How Big is Microsoft Azure, Really?

That’s a question that can only be answered by Microsoft. The Redmond giant does not give out revenue numbers specific to its Infrastructure as a Service offering, Azure…but it happily gives us its year over year growth rates and an “as of now” figure called annualized run rate.

The part that everyone knows is the annualized run rate of Microsoft’s cloud-related services revenue, which crossed $14 billion during the most recent quarter. But the annualized commercial cloud run rate that Microsoft reports every quarter includes revenue from its “SaaS 365” lineup, Microsoft Azure infrastructure as a service and all other cloud products as well.

“Commercial cloud annualized revenue run rate exceeds $14.0 billion” – Microsoft Q2-17 Earnings Report

“Commercial cloud annualized revenue run rate is calculated by taking revenue in the final month of the quarter multiplied by twelve for Office 365 commercial, Azure, Dynamics 365, and other cloud properties.” – Microsoft

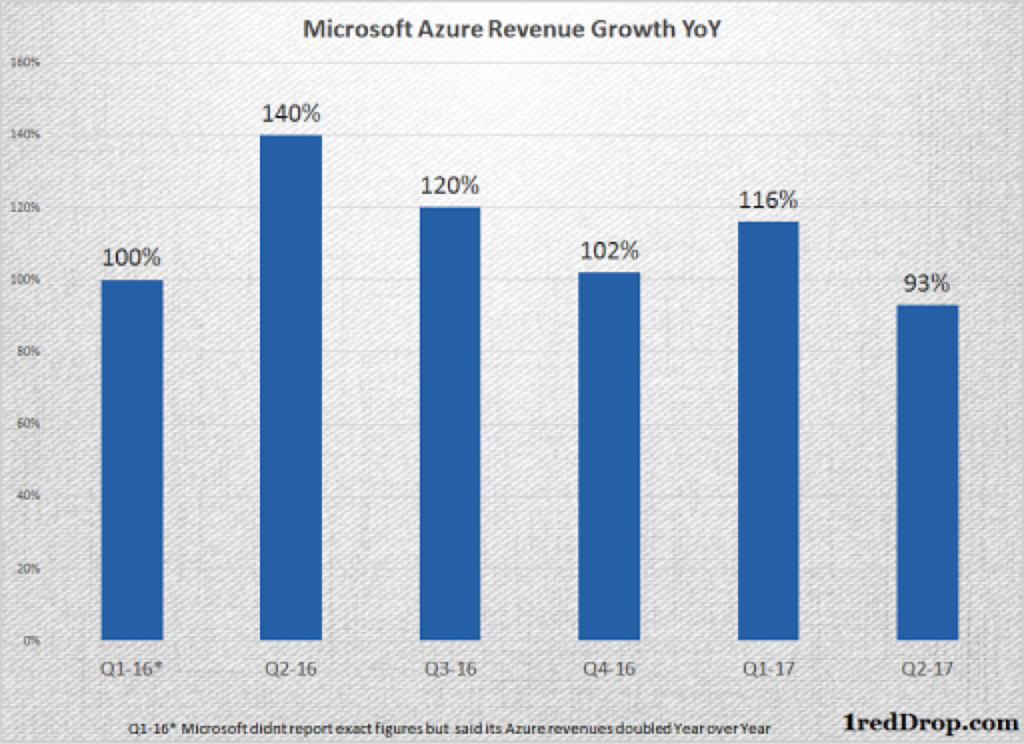

What we do know well is the rate at which Microsoft Azure has been growing for the last six quarters, which is nothing short of spectacular.

In Q2-2016 it recorded a growth of 140%, and in Q2-2017 Azure revenues grew by another 93%.

Which means, if Azure had $100 million in revenues during the second quarter of 2015, it would have grown to $240 million in Q2-16 and to $463.2 million in Q2-17. Another near-100% growth next year would mean that Microsoft Azure would have grown its 100-million-dollar revenue stream to near 1000 million dollars – all in a span of 12 quarters.

Simply put, a billion-dollar business born of a hundred-million dollar business – after only three years. There’s an investment I’d put my money into.

They’ve already grown five-fold in eight quarters, but what’s even more significant is that the growth seems to be far from over.

