In Part 1 of this article, we gave an introduction to how Apple Pay is part of an ‘ecosystem’ that Apple is building around its devices and its users. We saw how Microsoft was successfully doing this, and we reviewed some very important numbers for Apple Pay and its growth.

In this segment, Part 2, we’ll delve into some more key numbers from Apple’s revenues, and we’ll try to “fit” Apple Pay into the grander scheme of things. We’ll also show you how important this segment is to the future of Apple, Inc.

There were several reasons why Apple decided that it had to enter into the digital wallet or mobile wallet space. Of, course the possibility of earning more revenue is one of the top considerations, but there’s another very important benefit. By creating its own application for web and mobile financial transactions, Apple succeeded in keeping users engaged within that ecosystem we spoke about in Part 1 of this article series.

A third-party app on iOS for this purpose would have not only directed revenues away from Apple, but users as well. The significance of this becomes even more important when we realize that Apple is one of the very few companies that can truly say that they’re good at making hardware as well as software. Several companies with deep pockets have tried this and failed, and till today there’s nobody that comes close to Apple when it comes to the marriage of hardware and software.

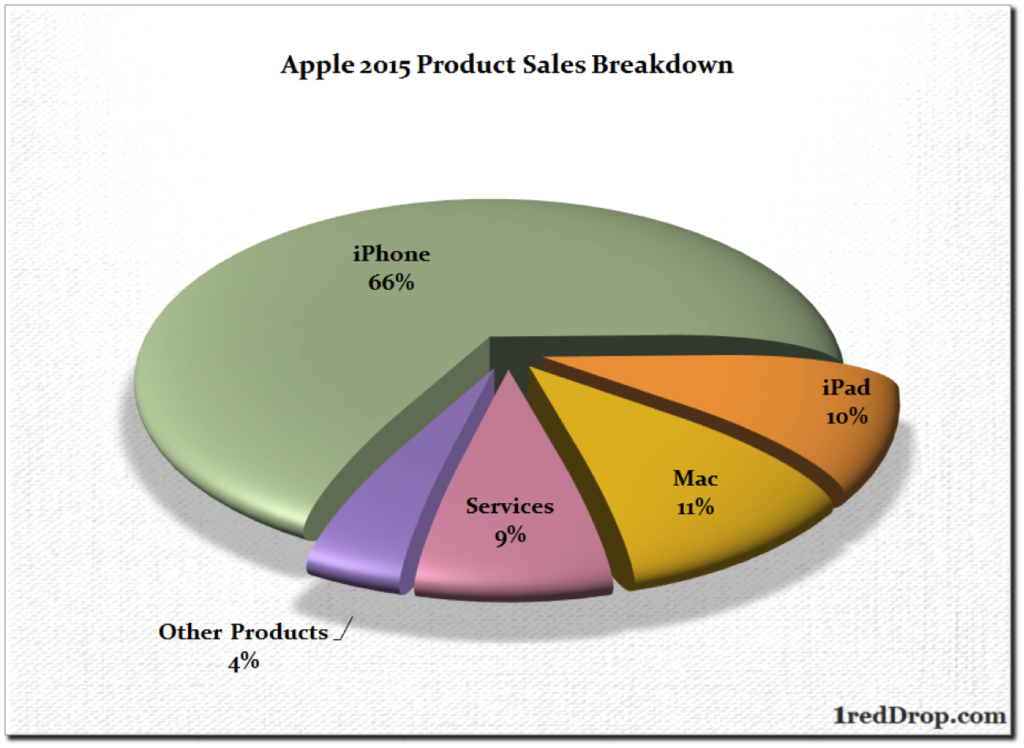

Now, considering the fact that Apple revolutionized the mobile world, it’s natural that most of its revenues would emanate from device sales – primarily iPhones, in fact.

Out of a total of $233.71 billion in revenues last year, a hefty $155.04 billion – or 66% – came from iPhone sales. Clearly, the iPhone is the chief breadwinner in the Apple household. Unfortunately for Apple, ten years after launching an iconic product and following it up with unbelievable encores year after year, it is now entering a new phase of slower growth.

According to Gartner, a reputed market research firm, smartphone sales are expected to slow down from here on out, and will no longer be able to grow in double digits.

“The smartphone market will no longer grow at the levels it has reached over the last seven years,” said Roberta Cozza, research director at Gartner. “Smartphone sales recorded their highest growth in 2010, reaching 73 percent.”

A further downside is the fact that most of the new growth will have to come from emerging markets as opposed to developed ones such as the United States, Canada, Japan and Europe. iPhone penetration is high in developed regions, therefore sales will inevitably slow down. The only way to grow in these markets is to keep releasing iPhone after iPhone until the magic wears off. That’s not a great place to be in if two-thirds of your income are from iPhone sales.

And that’s where Apple Pay suddenly becomes so important to Apple’s future. Clearly, Apple had to look at alternate revenue streams if they wanted to keep their sales growth intact, and the company is currently looking towards its services segment to do that. If you’re an Apple-watcher, you’ll have noticed that over the past two years, announcements around the services segment have been more frequent than ever before. And we can expect that to increase in the coming months as Apple lays the foundation for a second reliable pillar of income.

Apple, Inc. is obviously of the opinion that Apple Pay can play a significant role in that services portfolio, and that’s the best decision they could have made at this point.

In the next and final part of this article series, we’ll look at the market opportunities for Apple Pay, the kind of stiff competition they face from the likes of PayPal, Visa and MasterCard, as well as what actions Apple might take to stand out from the crowd as they’ve always managed to do.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world.