Wall Street’s Theory

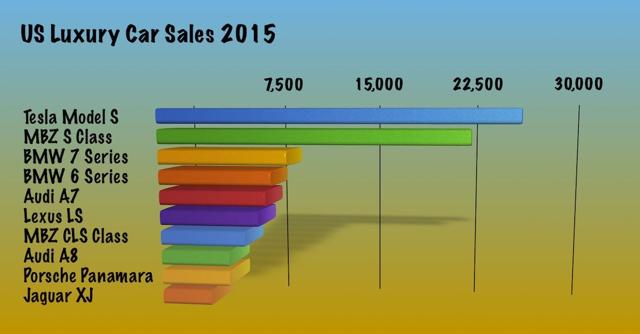

According to Needham & Co. analyst Rajvindra Gill, “sales of the Model S and Model X is “lackluster,” especially with the growing amount of competition from luxury manufacturers.

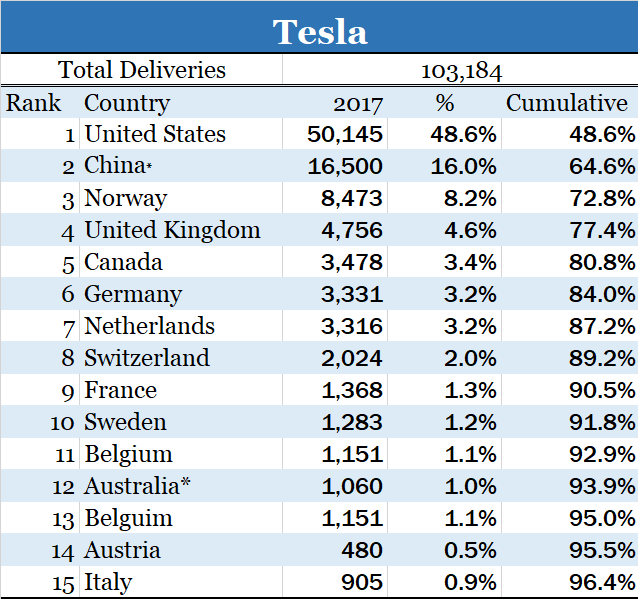

How is Tesla doing in its major markets?

United States, China and Norway are the top three markets for Tesla’s flagship vehicles Model S and Model X. These three markets accounted for more than 7 out of 10 cars Tesla sold in 2017.

United States:

Data from Insideevs shows that Tesla sold nearly 10,820 Model S and 9,525 Model X in the first six months of 2018, compared to 11,195 Model S and 8,945 Model X the company sold during the same period in 2017.

20,345 units this year VS 20,140 last year. Tesla held its ground in United States.

China:

According to Bloomberg data, Tesla recorded $508.7 million in revenue during the first quarter of 2018 compared to $503.0 million in the first quarter of 2017. Q1- Checked.

Yicai Global reported in May, ” A Tesla Inc. dealership in Shanghai sold its entire Model X 75D stock in a single day after trimming car prices more than a month before China reduces its vehicle import tariffs.” Q2 sales growth – Possible.

Though the trade war and subsequent increase in import tariff will dent sales during the second half of the year, its fairly clear that Tesla’s Model S and Model X sales were nowhere near lackluster status in Tesla’s second largest market.

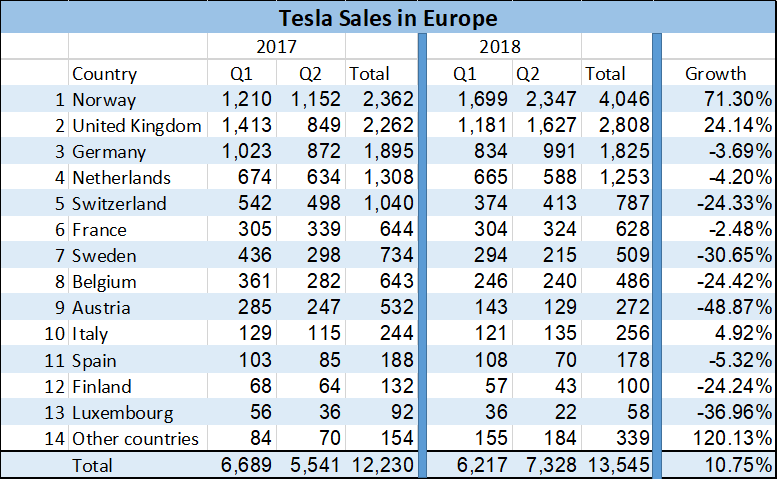

Norway:

Tesla sold 4,046 Model S and Model X in Norway during the first half of 2018, compared to 2,362 units the company sold during the same period in 2017. A growth of just 71%. It is a bit “lackluster” because Tesla should have aimed for 100% growth.

