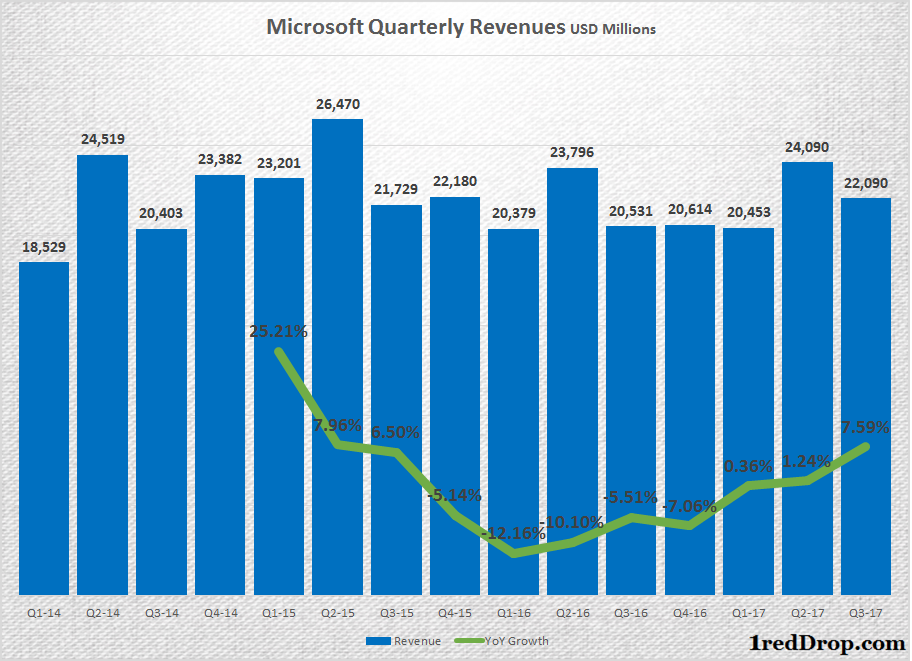

Microsoft reported Q3 earnings, which was in line with what most of us expected the company to do: keep its recovery intact. After watching through a period of sharply declining sales, Microsoft reported near flat growth during the first quarter, small growth during the second quarter and some solid growth numbers during the third quarter despite some parts of the business slowing things down.

As you can see from the chart, Microsoft is really on its way to making a U-turn as it posted $22.09 billion in third quarter revenues, which was 7.59% more than the $20.53 billion the company posted during the third quarter of 2016. Microsoft was able to post strong growth numbers because both Productivity and Business Processes, as well as Intelligent Cloud, Microsoft’s cloud-based revenue driver, grew 22% and 11%, respectively.

More Personal Computing continues to be a huge drag on the company’s revenues but, fortunately, it isn’t Windows that’s pulling things down. Segment revenue’s declined by 7% during the third quarter, and the numbers don’t look pretty because the decline seems to be accelerating. More Personal Computing revenues have now declined 2%,5% and 7% during the first three quarters of the current fiscal.

Microsoft knowingly placed all of its business units that are facing a difficult environment in one bucket. It was a strategic decision, and we are now watching the after-effects of that. During the first quarter, when the More Personal Computing segment declined 2%, Windows OEM and Commercial revenues were flat, but Phone revenue declined 72% and Gaming also took a 5% hit.

During the second quarter, when More Personal Computing segment declined 5%, Windows OEM recovered, while Gaming declined by 3%. Now, in the third quarter, Windows, Search and Gaming revenues increased, but Surface dropped a bomb by declining 26% compared to prior period.

Had Microsoft managed to hold its revenue numbers in the More Personal Computing segment and not decline by $703 million, their overall sales growth rate for the quarter could have easily touched double digits instead of the current 7.59%. Unfortunately, that was not the case; and with PC sales declining steadily around the world, Windows is always under pressure, adding more stress on this segment.

