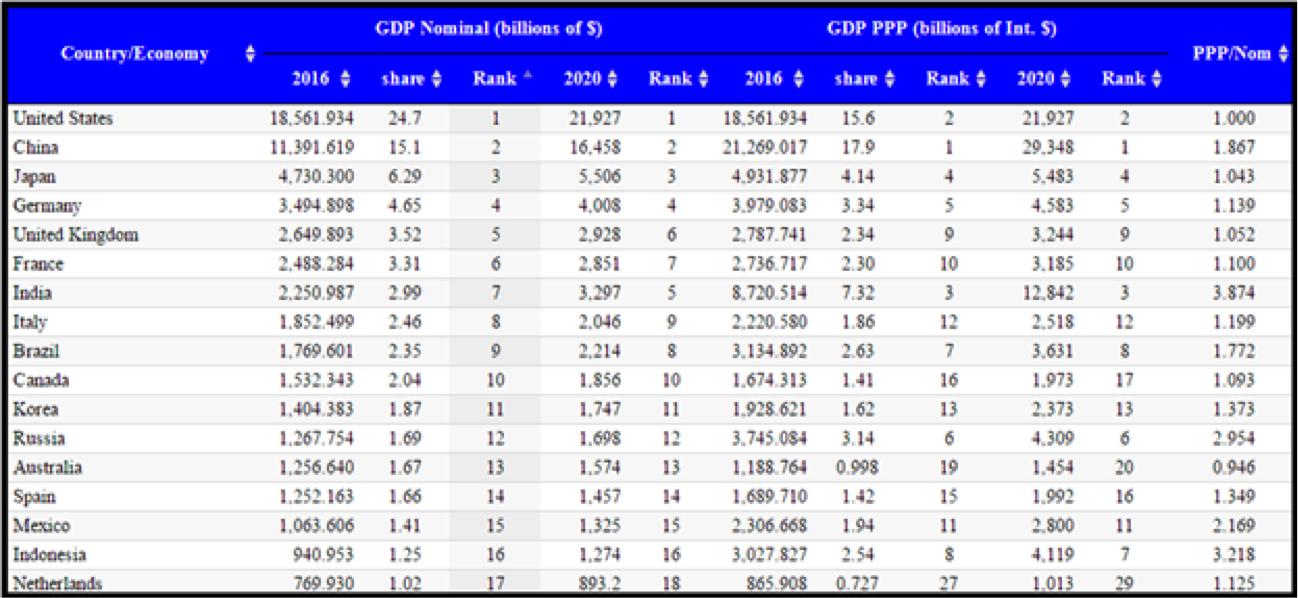

Amazon has carefully selected the countries it want to concentrate on in the International market. Outside its home market, Amazon has put its fingers into Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and the United Kingdom.

Source:StatisticsTimes

From the list of 17 top economies in the world, Amazon has entered 13 of them, only leaving out Russia, Korea and Indonesia – countries where the political landscape is not that conducive for business. Amazon could easily have left China out of the mix, but they were way too big, and play such an important role in Amazon’s supply chain that it was worth the risk even though the returns – and penetration – haven’t been that great.

There is no other retailer in the world who has a presence in all the top ten economies of the world. On the down side, Amazon has possibly spread itself a little thin by expanding so fast into so many countries, but this is not a company that shies away from risk. Besides, it takes time for a company to build its brand presence in new markets.

That time is prolonged when you’re a retailer building your logistics, supply chain, warehouses and fulfillment centers. And then, there are local regulations and competition to address as well. Amazon quickly entered several markets so it can take its time and build out its infrastructure, and not leave a chance for another Alibaba or Flipkart to just copy its model and rise up to challenge it.

The key for any retailer is scale. The more products they sell, the higher their margin is likely to be. Amazon needs plenty of time to achieve that scale in each of those countries, and their urgency to enter into so many markets was intended to give them that time, while simultaneously reducing the room for competition to step in and take away potential market share.

Take the United States, for example: In 2011, Amazon had $26.7 billion in revenues from North America, with an operating income of $933 million and an operating margin less than 0.5%.

By 2016, North America revenues grew to $79.78 billion, with an operating income of $2.361 billion and an operating margin of 2.9%. As revenues in United States keep growing, Amazon will be able to keep improving its margins. More often than not, all that extra cash on the bottom line goes towards adding even more services to Amazon Prime, which currently has at least two dozen significant money-saving or free services.

Amazon is trying to repeat this success in as many countries as possible. Of course, their attempt to capture the Chinese market fell flat thanks to the dominating presence of Alibaba. The Chinese clone (not really) of Amazon has such a lead in the market that the competition is finding it hard to even get close. Due to its size, scale and reach within the PRC, most buyers and sellers are already on Alibaba, making things difficult for competitors to catch up.

It’s the same kind of lead that Amazon enjoys over its competitors in the United States. Despite all the major big box retailers in the country pouring money into e-commerce, and despite them having solid physical store networks – which should make shipping easier for them – they are not able to get their e-commerce sales moving at the level they’d like.

The simple reason for that is because most online shoppers have already gotten used to Amazon’s platform and they don’t find the need to start using other platforms. And we’re not forgetting the golden ball and chain that Amazon Prime represents as an attractive lockdown. Somebody who spends $99 a year on the service isn’t likely to buy online from Wal-Mart even if they do offer free two-day shipping.

But outside China, there is no credible competitor for Amazon. Yes, there is Flipkart in India, which has been giving Amazon a run for its money, forcing it to up its investment in the country, but both Amazon and Flipkart are running neck and neck in India, and can possibly co-exist in this market with tremendous e-commerce potential.

In developed markets, however, no company has managed to capture the growing e-commerce market, simply because the retail segment there is controlled by big box retailers like Wal-Mart in the United States, Weston Group in Canada, Tesco in the United Kingdom, Carrefour in France, Metro AG in Germany and so on.

Amazon is slowly eating into retail markets around the world using its e-commerce strengths. The bigger it grows the stronger it will get, thanks to Amazon Prime and the kind of services that they keep adding month after month, not to mention the hundreds of thousands of products they keep adding to their catalog every month.

When you look at it from that perspective, the paradigm suddenly shifts to why it took Amazon so long to move into multiple markets. The question now is closer to “why are they not going faster” than “are they going too fast.”

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.