Europe:

In Europe, including Norway, Tesla sold 13,545 Model S and Model X during the first half of 2018, compared to 12,230 last year. A closer look at the chart reveals that Tesla prioritized customers in top regional markets.

Overall growth during first half of 2018 is 10.75%. Double digit growth in auto industry is now considered below par.

As we can see from the chart above, Tesla under performed during the first quarter of the current fiscal, but picked up pace during the second quarter. No bonus points for guessing why that would have been the case. Sales in all three regions – United States, China and Europe have tracked Tesla’s 2017 performance.

China could go both ways for Tesla as the company’s fortunes will be heavily tied to Chinese policy decisions. If China decides to offer leeway to Tesla for announcing its plans start production in Shanghai, there is good chance for Tesla’s sales growth to remain flat or post slight growth in the country.

Even if sales declines in double digits, there is plenty of room in Europe to absorb sales. Tesla sold additional 1,684 units in Norway during the first half of the year, and the company should face no problems in adding few more thousands to that number.

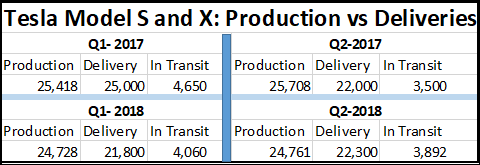

Tesla’s decision to hold back deliveries in North America to push (EV) federal tax credit phase out into the third quarter has helped the number inventors in a big way. It becomes easy to point out that Tesla delivered 47,000 Model S and Model X during the first two quarters of 2017, compared to 44,100 units this year. A mid single digit drop in deliveries.

How to make a mountain out of molehill: The Wall Street Expertise

A 6.5% drop in deliveries (47k to 44.1K), can be made more impactful by saying Tesla needs to increase deliveries by 27% during the second half of the year to reach 100,000 unit sales.

But the truth is Tesla only produced 49,489 units of Model S and Model X this year, compared to 51,126 units last year. Simply put, Tesla built 1,637 units less and delivered 2,900 units less during these two comparable periods. And they had $7,500 federal tax credit at stake for every US customer.

If Tesla is not losing its ground in its key markets then why did deliveries drop by mid single digits in H1-2018 compared to last year?

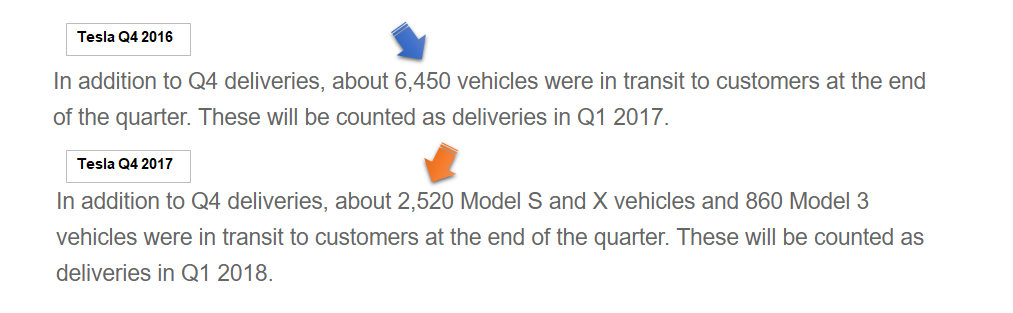

Tesla had 6,450 vehicles in transit in Q4-2016, compared to 2,520 Vehicles in transit in Q4-2017. In transit vehicles are counted as deliveries in the following quarter. Tesla had additional baggage to count in H1-2017, they didn’t lose their baggage in H1-2018.

Source Docs: Tesla Q4-16 Production and Delivery, Tesla Q4-17 Production and Delivery

Nope, lets not talk about Texas Sharpshooter Fallacy.

Can they increase production?

