The growth of cloud computing has drawn most of the media’s attention to the top four cloud service providers, Amazon, Microsoft, IBM and Google. But there is another segment that has been silently enjoying the benefits of rapid cloud adoption – infrastructure equipment manufacturing.

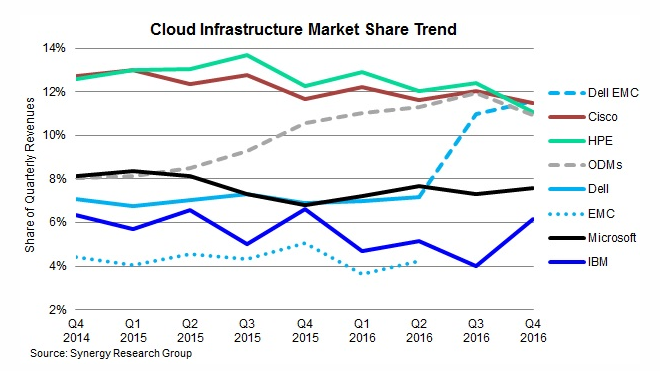

According to data from Synergy Research Group, Dell EMC, Cisco and HPE share the honors between them for the top position in the cloud infrastructure equipment market.

The research group notes that the cloud infrastructure equipment market, which includes both hardware and software, crossed $70 billion during the fourth quarter of 2016 – ten billion more than what the segment recorded in Q4 last year. The cloud infrastructure equipment market is a leading indicator for the cloud computing industry, and the year-over-year growth shows that things continue to be on the upswing in cloud uptake.

In terms of segment-wise leadership, Synergy shows HPE leading the field in cloud servers, and being a strong contender for storage solutions. Cisco dominates networking and is growing its server product offers as well. Dell EMC is right behind HPE in the server vendor segment, while holding a lead position in storage solutions.

Microsoft and IBM also feature in this list, with the former ranking on its server OS and virtualization applications strengths and IBM showing a robust all-round position “across a range of cloud technology markets.”

Research firm Gartner, meanwhile, says that investments in cloud infrastructure have accelerated, and forecasts strong growth for 2017.

“Aggressive build-out of cloud computing platforms by companies such as Microsoft, Google and Amazon is pushing the global server forecast to reach 5.6 percent growth in 2017. This was revised up 3 percent from last quarter’s forecast and is sufficient growth to overcome the expected 3 percent decline in external controller-based storage and allow the data center systems segment to grow 2.6 percent in 2017.”

In short, the market serving the cloud segment is growing in as healthy a manner as the cloud computing industry itself, which makes perfect sense. Where there’s strong growth in any core market, there is bound to be a peripheral market supplying that core market with what it needs to serve its customers.

These B2B vendors and suppliers are, therefore, a natural, litmus-like indicator of the demand for cloud computing services. A decline in this segment would not bode well for the cloud computing industry, but that appears to be a very remote possibility right now.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.