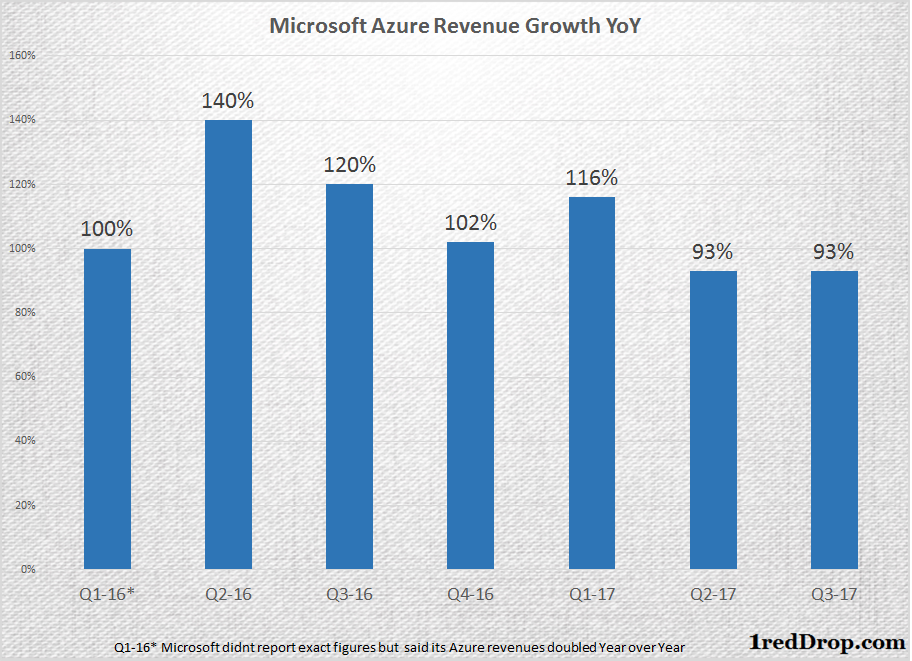

Azure, Microsoft’s Infrastructure as a Service offering, has been growing fast. Growth has been so fast, in fact, that it has been clocking near-triple-digit speeds for the past two years. If Microsoft continues the current pace for two more quarters, it will be making $4 million in the first quarter of 2018 for every million dollars it made in the first quarter of 2016!

Microsoft does not tell us how much money they make on Azure. There are some estimates that put their annual revenue from Azure at around $2.7 billion. The Intelligent Cloud segment, under with Microsoft Azure revenues are counted along with server products and Enterprise Services, posted $6.8 billion in revenues during the third quarter, a growth of 11% compared to last year.

But despite the stupendous growth rate Azure has been reporting for the past several quarters, they are still playing catch up Amazon Web Services. According to data from Synergy Research Group, Amazon Web Services held on to its 33% market share during the most recent quarter, while other players like Microsoft and Google are growing at much faster rates than Amazon.

That’s because of two reasons: Microsoft’s and Google’s cloud infrastructure services are much smaller in size compared to that of Amazon Web Services, and they are growing at the expense of other cloud players in the segment rather than by encroaching into Amazon’s turf.

With the cloud industry itself growing at a fast rate, all the players are growing, including the leader, Amazon Web Services, which reported $3.661 billion in revenues during the recent quarter, a growth rate of 42.6%.

But if Microsoft wants to challenge Amazon Web Services, it has to win the perception battle as well. During a recent price reduction announcement, Brian Hillger, Senior Director, C+E Business Planning, wrote in his blog post:

“We believe in providing the most innovative cloud offerings at incredibly competitive prices to our customers. As part of this promise, we regularly lower our prices as Azure continues to grow at scale and remain committed to our price match promise.”

Microsoft’s Price Match Promise that Brian Hillger is talking about here was first announced in early 2013.

“we are announcing a commitment to match Amazon Web Services prices for commodity services such as compute, storage and bandwidth” – Microsoft, April 2013

A lot of water has flowed under the cloud bridge since that announcement was made four years ago. It may have made sense then, but to continue with that commitment is a tacit admission that Microsoft is only going to be reacting to what AWS does, instead of being proactive on pricing.

When you think about it, this is a purebred tech company trying to use an age-old retail tactic – against one of the most price-savvy retailers in the world, no less. That’s like trying to match prices with Wal-Mart on onions or dog food!

Why Not Take a Different Route for Azure Pricing?

In actuality, Microsoft could have done so many things that could have forced AWS react to it, but the problem in continuing with a price match promise that first saw the light of the day four years ago is that it reinforces the perception that Microsoft just wants to follow whatever Amazon does.

Microsoft has enough bandwidth to push the pricing boundary on its own. Their SaaS portfolio is growing by leaps and bounds, and the two segments that hold all their cloud revenues – Productivity and Business Processes and Intelligent Cloud – are not just growing: they are extremely profitable for the company. During the third quarter of 2017 these two segments posted combined revenues of $14.721 billion, with an operating income of $4.964 billion. That’s a margin of 33.72% they have to play around with.

So, we don’t really understand the reasoning behind a price match promise, because Microsoft has a lot of room to stretch its pricing. Considering the competitive nature of the cloud industry, we are already at a stage where every move will be matched with an equivalent reaction from your competitor. Every price cut will be matched by all the other providers, sooner are later. But by dumping its price match promise for Azure, Microsoft can shake off the perception that it is merely following AWS and reacting to it.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.