It’s a well known secret that Tesla’s max production capacity for Model S and Model X is around 2000 units per week. In 13 weeks, Tesla can easily build 26,000 units without breaking a sweat.

Tesla has already built 49,489 Model S and Model X. They need to increase production by 2.06% during the second half of the year to hit their guidance of 100k Model S and Model X for fiscal 2018.

The one headache

Tesla sold closer to 17,000 units in China last year. No one really knows how things will play out in the second half of 2018 due to the ongoing trade war between China and United States. There is a good chance for Tesla sales in China to slip due to additional tariffs.

In the worst case scenario Tesla may have to find 8,000 buyers from other markets to compensate.

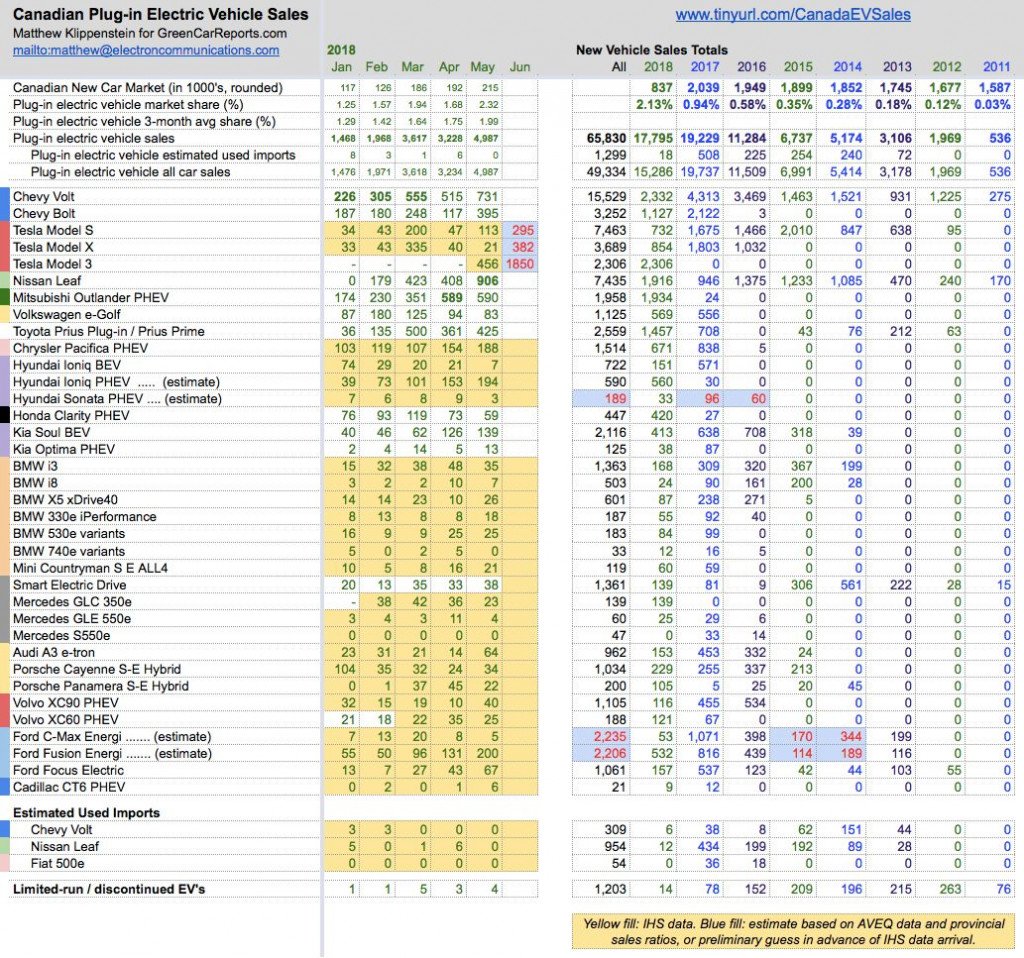

But there is plenty of room to increase sales in Europe, especially in Norway and Netherlands and also in Canada, regions where Tesla grew in double digits last year.

Update (07/21/2018):

Tesla increased Model S and Model X price yesterday. Automakers now increase price whenever their sales is declining. Wall Street analysts will soon release their detailed findings about the new order of price elasticity, where demand increases proportionally with price increase.

Give them the Nobel Prize for Economics already.

