If you are a public company, Wall Street is like a shadow that you can never shake off. There will be a torrent of upgrades when things are going fine, and a torrent of downgrades when things are headed South. But at the end of the day, Wall Street has customers to serve, so they will do the upgrade-downgrade business no matter what, and their recent casualty is Amazon.

CNBC reported today that Wall Street firm Raymond James lowered its rating on Amazon, saying that it needs to show profitability to justify further gains.

But wait a minute.

Here is Amazon CEO Jeff Bezos taking about his vision, profit margins and much more on Harvard Business Review:

ADI IGNATIUS: At what point will the goal change from lowering margins, building market share, to making a bigger profit?

JEFF BEZOS: Percentage margins are not one of the things we are seeking to optimize. It’s the absolute dollar-free cash flow per share that you want to maximize, and if you can do that by lowering margins, we would do that. So if you could take the free cash flow, that’s something that investors can spend. Investors can’t spend percentage margins.

There it is, as clear a view into how Amazon thinks as you can get. It never looked after its margins, and it is not going to change that now.

“We believe shares are fairly valued and near our previous price target. … At current levels, we believe Amazon will need to begin to show greater operating leverage for shares to move meaningfully higher and reach our bull case,” analyst Aaron Kessler wrote in a note to clients Tuesday. “Specifically, we would like to see improved margins/less losses for International, shipping costs, Prime Video.” reported CNBC

Amazon seems to be looking the other way on the very things that Wall Street analysts consider sacrosanct. Like margins.

But there’s a very simple reason why Amazon is doing this. Unfortunately, simple things typically do unseen fly-bys on Wall Street.

In the retail business, scale is everything. Amazon’s North America business margins expanded as it got bigger and bigger, and Amazon is now chasing $100 billion in sales from the segment. The margins will inevitably follow.

To elaborate, let’s look at what’s happening overseas.

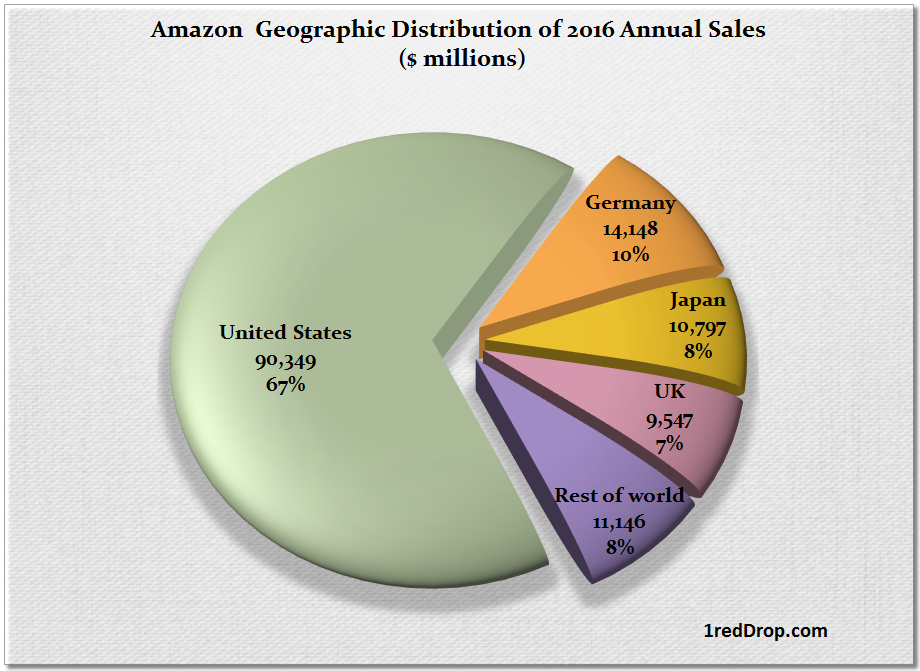

When it comes to the International segment, there are only three countries that are either at or above ten billion dollars in annual sales for Amazon. Amazon needs scale, and it needs to establish its logistics and infrastructure before it can even start thinking about margins. They need their systems in place to capture the market and increase their size as much as they can – and then the margins will slowly improve, the way it happened in North America.

If Amazon goes about it the other way around, then it will never, ever get there.

To continue that train of thought, the online retail and technology giant will first want to establish its position in a lot of these markets, and that means shipping costs are going to be greater than revenues, a lot more money will be pumped into Amazon Prime, and heavy investment needs to go towards fulfillment center expansions and so on.

To put it simply, Amazon International will not hurry towards profitability because that would only happen at the expense of scale, which the company sorely needs in International markets – in any market for that matter, including North America, as we saw.

I’m not usually given to sarcasm, but asking a company that keeps its focus on growth and cash flow to turn its attention towards margins and profitability is a very insightful move. And downgrading the company until it does? Brilliant!

Nice going, Wall Street. Just keep swimming, Amazon.

Hey, would you do us a favor? If you think it’s worth a few seconds, please like our Facebook page and follow us on Twitter. It would mean a lot to us. Thank you.