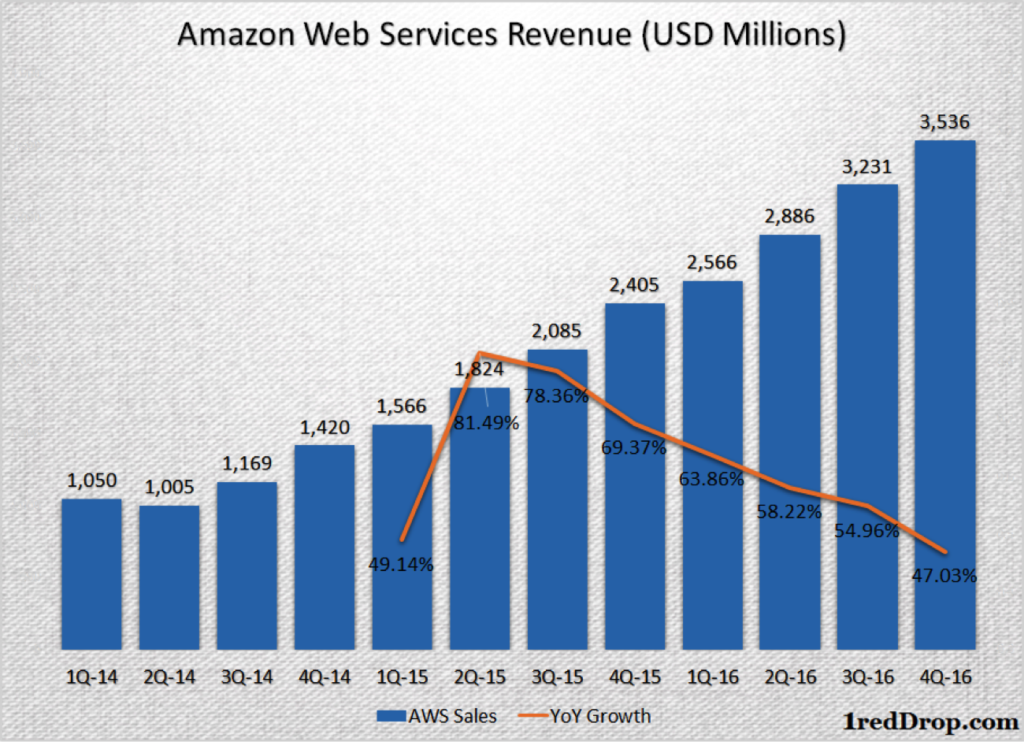

On a comparative note, current segment leader Amazon Web Services, which makes most of its money from IaaS-related services, has been growing at around the 50% mark for the past several years.

As Microsoft Azure gets bigger and bigger, the growth number will have to come down. But even if it comes down to 50% next year, that’s still a solid position to be in. In other words, having made a five-fold jump since Q2 2015, even an ultra-modest 50% growth next year would result in about 7X growth in three years.

That’s massive amount of growth, and it’s a testament to how effective the marketing behind Azure has been. But it’s also a testament to how well Azure is being received.

Microsoft has never been the most diplomatic marketer in the room, so even if they’ve been pushing Azure down their customers’ throats (I’m not the most diplomatic writer), it couldn’t have consistently grown at an average of 100% year over year for two years running unless it was a “value-able” product.

If Microsoft can keep up this kind of growth performance or even keep it at half-steam – above the 50% mark – for a while, they may actually eliminate the gap with AWS on the IaaS front in the next eight to twelve quarters.

A survey of CIOs by Morgan Stanley shows that Azure is quite possibly going to be the more preferred of the two IaaS options by 2019:

“According to Morgan Stanley’s 2016 CIO Survey, Microsoft’s Azure will edge out Amazon Web Services by 2019 for both Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) use among 100 executives surveyed. Roughly 31 percent of the CIOs will be using Azure for IaaS, versus roughly 30 percent using AWS. Today, about 21 percent are using AWS and 12 percent are using Azure. While nearly 55 percent of the surveyed CIOs said they’re using no public-cloud IaaS today, that number will drop to less than 10 percent by the end of 2019.” – Geekwire

Microsoft does have several advantages over Amazon. It’s an enterprise-centric company because of its productivity applications and business management software. It has LinkedIn as a gateway to millions of businesses around the world. It has the ideal blend of standalone and cloud software comprising some of the most-used office productivity tools in the world, and it has an adequately robust cloud infrastructure set up underneath it all.

But if you think all of this makes overtaking AWS a breeze, then think again.

Amazon is no slouch in IaaS, and it is as focused a company as you’ll find in any aggressive industry segment in the world. Including retail, incidentally.

Microsoft is growing fast, but Amazon is not going to make it easy for them to take pole position as a cloud infrastructure provider.

Our take is a little different from Morgan Stanley’s. Told you I wasn’t diplomatic. At 1redDrop, we realize it’s a very tough call to pick a winner in IaaS. What we believe is that Microsoft’s overall cloud revenues will certainly overshadow that of AWS in time because of their SaaS strength in the enterprise segment, but Amazon’s cloud unit is not going to be the easiest of competitors to topple off the Number One rung in cloud infrastructure.

As such, we’re a little uncomfortable accepting 2019 as the definitive year of Microsoft’s IaaS strengths taking it past what Amazon will be able to do by then.

At the end of the day, neither Morgan Stanley nor we know who the King of IaaS will be in 2020. It’s all guesstimations, extrapolations, interviews, interpretations, modeling and such until the actual event proves every guess, no matter how educated, either wrong or right!

But one thing is clear: in the race between Microsoft and Amazon’s AWS for cloud dominance, the real winner is the average cloud consumer. We continue to get more products, better services and lower prices. Cloud is getting cheaper, more accessible, more efficient and more powerful because of this level of competition.

If you want to see cloud computing competition at its best, watch these two accomplished cloudsmen exchange thrusts and parries with each other. Meanwhile, you can also watch IBM grab and run away with the analytics market, and the very crucial niche that is hybrid cloud deployment.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.