“While all the focus is currently on the Model 3, Tesla updated the Model S and Model X design studio by making the ‘Premium Upgrades Package’ standard on the non-performance versions of both vehicles.

The result is the base prices of the Model S and Model X have now increased, but both vehicles are getting the more premium features for less money.

The ‘Premium Upgrades Package’ used to be a $5,000 ($6,000 for Model X) package that includes features like the HEPA air filter with the ‘Bioweapon Defense Mode’ and a premium audio system specifically tuned for a Tesla featuring 11 speakers with neodymium magnets and 8″ subwoofer.” – Electrek

A small history of Tesla’s competition:

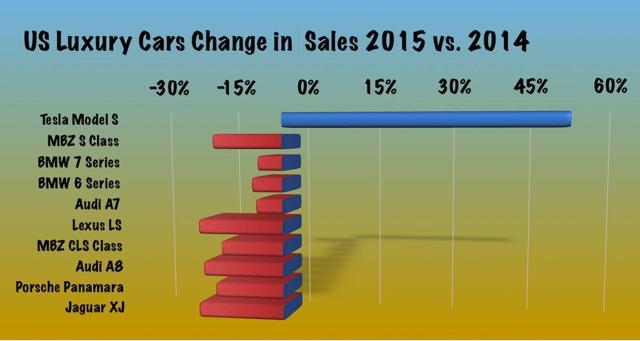

We can also discuss about the imaginary competition (which existed since 2012) as and when it decides that its ready for prime time. For now, “lackluster” sales has no hard data to back it up.

2014: “However, as Tesla is more and more approaching the mass public via cheaper EVs, margins will shrink and competition will intensify.” – Foresightinvestor

2015: “Tesla’s competition is intensifying: Audi is targeting 2018 to transition its electric vehicle concept into a full-production 500-horsepower Quattro SUV to compete with Tesla’s newly released Model X. And there is certainly more competition in the industry through the likes of the BMW i3, the Volkswagen Golf, and the Chevrolet Volt, to name a few.” – Blueharbinger

2015: Tesla isn’t much of a sales threat to companies such as Audi and Porsche just yet — but the auto industry is clearly watching Elon Musk’s company closely. The Porsche looks like a rival to the Tesla Model S, while the E-Tron Quattro Concept seems to set its sights on the Model X. – Mashable

To explain the current state of competition against Model 3 in Dan Neil’s (WSJ) words,

But the car is a star. Doubters will have to bring it. Show me another car with an all-glass roof and five-star rollover crash rating. Point out another $80,000 sedan that out-clouds a Rolls-Royce, out-punches a Porsche Boxster and gets an electric equivalent of 116 mpg. You can’t, unless you’re building something in your garage we don’t know about.

Model S and Model X are still the king in the north, while Porsche and Audi have continued with their development programs. It’s possible that Wall Street is worried about the experience Tesla’s competition accumulated by relentlessly developing their products for the past several years.

Experience counts.

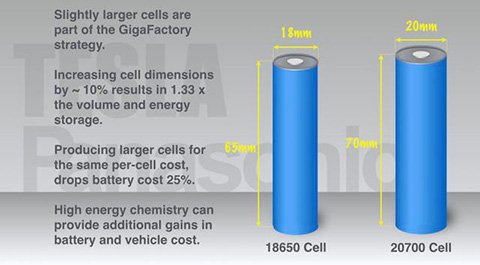

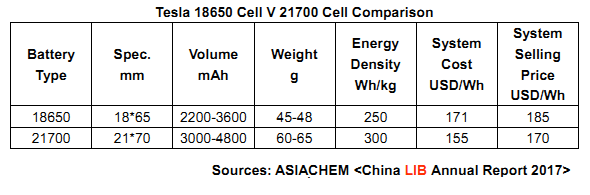

In the interim, Tesla moved on from 18650 battery cells to 21700 cells and according to Sandy Munro, the president of Munro & Associates, 21700 is 20% bigger but offers 50% more power.

And its cheaper.

You can reach me at shankar.ssn@gmail.com or @ShankarsTwits .

Sources:

Insideevs Monthly Plugin Scorecard: Tesla US sales numbers

Yicai Global: Tesla sales in China

Tesla Motors Club: Europe sales numbers

GreencarReports: Canada sales numbers

Coptool: Battery