In an interview with Japanese news media service Nikkei, Apple CEO Tim Cook talked about Apple Pay and his vision of creating a cashless world where digital payments rule. Cook claimed that “we don’t think the consumer particularly likes cash”, referring to Apple, Inc.’s attempt to push its digital wallet Apple Pay to as many users as possible.

But is this a realistic view, is Cook referring to just the “Apple” world or does he really mean business? To answer those questions, we need to look at the state of the world’s financial transactions. You’d be surprised to find out how different it is from what we think it might be in 2016, now that we’ve entered a digital and mobile age.

To begin, here are some interesting statistics from recent years:

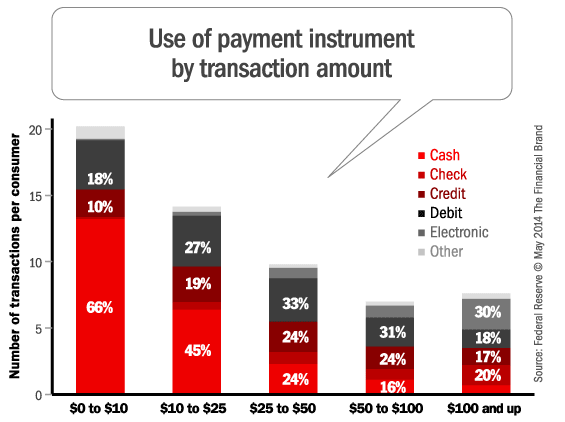

The graph above from the Federal Reserve shows consumer payment preferences for various types of instruments such as cash, check, plastic and so on. You can clearly see that at the lower end of the spending spectrum, which is also the largest segment, 76% of America prefers cash and checks. Even at the top end of $100 and up that combined figure is 37%.

Now that’s the user base that Tim Cook essentially wants to target with Apple Pay. In addition, Apple Pay also means no more using plastic, so credit and debit cards – though linked to the Apple Pay account – need no longer be carried around.

To put that another way, only a small percentage of consumer transactions are purely electronic – meaning mobile wallets, e-checks and services like PayPal.

That’s the first mountain that Apple has to scale in its attempt to eliminate cash and move the world to digital payments.

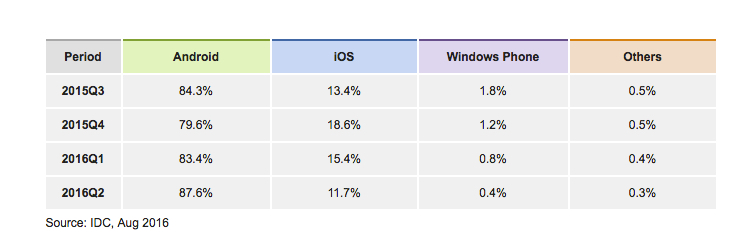

The second problem is Apple’s closed ecosystem. Apple Pay is not available anywhere outside iOS and macOS, so that presents the next challenge. Over a billion iPhones have been sold to date, but Apple still struggles with market share because of its premium pricing. Here’s what research firm IDC says:

“Android dominated the smartphone market with a share of 87.6%. Samsung, the #1 contributor showed strong performance with its flagship releases, the Galaxy S7 and Galaxy S7 Edge. Android share has risen both YoY and QoQ, with strong growth in unit shipments by other players such as Huawei, OPPO, and vivo.”

Here’s a table of data to put that in perspective:

