There are several theories and articles swirling around on the internet that argue that iPhone sales have already peaked, and the odds of scaling the high of 231.218 million iPhones Apple sold in 2015 are very slim, or next to impossible. The primary thrust of arguments that support the “iPhone sales have peaked” theory is that the market potential at the premium end of the smartphone market has peaked, so growth will naturally be slower moving forward.

But that’s only half the argument. What nobody is saying is that Apple is deliberately not chasing unit growth for the iconic iPhone. And that’s the half of the argument we intend to explore with this article.

Arguments in Support of the “iPhone Sales Have Peaked” Theory

Pricing

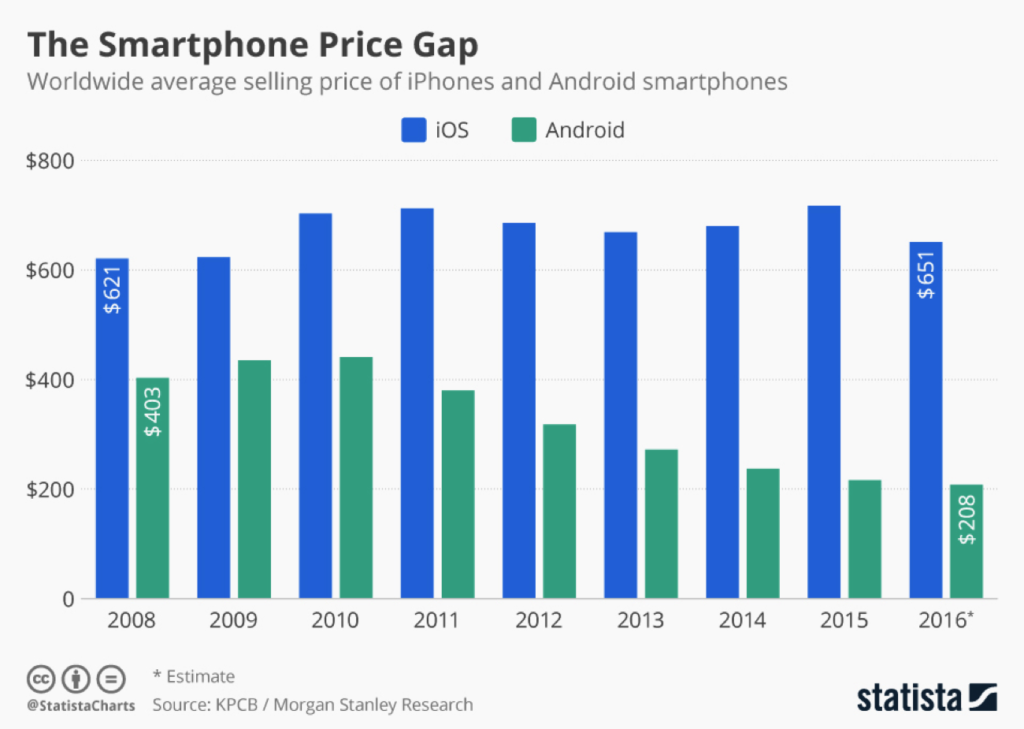

First, let’s look at iPhone’s historical pricing over the past decade. To put that in perspective, we need to compare that with Android, the only other operating system that powers devices at such scale.

As you can clearly see, the average selling price of iPhone has consistently stayed above the $600 level, while that of Android smartphones has kept coming down. Apple has been cementing its place at the top end of the pricing spectrum, while the third-party-manufactured Android phone prices have kept moving lower and lower. The difference is also fueled by regional influences such as smartphone penetration in developed markets, the demand for low-cost phones in developing markets and the resulting supply part of the equation.

