The global sales and shipment of mobile phones (including smartphones) and PCs took a hit in 2016. In the case of PC shipments, the decline has been going on for no less than five consecutive years. Last year, smartphones underwent the same phenomenon as well.

In this article, we piece together the historical and forecast data from research firm Gartner and other sources to see what the state of mobile phone and PC shipments look like for the year 2017.

Global Smartphone Data with 2017 Forecast

Ranjit Atwal, research director at Gartner, says that the chief reasons for the decline we’re seeing in smartphone prices are market saturation and a slowdown in innovation.

That’s understandable, because even an innovative company like Apple has only been making incremental improvements on its flagship smartphones for the past three years. The iPhone 7 and iPhone 7 Plus are not very different from the iPhone 6 and iPhone 6 Plus that were launched in 2014.

Of course, product enhancements have definitely been made. The new phones are faster and more capable, with better displays and better performance, and a few major changes have been brought in, such as a dual camera.

But, on the whole, there’s definitely some raw, bold innovation missing from Apple’s products over the last few years.

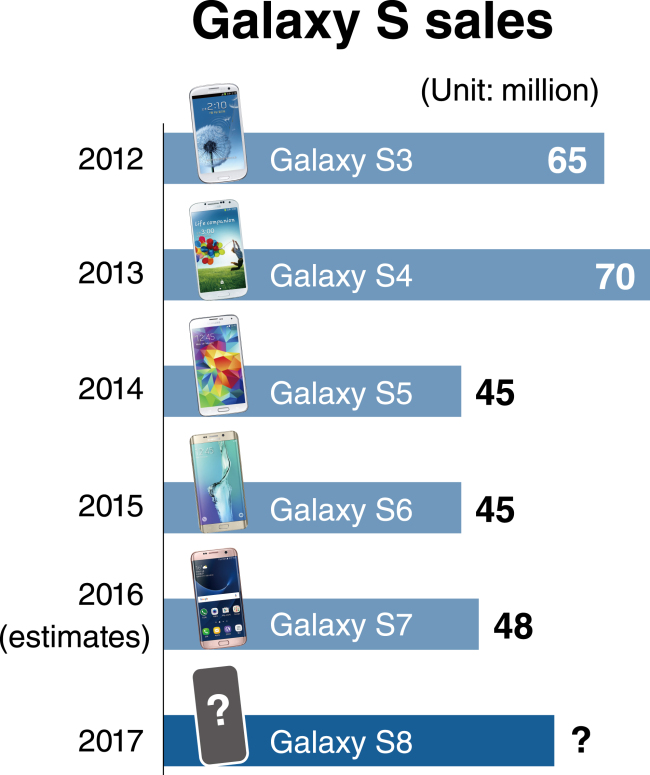

Take global smartphone leader Samsung, for example, and you’ll see the same pattern emerging. That could be one of the reasons why the sales of their flagship “S” models have been looking like this:

Nevertheless, Apple is targeting 80 million iPhone sales in the last quarter of 2017, while Samsung hopes to sell 60 million Galaxy S8 units over the course of the year.

Now, obviously, the targets of the world’s top two smartphone makers conflicts with the trends that Gartner predicts for 2017 and beyond.

Moreover, Gartner says that buyers have fewer reasons to upgrade and buy traditional devices. Instead, they’re looking for newer experiences such as HMDs (head-mounted devices) and virtual private assistants. That’s applications such as Google Assistant and Alexa, which bodes well for products like Google Pixel and Amazon Echo.

Nearly all the top consumer technology companies have plans to release smart speakers this year, with Amazon and Alphabet’s Google taking the lead, and players like LG and Lenovo following hard on their heels. Microsoft has plans to launch a similar smart speaker with Cortana built-in and Harman/Kardon speaker technology powering the audio.

As for smartphones with virtual private assistants (VPAs), there’s already the Google Pixel, but now we’re seeing smartphone makers like Huawei start to integrate Amazon Alexa into their products. That trend should continue through 2017 because it calls for the next level of innovation in smartphone technology.

The other innovation we’ll see this year is foldable smartphones and mobile devices. Samsung, for example, is already looking at shipping 100,000 units of a new foldable device that can be used as a smartphone when folded in, and a 7-inch tablet when folded out.

