum.

We’re lowballing the numbers, obviously, but even if we calculate it at $5 per user per month, 85 million active users will be bringing in a cool $425 million in monthly revenues, with a quarterly run rate in excess of $1.2 billion per quarter and an impressive annual run rate of $4.8 billion.

That number should be significantly higher because we’ve used very conservative pricing for our calculations. It’s clear that Microsoft is making at least half a billion dollars in monthly revenues from Office 365, which brings that figure to $6 billion per annum.

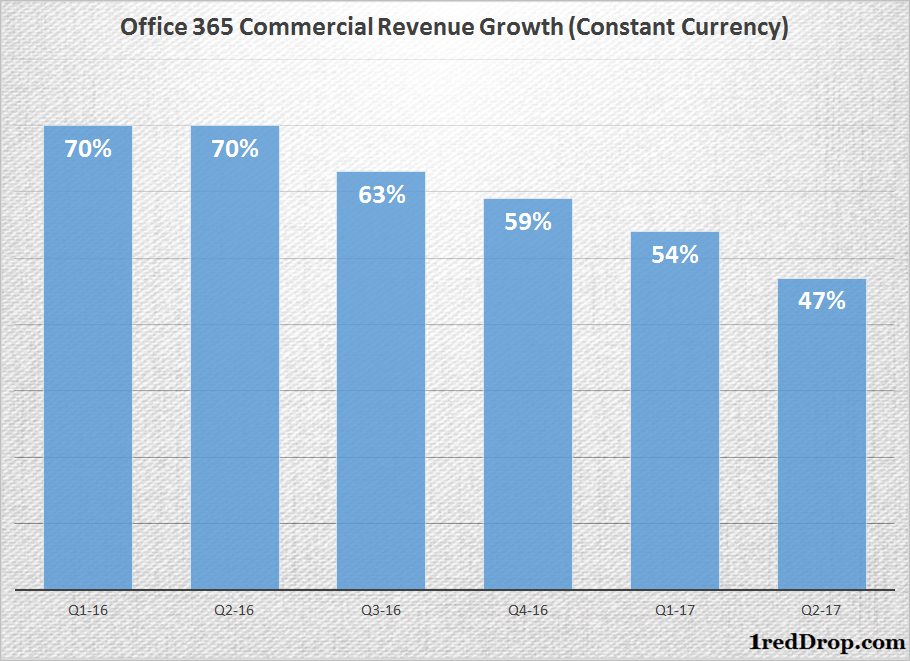

And, considering Office 365 commercial revenue growth at very health double-digit numbers for the past several quarters, as shown above, it’s clear that the growth momentum for Office 365 is far from being spent.

During this same period (Q1-16 to Q2-17), Office 365 consumer subscriptions grew from 18.2 million to 24.9 million. As you can see from the graph below, that’s 30%+ year-over-year growth in Q1-17 and 20%+ in Q2-17. That’s another case for Office 365 momentum, but in the consumer space, which obviously won’t be nurtured as aggressively as the commercial segment.

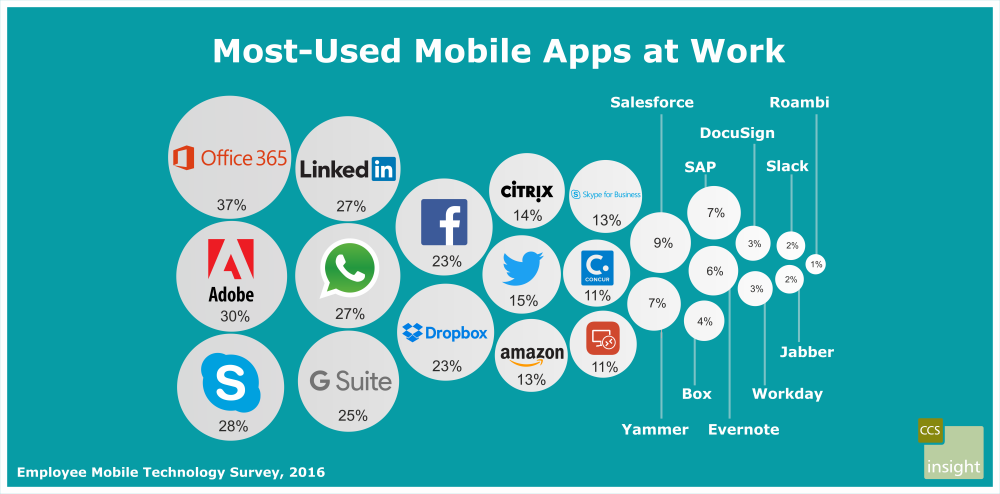

What’s really interesting is that, according to CCS Research, Microsoft is scoring points in the enterprise mobile space as well.

“According to decision-makers, the five most-supported apps for employees beyond e-mail were Microsoft Office, Skype, Google Apps, Dropbox and Facebook. These were fairly consistent with results in 2015 and with employees’ responses to our 2016 employee survey, which listed Office, Adobe, Skype, LinkedIn and WhatsApp as their top five most commonly used apps at work.”

As you can see, both Office 365 and Skype are two of the most popular enterprise mobile apps, along with Adobe. And LinkedIn being in the group of second most-used apps, the key SaaS application from Microsoft is only going to grow bigger.

Microsoft letting the cat out of the bag is a big deal for us because we’ve been tracking Microsoft’s cloud products for quite some time now. And it’s a big validation for our stand that Microsoft is the undisputed dominant player in office productivity and collaboration software served on the cloud. Simply put, enterprise productivity SaaS.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.