Penetration

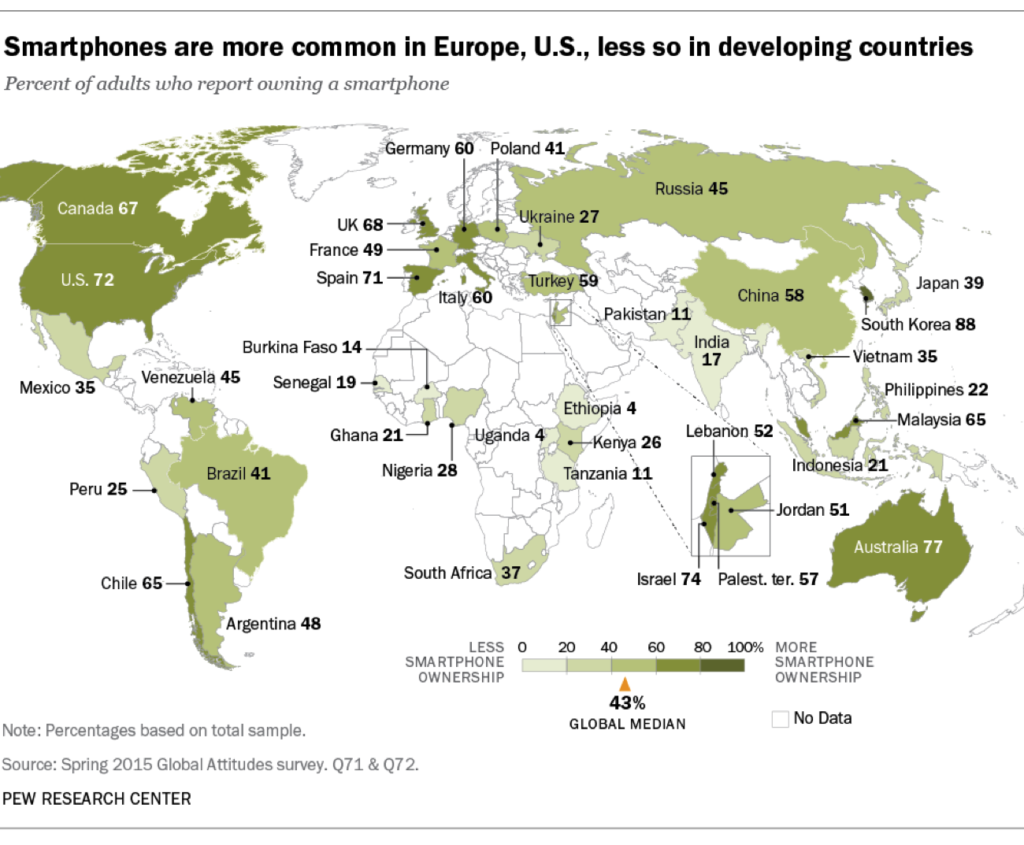

To flesh out that argument, let’s have a look at smartphone penetration around the world. In North America, Western Europe, Australia and a few other pockets around the world, more than two-thirds of the adult population owns a smartphone. Conversely, the rest of the world has a penetration that goes from 58% in China down to single digits in countries like Ethiopia.

The side effect of this is that the penetration in developed markets is already so high that growth in such markets can only come from product refreshes and upgrade cycles. The first is the rate at which new models are introduced and the second is the rate at which consumers typically upgrade to newer models of smartphones.

The real growth for the smartphone industry lies in emerging nations such as China, India, Indonesia, Russia, South Africa and other countries. But the problem is, the market for luxury-tier smartphones is much smaller in these nations.

As a result, smartphone manufacturers who operate in the lower price bands will be the ones capturing the growth in these markets, which is why there are literally hundreds of smartphone makers today targeting the huge pool of demand for low-cost smartphones.

And this is the sole premise for the “iPhone sales have peaked” theory – or, at least, the one that’s being spread like wildfire on the web.

Profitability

But that also assumes that Apple has already taken the decision to not compete in the low end of the market. Admittedly, there is some sound logic to that argument.

According to Strategy Analytics, global smartphone profits reached $9 billion during the third quarter of 2016, with Apple iPhone sales capturing a whopping 91 percent of that market.

The reason for such a skew is simple: Apple asks its buyers to pay a huge premium for its smartphones, and those who can afford it are willing to pay that premium because, at the end of the day, its an Apple product. Years and years of goodwill collected by the company, coupled with tangibly better quality, has convinced the market that the value of the product is equal to or higher than what they pay for it.

