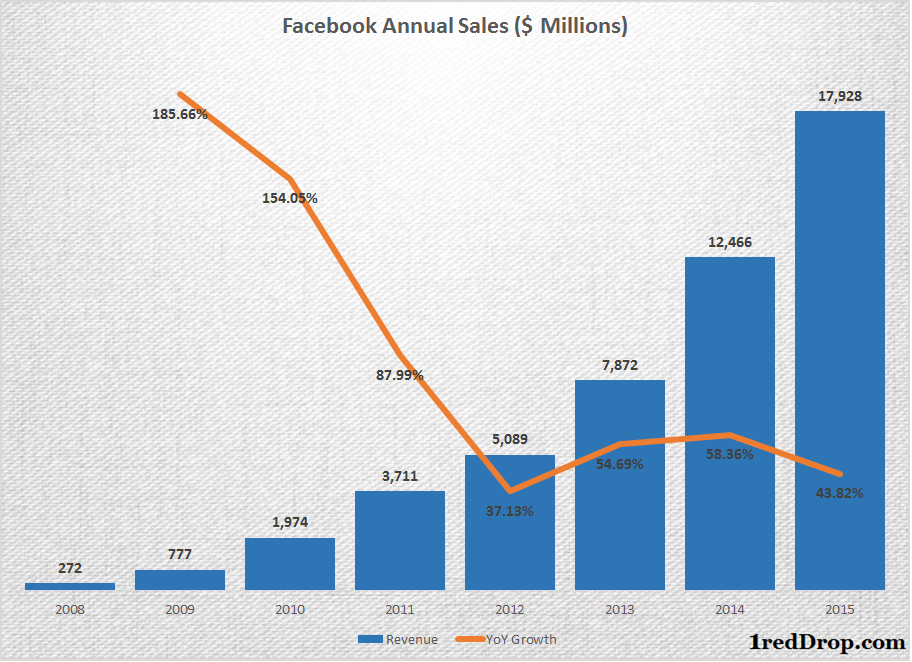

Facebook’s monstrous sales growth can easily become a case study of our times. And it’d be titled “How to double your sales every two years for nearly a decade.” Such has been their speed that the company could be breathing down Google’s neck in a few years. But how did Facebook revenue explode at a time when everybody and their uncle thought that social media was where you went to burn your advertising dollars? In fact over the last several years more than a dozen social media networks only made it as far as the graveyard.

It might be easy to think that revenues simply followed user base, but that is only partially true.

