Despite reports that iPhone sales during the last quarter beat out all other phones in terms of activations, Apple has decided to cut iPhone production by 10% for the first quarter of 2017, says a report by Nikkei.

This isn’t the first time Apple is doing this. When there was a surplus of iPhone 6s units at the end of 2015, Apple did the same thing for the first quarter of 2016.

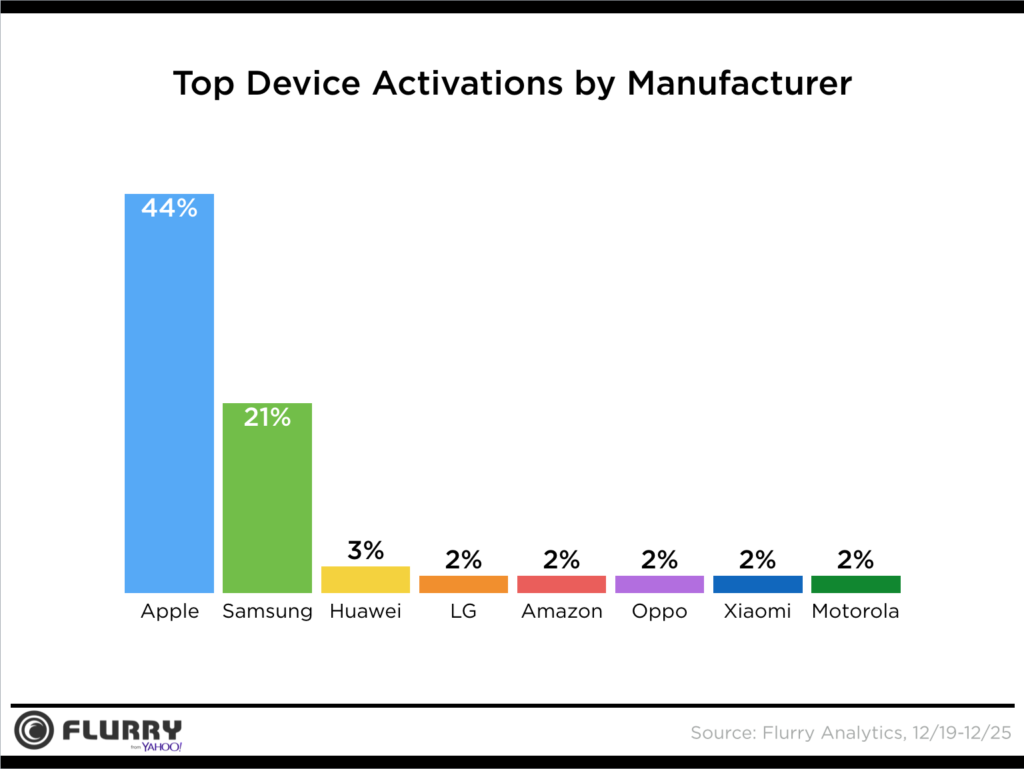

This past holiday season, 44% of all mobile smartphone activations were for iPhones, followed by Samsung at 21%. Apple’s share of activations actually dropped from the previous year’s 49.1%, but even more surprising was the fact that Samsung’s share grew from 19.8% despite the huge fail from Note 7 devices.

As you can see, none of the other smartphone players even reached the 5% mark, so Apple’s and Samsung’s positions at the top are fairly cemented for now.

Of course, Google Pixel came in strong during the final quarter of the year, but it’s still too early to see them figure in this analysis. The Google Pixel did pick up a 10% market share in India barely a month after it was launched, so that was, indeed, a good indication of the traction they gained in that market.

The United States, however, is a much tougher market, and if Google can pick up even a 5% share by the end of 2017, it’s a major achievement for #madebygoogle.

In the meantime, Microsoft is still working under the tarp to finally unveil its Surface Phone / Cellular PC this year, so it can muscle its way into acquiring some mobile market share of its own. But that’s not going to happen in the next 12 months. They might release a flagship model early on in 2017, but strong initial adoption is not something they or any one else can guarantee, even if they do have several advantages.

iPhone cutting its production for the next three months also indicates a need for more sales. They’ll push carriers into offering deals and even work with retailers on offers for iPhone 7 and iPhone 7 Plus. As such, the next three months might be a good time to switch to iPhone 7 in case you haven’t already done that.

We also need to remember that Samsung is still the biggest smartphone brand in the United States with an overall market share of 28.8% as of March 2016, according to a study by CounterPoint Research. That might have changed with the activations data for the final quarter of 2016, so it’s clear that both these smartphone makers are still playing leap frog when it comes to market share in the world’s most lucrative nation.

2017 will be a critical year for all smartphone makers because it is going to be a year of consolidations and the death of several smaller brands. The premium smartphone segment is the only profitable one right now, and Apple holds more than 90% of that profitability. But Samsung has the technology and the deep pockets to give Apple a solid run for its money, and the South Korean electronics giant isn’t going to allow 2017 to repeat the mistakes of 2016.

So, while we wait for Microsoft to debut their Windows 10 OEM smartphones and for Google to gain traction with Google Pixel and Pixel XL, the set has been cleared for Samsung and Apple to stage their battle for dominance in key markets.

And what that boils down to are essentially the ‘8’ line-up of smartphones for 2017 – iPhone 8 versus Galaxy S8. These are the devices to watch out for this year – how well they sell, the problems they face, early adoption rates, activation rates and so on.

We’ll be tracking all of those metrics and more, and you’ll have it served to you piping hot as the information breaks. Stay tuned, and have a wonderful 2017!

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.

Sources: Nikkei, Flurry Analytics