Bain & Company, one of the world’s top management consulting groups, has released its analysis and forecasts for the cloud computing industry, titled: The Changing Faces of Cloud.

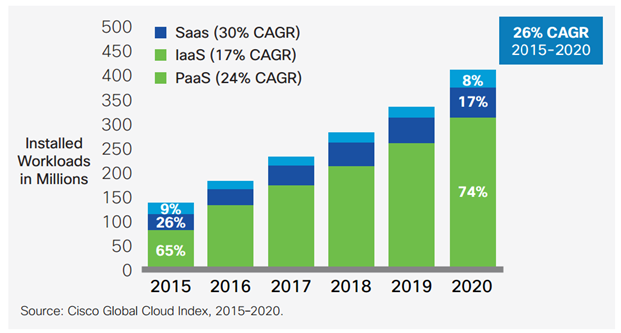

Bain expects the Infrastructure as a Service and Platform as a Service segments to grow at 27% CAGR between 2015 and 2020. From a pure numbers perspective their estimate sort of validates the forecasts by Cisco and IDC.

Cisco has predicted cloud datacenter traffic to grow at 30% CAGR between 2015 and 2020, while market research firm IDC is tracking the Infrastructure as a Service segment to grow at 28.2% CAGR during the same period.

Not very often do we see three different and independent reports coming in so close to each other. More to the point, looking at the performance of Microsoft and Amazon in the last four quarters, which saw their cloud revenues hit above 50% growth rates, 25-30% growth in IaaS seems to be a highly achievable target.

According to Bain, security remains the top-most concern for companies that are thinking about a shift to cloud. Concerns about cost savings and loss of control have become more moderate, but new concerns such as compliance, vendor-lock in and portability have emerged.

Possibly the most important piece of insight Bain offered in its research report is this:

“Bain estimates that more than 90% of current customer demand for the cloud comes from replacing or upgrading existing, non-mission critical applications and from the creation of new digital businesses. Most customers are not yet using the cloud to fundamentally change or reimagine how work is done, or to connect business processes to create new value. Many customers still use public or private cloud services for a small percentage of their IT needs.“

If this is true, then a major portion of the cloud segment’s growth is actually coming from non-mission critical applications, which means a bulk of IT infrastructure is still sitting outside the public cloud environment.

That’s understandable because IT spending on datacenter systems, enterprise software, IT services and communications services stands at nearly $3 trillion, while the total spending on cloud is still less well below half a trillion dollars. At the enterprise level, IT spending is $1.1 trillion, while cloud workloads, software, hardware and services account for only $180 billion.

As businesses around the world get the taste of cloud, learn with experience and become more confident, the transition from moving non-mission-critical applications to moving mission-critical applications is sure to happen, further accelerating cloud adoption in the future.

Another point to note is that AWS has, from the beginning, targeting developers and startups. In ten years, we could see enterprises rising from this segment. Most of their mission-critical workloads will already be on cloud, making “cloud adoption” a redundant term.

Whichever way we look at it, the industry seems to be on a sustainable growth path. The increase in functionality and the rapid cost decline are bound to keep expanding the public cloud infrastructure market. In time, companies that are sitting on the fence will move in, while companies that are already using cloud in bits and pieces will start increasing their cloud exposure.

See the full Bain report here.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.