Twitter’s future seems to be in a constant state of flux. After the initial euphoria of a buyout by another major company died a sad death, it became clear that Twitter has to manage its recovery on its own. A buyout could still happen, but definitely not as fast as some Twitter investors would want it to happen.

“Neither Google nor Disney plan to bid on Twitter, despite reports saying both were interested. Recode says that Apple is likely also out of the picture. And Verizon immediately dismissed speculation that it was considering a bid.

Facebook is also said to be uninterested, according to CNBC. And while Microsoft’s name has been tossed around, no one seems to think the acquisition would make any sense for an increasingly enterprise-focused company.” – The Verge

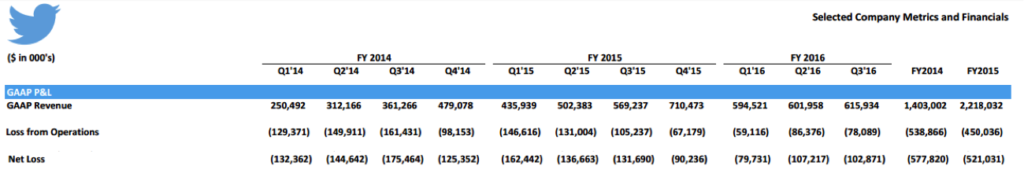

Twitter’s total liabilities stood at $2.1 billion dollars with cash and short term investments around $3.6 billion at the end of third quarter this year. Twitter’s quarterly losses have been staying at around $100 million to $150 million in the last few years. Clearly, neither Twitter’s financial position nor the bottomline would have been a factor for the companies who were supposedly interested in acquiring Twitter – especially for Alphabet, Apple or even Microsoft.

But unfortunately, no news is trickling down on the buyout story, with even Salesforce CEO Mark Benioff saying that he had to walk from the deal. Nobody knows the exact reason behind his decision but, clearly, Twitter seems to lack the attractiveness quotient. What’s even more surprising is that people are refusing to take a risk on the company.

Take Alphabet, for example. The company’s Other Bets reported an operating loss of $980 million during the third quarter. That’s nearly ten times what Twitter lost during its third quarter. So, it’s very clear that, from Google’s standpoint, Twitter’s current profitability would have never been the most critical factor. It could have played a small role in their decision, but definitely not the one that would have pushed them towards the ‘No’ button. With more than $73 billion in cash, Alphabet could have easily snagged Twitter, and the integration could have quickly boosted Twitter’s overall numbers. In addition, with the advertising expertise that Alphabet has already built, Twitter would have easily become profitable within a few years.

One reason that could have made fellow tech companies shy away from the deal is the amount of premium that Twitter was asking these companies to pay, but nobody knows what exactly happened behind closed doors. However, the fact that all these big companies have voted down on the buyout is a big red flag for Twitter, which will be now left to its own devices to pull itself out of trouble.

Twitter’s revenue has been growing, and their financial position is not really so bad as to warrant a sale. But it could have been a huge boost for the company’s morale, and would have brought the added benefit of being able to do things on its own without having to go through the intense scrutiny of Wall Street each and every quarter. Think how Instagram and WhatsApp are now able to grow on their own while Facebook takes away all the tension (and attention) during the quarterly earnings calls. That’s what Twitter is missing out on.

Twitter stock is now back to trading at the mid-July levels around the $18 mark, and the subsequent brief surge could actually have hurt a lot of investors who added to their position based on the buyout news. Twitter, along well as its stock, now faces a long, hard road ahead to gain back investor trust. Growth may well come, but with just a 3% increase in active users over last year, it’s going to be a long wait for existing investors who got in anywhere over the $20 level – unfortunately, that would be the majority of them.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.