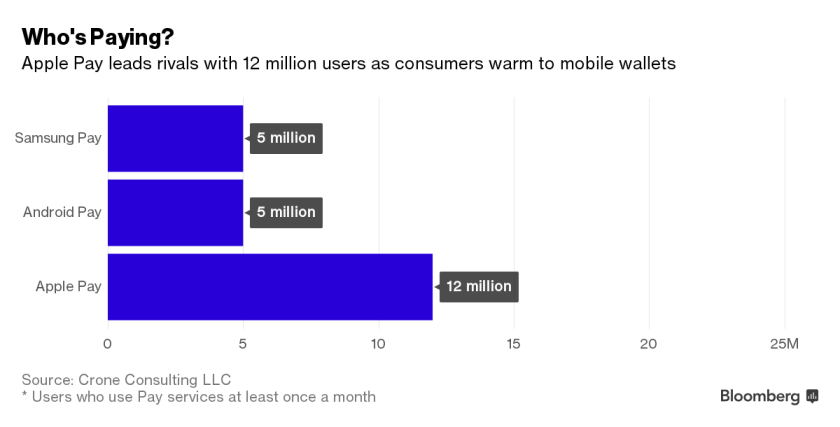

So Apple, with an iOS market share of only 11.7% (last row, most recent data), essentially wants to be a “catalyst” that wants to move the world from cash payments to digital payments, according to Tim Cook. Their market share, therefore, is the second mountain to the scaled. Even if Apple Pay opened up to Android users, they’d have to contend with Android Pay as well as Samsung Pay, both of which currently have around 5+ million users against Apple’s 12+ million, which brings us to the third hurdle.

With over a billion phones sold, Apple Pay has only garnered a meager 12 million users. That figure might have gone up nominally over the past few months since the data was last collected, but it still leaves a majority of Apple users who are yet to use Apple Pay.

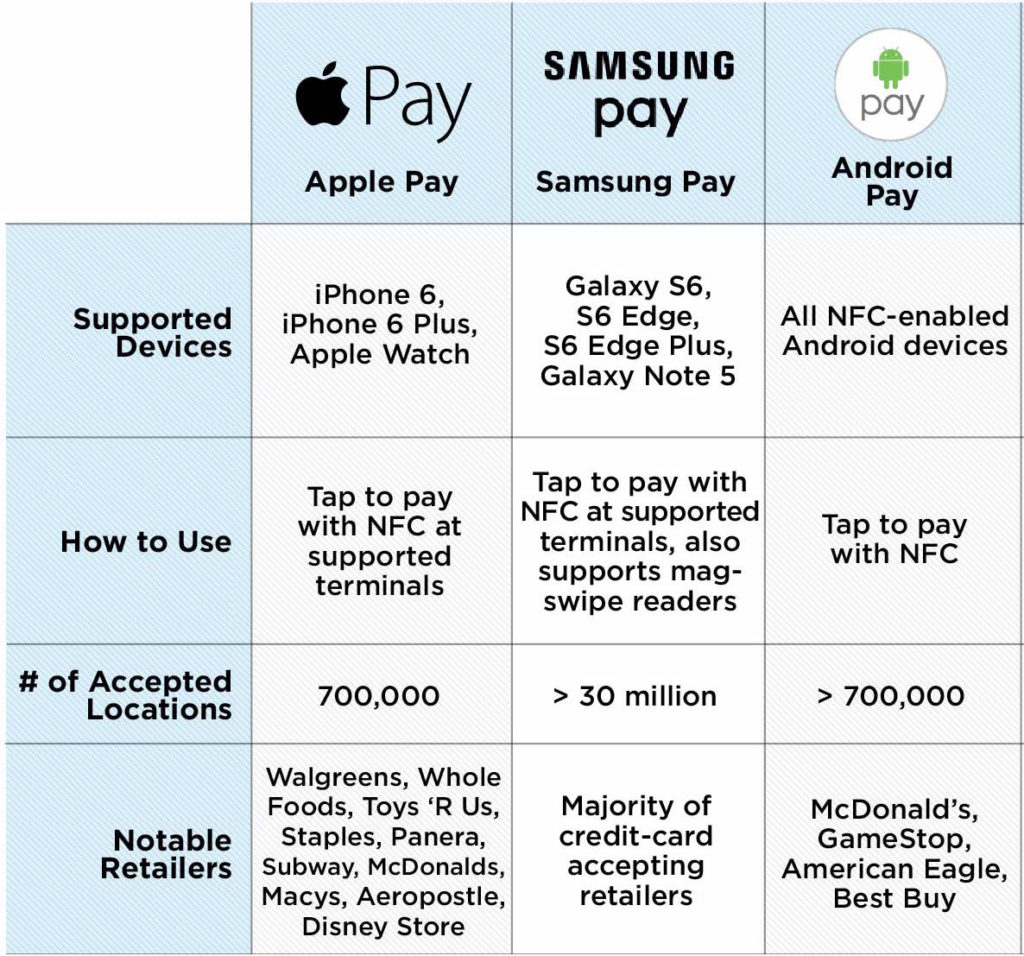

The fourth stumbling block is usability. While Apple Pay is great for online transactions – which are already electronic, by the way – it’s not so great for physical transactions, where the bulk of cash usage happens. Here’s why:

