IBM’s cloud initiatives have largely been flying under the radar thanks to the weight of Big Blue’s revenue decline, which has been overshadowing the smaller but fast growing parts of its business.

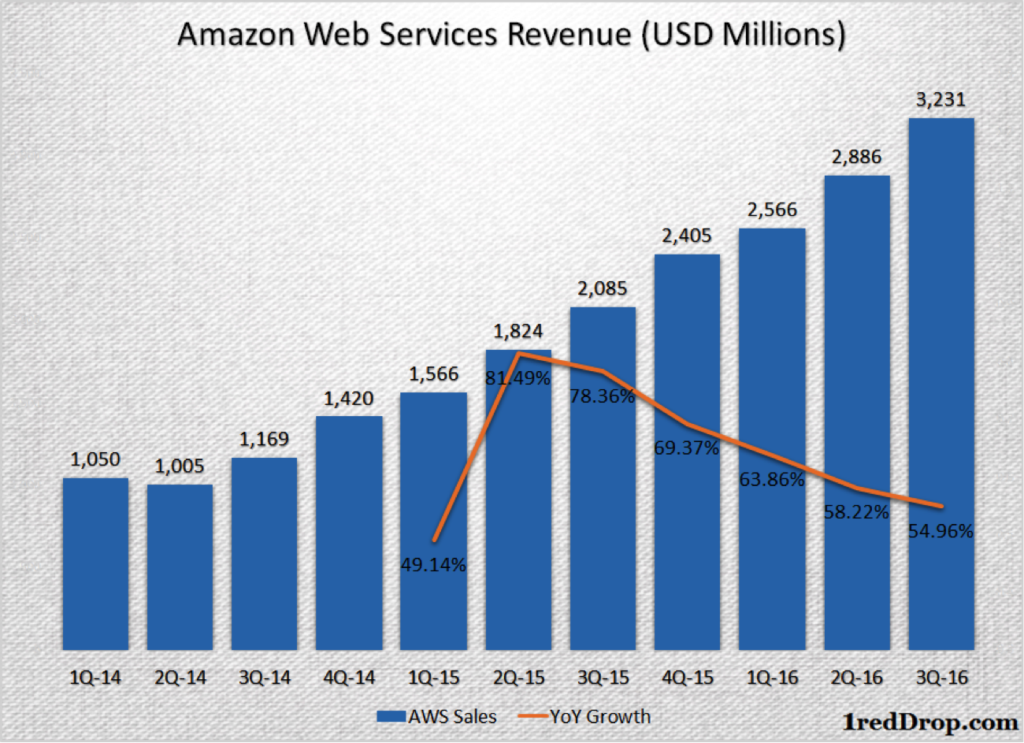

Amazon and Microsoft have already scaled above the $3 billion a quarter barrier, and for a while now they’re been running practically neck to neck when it comes to cloud revenues. IBM now has a five-billion-a-quarter and steadily growing Analytics division, while its cloud-as-a-service segment has been growing at strong double digit rate last year as well.

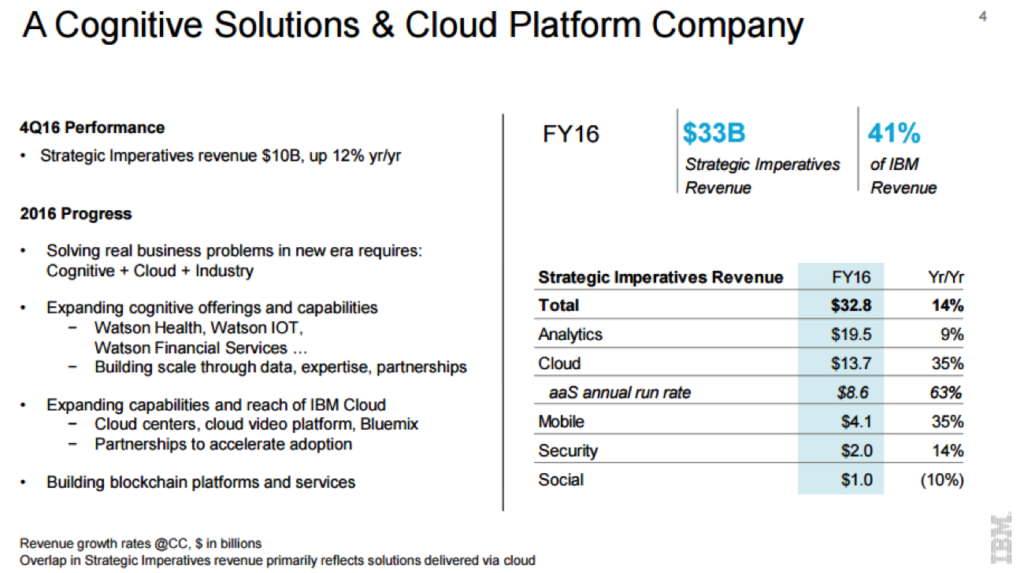

In 2016, IBM Cloud reported $13.7 billion in sales, putting them squarely in the spotlight where Amazon and Microsoft are standing in terms of their respective overall cloud revenues.

All three companies have established their own strongholds within the cloud segment. Amazon leads the pack when it comes to IaaS, Microsoft has a solid SaaS business along with strongly growing IaaS, and IBM Cloud pivoted towards the hybrid deployment model, along with a laundry list of analytics-based services.

Amazon Web Services revenue grew a little bit faster than IBM, in excess of 50% for the last four quarters.

But IBM was no slouch either, reporting growth of 35% in 2016 compared to the previous year. IBM’s as-a-service offerings have also been growing fast for the company, with annual as-a-service run rate increasing from $5.4 billion at Q1-16 to $8.6 billion at the end of Q4.

Annual run rate is either calculated using monthly revenue multiplied by 12, the way Microsoft does, or on a quarterly basis multiplied by 4. We don’t know which method IBM uses, but if they hit a run rate of $5.4 billion in Q1, that translates to either a March 2016 revenue of $450 million or a first quarter revenue of $1.35 billion.

Now, at the end of the fourth quarter, they’ve reported an as-a-service run rate of $8.6 billion, translating to either $716 million in December or $2.15 billion for the quarter.

Clearly, IBM’s as-a-service product line up is experiencing solid sequential growth and should easily cross over billion dollars a month in revenue in the next four quarters, if they can sustain the current growth rate.

Compared to the fourth quarter of 2015, IBM’s as-a-service annual run rate has grown by 65% as at Q4-16, so there is enough momentum within the division to continue its growth path.

We don’t know exactly how much of the growth in the as-a-service product line up is actually contributed to by their strong Analytics division, buts it’s clear that IBM has found something that’s keeping them ticking.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.