- Strong cloud growth for Oracle signals a shift in revenue stream structuring.

- With software and hardware losing ground, the company still has a long way to go for cloud revenue to adequately support losses elsewhere.

- Rather than going heavily into the aggressive IaaS market, ORCL should focus on core offerings in SaaS and PaaS by leveraging its expertise in ERP and HCM.

Oracle’s (NYSE:ORCL) third-quarter results were a mixed bag for the company, as revenues declined across the board with the exception of its cloud services.

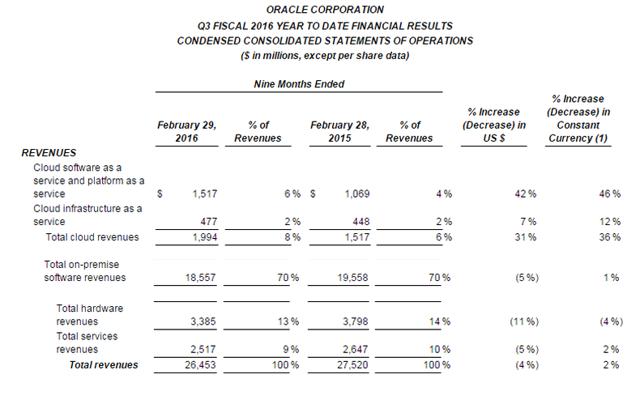

Source: Oracle

Except for cloud, the sales decline was across the board. Total cloud revenues were up 31% while software sales declined by 5%, hardware by 11% and services by 5%. To be fair, to the company, things don’t look that bad when you look at the sales growth numbers on a constant-currency basis because total sales were actually up by 2%.

The main takeaway from these figures is that the company is shifting its focus from traditional hardware and software sales to cloud-related services – significantly, Software-as-a-Service and Platform-as-a-Service. I’ll also show later Oracle is exploring every possible way to exploit the aggressive two-digit growth in the cloud market.

Continue reading at Seekingalpha.com where the original article was published.