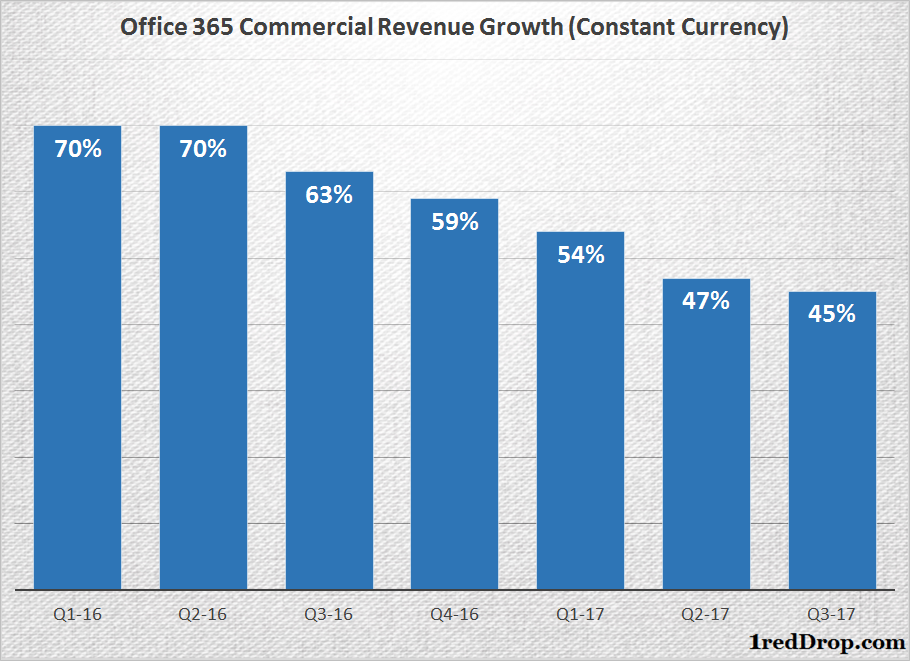

But Microsoft has not just one, but two, units that can more than cover for the problems faced by More Personal Computing. Microsoft’s Productivity and Business Processes segment has been on a massive surge as its 365 lineup – Office 365 and Dynamics 365 – continue to grow aggressively. Office 365 commercial revenue grew 45% during the quarter, with Dynamics 365 reporting an 81% increase. The surge was good enough to take Productivity segment sales to touch $7.96 billion during the quarter, 22% more than what the company posted last year.

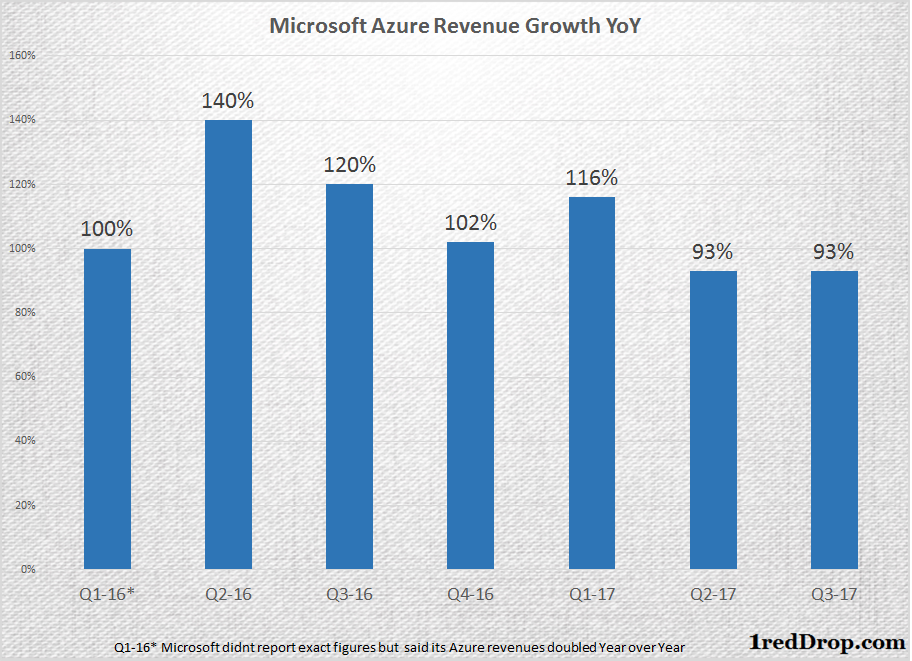

The Intelligent Cloud segment has also reached double-digit growth status, and its lead product – Microsoft Azure, their infrastructure as a service offering – kept its near triple digit growth rate intact, with revenues growing 93% once again during the quarter.

Overall, it was mixed bag for Microsoft as it continues to show momentum in cloud, while different parts of More Personal Computing continue to take unhealthy bites out of their numbers.

But, with combined revenues from Productivity and Business Processes and Intelligent Cloud segments accounting for 66.64% of Microsoft’s overall revenues during the third quarter, Microsoft has plenty of time and space on hand to fix its More Personal Computing problems.

Hey, would you do us a favor? If you think it’s worth a few seconds, please like our Facebook page and follow us on Twitter. It would mean a lot to us. Thank you.