Take a look at the # of accepted locations for each of these services. See the problem? Because Apple Pay only uses NFC (near field communication) technology, there are only 700,000 locations where Apple Pay can be used, versus 30 million for Samsung Pay because it works on magnetic strip payment terminals that are pretty much standard.

They could solve the problem by including mag-stripe technology on Apple Pay, but retailers today are shifting to EMV terminals because they are much safer. EMV terminals do come with contactless NFC options, but they’re expensive. Retailers would need to pay anywhere between $500 and $1000 per unit. PayPal and Square do offer them at around $49, but there’s a 2.5% charge per transaction, making it an unattractive proposition for many retailers.

In summary, the current state of payment transactions, Apple’s closed ecosystem, their minority market share and the technology for Apple Pay support are all major hurdles that Apple will need to cross before realizing their dream of a cashless world.

Can Apple Pay be the Catalyst for a Cashless World?

Is it possible? I’m not going to say no, but we’re looking at a massive shift on a global scale. That could take decades. It’s not going to happen in the next 5-10 years, that’s for sure. There are still billions of people with no access to plastic money, let alone smartphones – even cheap Android ones.

If Tim Cook were only talking about small pockets around the world, like large metros in developed countries, that would be a more acceptable goal. But the entire world going without cash? That’s something else.

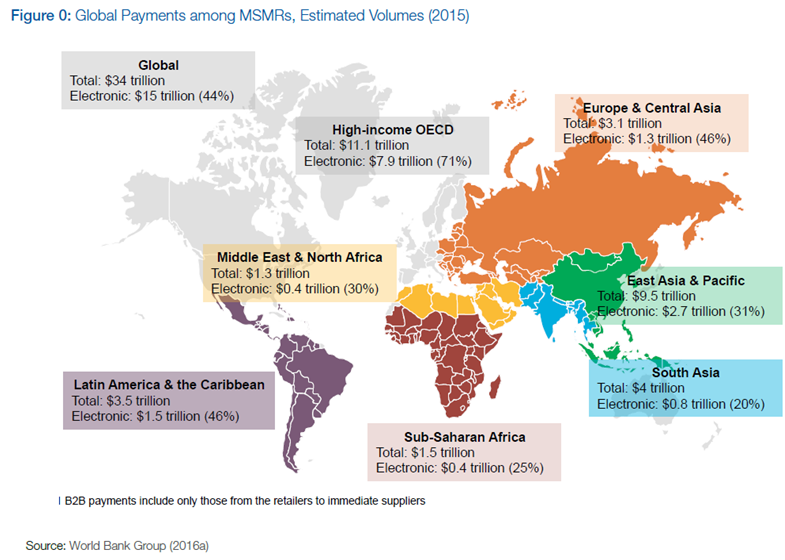

Yes, many countries are trying to move to a world of paperless money, but even business-to-business payments across the world are mostly in cash. Take a look at this map of the world showing how B2B transactions are split between electronic and other methods of payment. 29% of businesses in developed countries still transact non-electronically (see high-income OECD countries.)

If the majority of the world’s businesses themselves transact non-electronically at the moment, what can you say about consumers?

My opinion is that Apple Pay will definitely make a dent in the payments world, but I don’t think that it can be a “catalyst” for a cashless world any more than Amazon can catalyze the entire world to move to online shopping and eliminate physical retail in the process.

Cold, hard cash has been around for thousands of years, and consumers aren’t going to be easily convinced to go purely electronic. Besides, there’s something indescribably satisfying about carrying a wad of crisp notes fresh from the ATM in your pocket, wouldn’t you say?

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world.