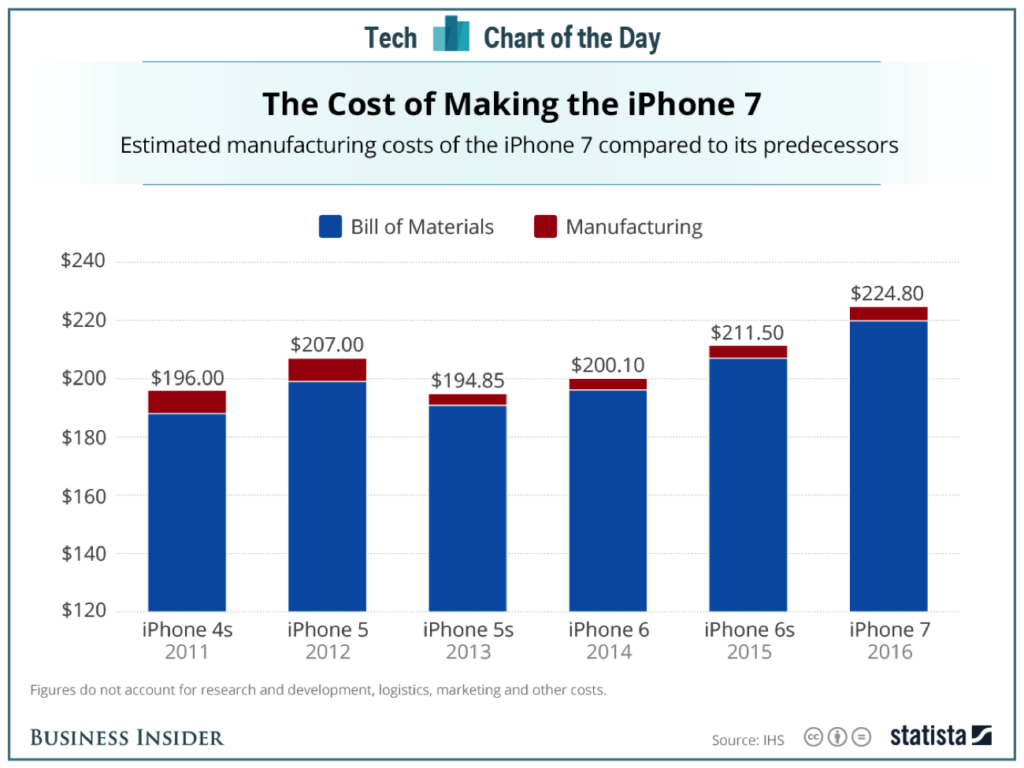

So, how profitable is Apple’s premium market, exactly? Let’s take a look at the actual cost of making the iPhone over the past five years.

Since 2011, the cost of making the iPhone has kept on increasing, but only marginally. What cost $196 to make back in 2011 has only gone up by less than $30 as of this year.

It costs less than $250 to manufacture the iPhone 7, but it retails in excess of $649, turning a huge amount of profit for the company. But that fact that Apple enjoys more than a lion’s share of the profits in the smartphone market also tells us that there is no money to be made at the low end. The margins are literally non-existent there, and you need continuous investment to upgrade the technology, manufacturing process and so on.

With most of the future smartphone sales expected to come from emerging economies where only low end smartphones can sell, why would Apple want to dive deep into the low end of the spectrum? The company has already gone to the next lower price band with the iPhone SE specifically designed to increase its market potential, which is now selling for $299 at Walmart after a $100 discount – a price point that is still higher than the average Android smartphone.

But will they continue to take that direction? They could, but only if it satisfies their hunger for profitability.

The Future of iPhone Sales

Let’s take the upcoming iPhone 8 planned for 2017 as the perfect example. There are rumors that Apple could bring in a price drop to make it affordable to more people. But you can bet your last pixel that they won’t be bearing the loss themselves. In fact, KGI analyst Ming-Chi Kuo already believes that Apple will put immense pressure on its suppliers to bring down the costs for iPhone 8 components.

So, even with a potential price drop, Apple is not willing to forgo its margins. That’s the real reason why they won’t go into the sub-premium segment – at least, not lower than they’ve already gone with iPhone SE.

Apple can easily price-compete with premium Android phones, but that will not only erode their margins, it will also erode their brand value over time. The company will never put its positioning at the premium end of the devices market at stake because that will cause the entire edifice to crumble.

Yes, iPhone sales may well have peaked, but it is because Apple has chosen not to go low and lose money rather than because their phones have limited market potential. That choice may be a forced one because of the way they have positioned their products, but it is a choice nonetheless.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.