This is the kind of innovation we’ll be seeing in 2017, although Apple may not be joining the innovation bandwagon this year as well. The biggest innovation we’ll probably see on iPhone 8 is the OLED panel, the forged steel chassis and possibly a larger screen size. Everything else we’ve heard just seems to make the iPhone “better’, not necessarily “different.”

Global PC Shipments Data with 2017 Forecast

Things don’t seem much better for the PC market, either. 2016 was the fifth year of consecutive decline in PC shipments worldwide.

One of the reasons that’s been happening is the proliferation of mobile devices during that period. As consumers gradually shifted their online activities to their smartphones and tablets, their PCs sat gathering dust.

That’s not to say the PC market is dead. Far from it. What’s happening is that PCs are increasingly being relegated to office and professional environments. Even though most companies have a BYOD (bring your own device) policy, workstations at the office still have PCs. That’s because PCs have more maneuverability, they run classic desktop apps and they’re generally more sturdy than mobile devices. There’s also the advantage of larger screen sizes, more connectivity options for peripherals and so on.

Gartner’s forecast shows that the decline of PC shipments is finally finding a bottom. That doesn’t necessarily mean they’ll start showing healthy growth again, but it does mean the PC market could be reaching a stage of stable but slow growth.

That could be bad news for Microsoft because the company’s core revenues come from Windows 10 licensing. If PC shipments are soft this year, it could seriously impact their top line numbers for 2017.

The Takeaway

Does that mean the transition from desktops to mobile devices is complete? It would seem so, considering that both PC and smartphone shipments are finding their plateaus. But there are other factors to consider.

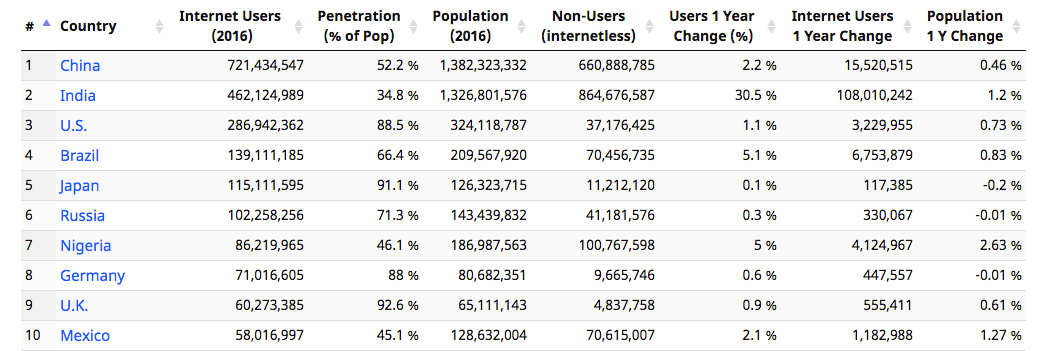

Smartphone sales in emerging markets, especially the APAC region, are still strong. One reason for that could be that internet penetration is still quite low in several of these markets.

As you can see, the top two internet user regions are still under the 60% penetration level and have tremendous growth potential. That should help the smartphone market eke out a little more growth over the next few years.

The other factor is what smartphones are actually used for. Mobile payments are on the rise, but so far that’s been restricted to web-based payments, not mobile wallets. Even in 2016, during the holiday season, only 30% of purchases were made on mobile. The emergence of four big-pocketed players into the mobile wallet space – Apple, PayPal, Google and Samsung – could change that, but it will take a few years for that transition to happen.

Yet another significant takeaway is the state of the smartphone industry – specifically, smaller companies struggling to make a profit. Apple already takes in 91% of the industry’s profits, which leaves smaller players struggling just to stay afloat. As a result, we may see an escalation in mergers and closures among smaller smartphone companies, and it’s already begun to happen in markets like China, where a lot of smaller smartphone makers are based.

Things don’t bode well for the smartphone industry in 2017, and more so for the PC market across the globe. The bigger players will survive even though they may not show impressive growth, but both industries will go through a cleansing process that only leaves the fittest surviving into 2018.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.