Mobileye is a familiar name in autonomous vehicle technology, or self-driving tech. The company is at the heart of Tesla Motors’ Autopilot that gives semi-autonomous capability to Tesla Model S and Model X variants.

But that relationship failed, and the two companies parted ways last year after a fatal crash allegedly caused by a situation that Autopilot was not ready for. For Tesla, it meant developing an in-house solution for the camera systems, while retaining EyeQ3, the processor chip developed by Mobileye that does the heavy-lifting on the complex calculations needed for effective self-driving capability.

For Mobileye, it meant the loss of a major partnership, but the company’s links with the auto industry remained strong. They were already providing their autonomous vehicle technology to several auto majors, including BMW, Audi, General Motors and Ford.

One particularly interesting partnership was the one with Intel and BMW, which was announced around the middle of 2016 and involved a bid to have self-driving cars in production by 2021.

That relationship has now taken a twist as Intel agrees to acquire Mobileye for a whopping $15.3 billion. Mobileye has a market value of $10.5 billion and revenues of $358 million as of fiscal 2016. Analyst forecasts show that it will hit $500 million this year, a 40% increase.

While that kind of growth is certainly attractive for an investor in forward technologies, that’s not likely to be Intel’s real motivation to put more than $15 billion behind the deal.

The acquisition gives Intel a massive leg-up in autonomous vehicle technology. From a chipmaker’s perspective, NVIDIA is already well in the space, with $320 million coming from the auto segment as of full fiscal 2016. The Mobileye acquisition will give its rival, Intel, a booster shot in the automotive segment.

Intel is already the largest employer in Israel, with approximately 10,000 employees on its rolls. The Mobileye acquisition might not move that needle by that much, but it is still a significant investment in the region.

The real significance of the deal is in the form of a technology jump for Intel. With the PC market on the decline – CCG (Client Computing Group) revenues were only up 2% from the prior period) – and the company’s DCG (Data Center Group) not growing as fast as the company would like (8% in 2016, over 2015), latching on to forward technologies is one way to address these issues.

Moreover, Qualcomm’s dominance of the mobile processor space will surely have left a bad taste in Intel’s mouth, especially since its unceremonious exit from the game last year. Of course, Intel is still a very strong contender in 5G mobile technology, which is critical to the development of autonomous vehicle technology, and that’s where the acquisition becomes even more significant.

Autonomous vehicles generate huge volumes of data that need to be processed in realtime, and Intel’s 5G strategy addresses that issue. The company acquired Ascending Technologies last year, which makes the drones that Airbus uses to inspect its aircraft, and Intel’s RealSense 3D Technology is also a part of that project.

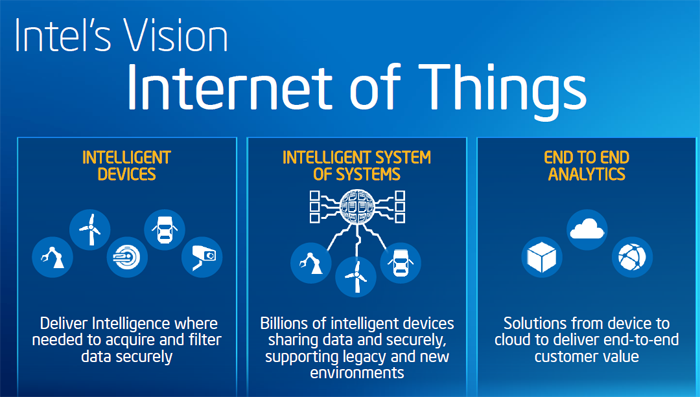

Looking at the bigger picture, the Mobileye acquisition fits perfectly with Intel’s strategy around the Internet of Things, 5G and autonomous vehicle technology. Not only does Mobileye give them a better negotiating position with large automakers, but it also gives them the ability to offer end-to-end autonomous vehicle technology solutions.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.