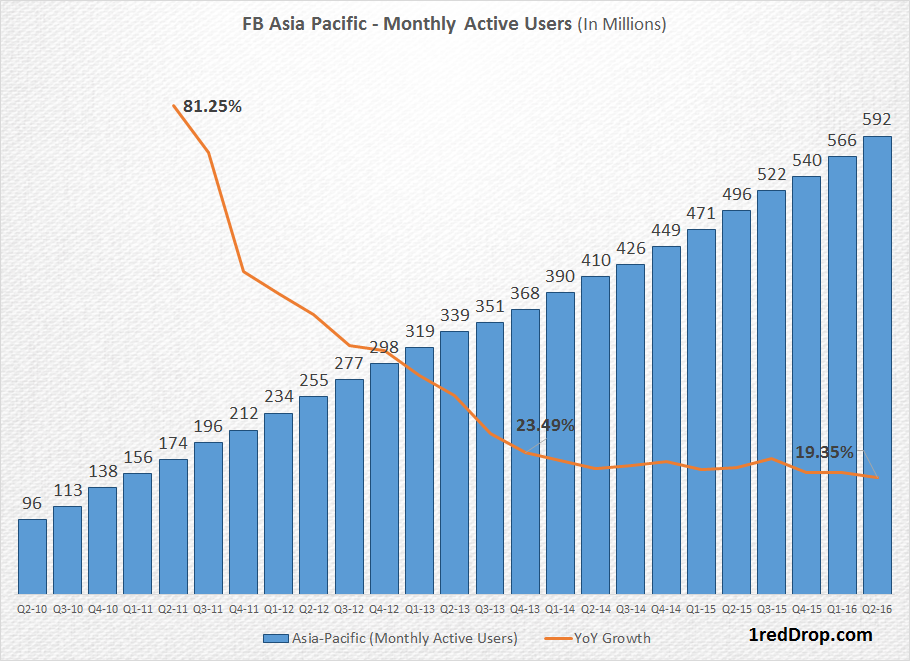

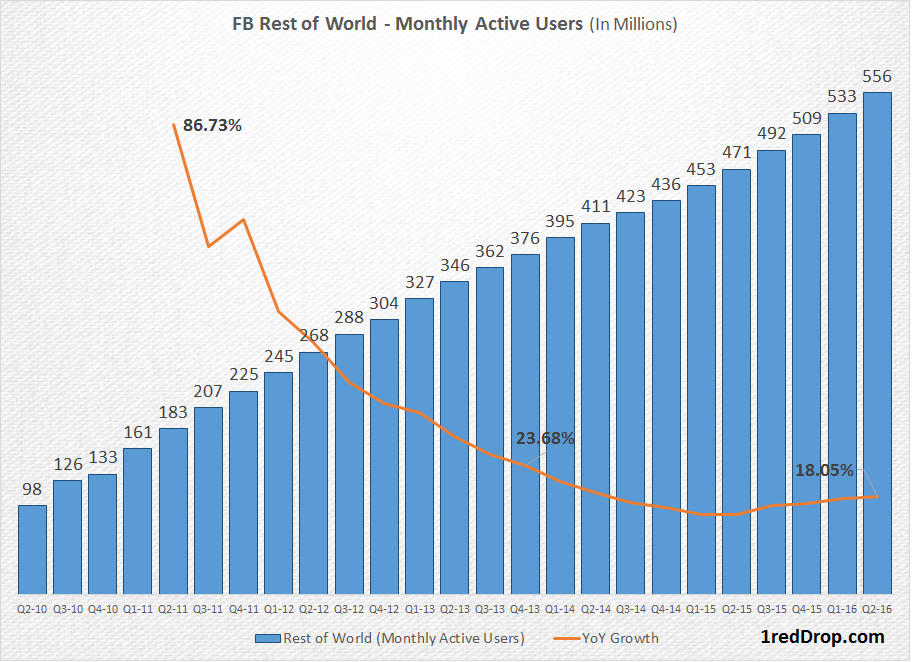

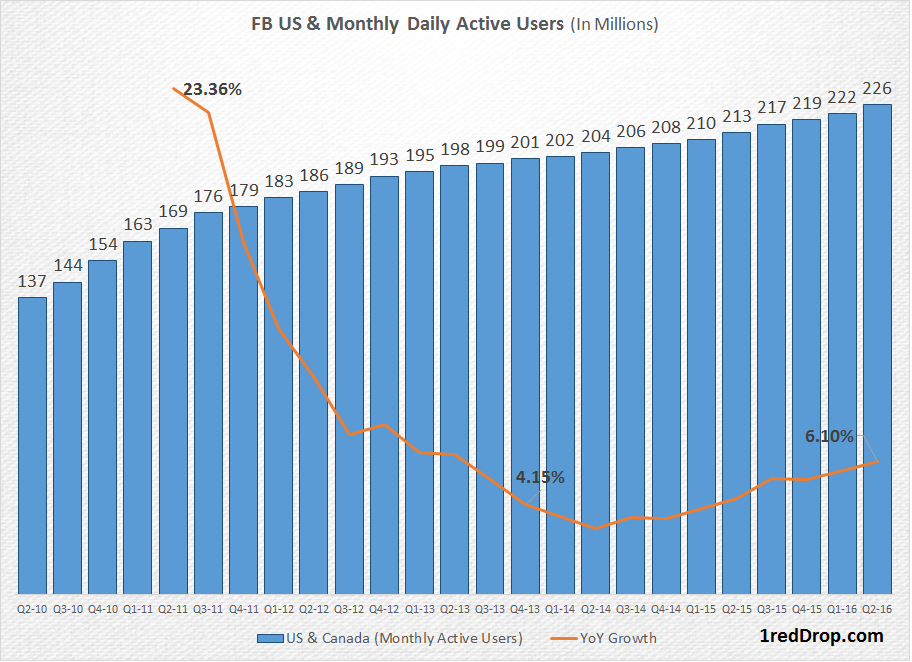

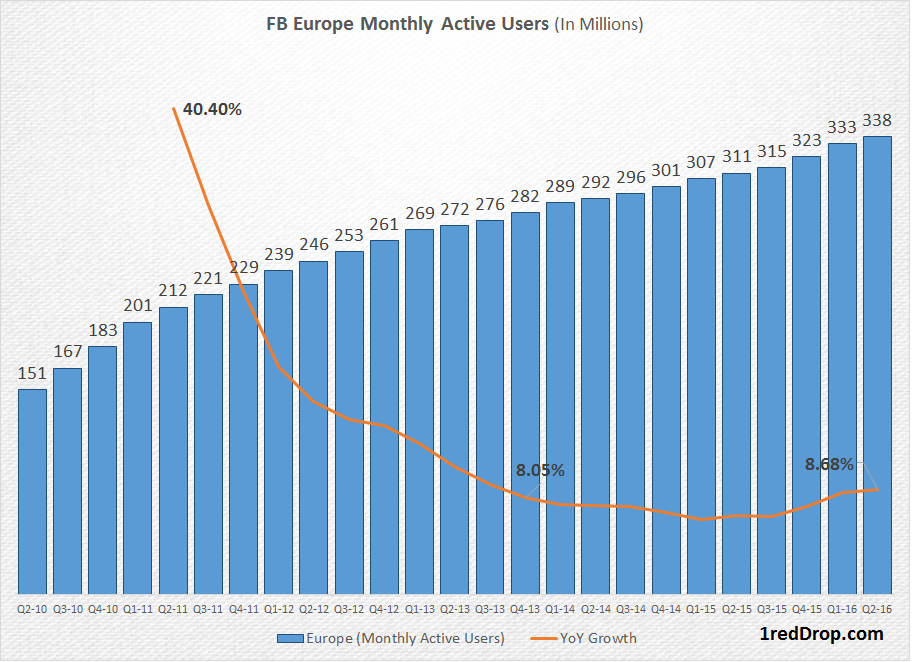

Facebook’s user base growth in the last few years was mainly due to their fast growth in developing markets. User growth in United States, Canada and Europe has been well below the 10 percent range in the last few years. Asia-Pacific and Rest of the World have been growing in the near 20% range.

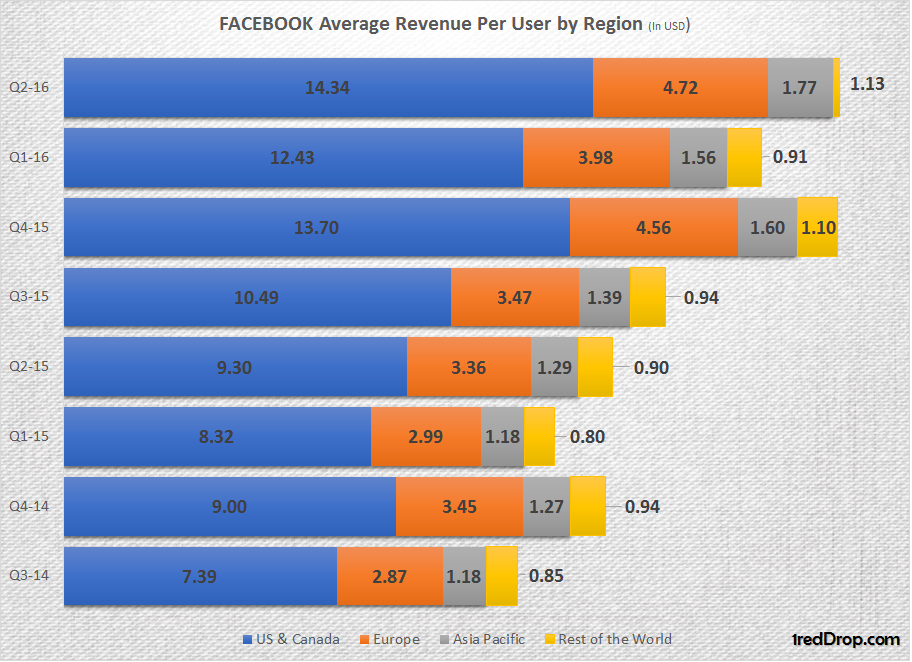

On a per-user revenue basis, a developed market will always beat an emerging one. On top of that, you will have to convert those earnings into dollars, making whatever little you earned look even smaller. But if that is the case, then how did Facebook revenue manage to move in the above-40% range in the last three years?

The answer to that lies in their average revenue per user in mature markets like North America and Europe. If you look again at the graph above, you’ll see that the US/Canada and Europe markets have nearly doubled their ARPU over a period of two years – or eight quarters from Q3-14 to Q2-16. Now throw in the 5% user growth in these regions and you’ll see where their explosive revenue growth is primarily coming from.

Update May 19, 2018: As of FY17 Facebook’s annual revenue had crossed $40 billion, a 47% growth rate over FY16.

Facebook continues to explore monetization opportunities in these core markets. The spinning off of apps – Messenger, Events and Workplace – has been instrumental in keeping users engaged and coming back. By doing this, Facebook is artificially multiplying its user base and creating more opportunities for advertisers. Each new app they introduce has a new audience as far as advertisers are concerned. So they’re only happy to pay more to get more eyeballs. Yes, even if those eyeballs are the same people accessing different apps.

And if the app advertising approach won’t work, they just take the subscription route. That’s what they just did with the Workplace by Facebook app for enterprise companies.

The company will doubtless continue to release new standalone apps. It will also explore new opportunities to monetize its 1.7 billion-strong userbase. That’s in addition to the 500 million on Instagram and another 1 billion on WhatsApp.

Facebook is starting to resemble Amazon more and more with each passing year. Both companies are growing aggressively and forcing established players to either haul their sluggish behinds or scramble for cover.

Amazon is doing this to big-box retailers and major tech giants that provide cloud solutions. Facebook revenue is on track to match Google’s, dollar for dollar.

Will it ever happen? I’m pretty sure it’ll be hard to find anyone who’ll bet against it.

Thanks for reading our work! On Apple News please favorite the 1redDrop Channel, and please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world.