As Tesla Motors gains momentum in their production ramp up plans, the Gigafactory battery production unit officially opened to global coverage yesterday (Tuesday, July 26).

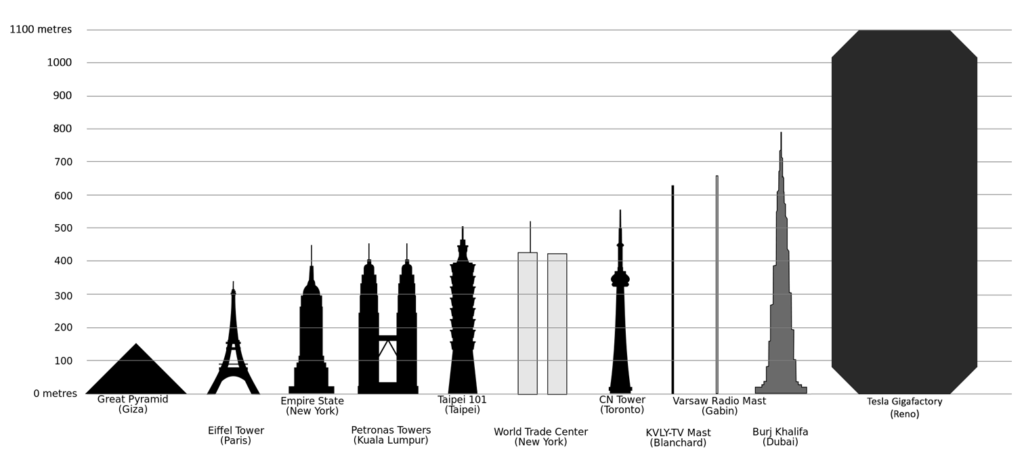

Though only 14% complete, the factory will be a massive 10,000,000 square feet when ready, making it one of the largest buildings in the world. But that’s not the only thing that will make the Gigafactory a first.

By 2018, the Gigafactory’s output will be 35 gigawatt hours – equal to the 2014 production of battery power worldwide. Tesla CEO Elon Musk, however, stated that the factory is designed to produce more than four times that, or 150 gigawatt hours.

So why is Tesla rushing the opening of the Gigafactory when it was originally slated to start production only at the end of 2017? The main reason is the overwhelming global demand generated by their cheapest car yet, the Tesla Model 3. Priced at $35,000 in the United States, the car saw massive response to its debut on March 31, 2016, when the company opened up reservations to buyers all over the world.

China surprised everyone by being the country with the second highest number of reservations after the U.S. Mostly as a goodwill gesture, Tesla delivered on orders for the SUV crossover Model X a full six months ahead of schedule at a swank location in Beijing last month.

The elevated demand for the Model 3 necessarily means that Tesla has to ramp up its production sooner rather than later, and the Gigafactory – a joint venture in which cell-maker Panasonic invested $1.6 billion – is a pivotal part of those plans.

Elon Musk knows the risk of ramping up production too quickly. If the reservations don’t eventually translate into sales – meaning, if the conversion from reservation to confirmed sale comes in at a low rate – then the company will be left with thousands of surplus batteries.

Another major risk is competition from Chinese electric vehicle maker BYD, in which company investment guru Warren Buffett has an interest. BYD does have plans to ship a much cheaper EV into the United States over the next few years.

So despite the massive capacity of the Gigafactory, Tesla must also look at producing the battery even cheaper; and that’s exactly what they’re doing with their reported $9 billion investment in a production unit in China.

Though this particular unit may not be producing batteries, it will allow for significant labor cost leverage to bring the price of the Model 3 down in China by avoiding certain import and excise fees to the tune of approximately 25% of the car’s on-road cost.

The road ahead seems to be clear for Tesla to keep growing, but concerns with delivery misses this past quarter have forced analysts to revise their expectations downward on Tesla’s financial performance.

Nevertheless, the average buyer is likely to be more worried about delayed delivery than how strong the company is, financially speaking. And that’s the real reason Tesla is pushing the Gigafactory into production well before the planned date.

If you enjoyed this article, I encourage you to please share this article using the social media buttons on this page. Every reader counts!