Amazon Web Services, or AWS, is the undisputed leader of the Infrastructure as a Service (IaaS) segment within cloud computing. Amazon Web Services’ growth rate has been slowly edging lower and lower in recent years, but the question is whether the growth is slowing down because of Amazon’s (AWS’s) own size, because of the increased level of competition or because the industry is slowing down as a whole because the cloud computing industry itself has come a long way in the last several years, with big tech names jumping into the cloud fray one after the other.

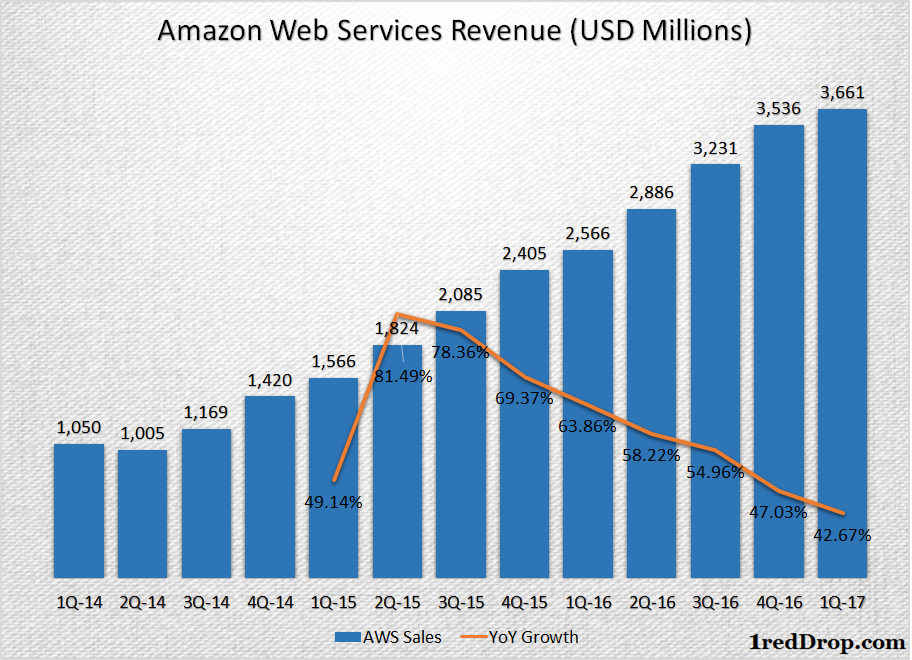

Numbers tell us a lot. Amazon Web Services grew 49.14% during the first quarter of 2015, 64.86% during the first quarter of 2016 and, during the latest quarter, growth rate has come down to 42.67%.

As you can see clearly from the graph above, the rate of growth has been slipping by few percentage points quarter after quarter, gradually edging lower and lower since the third quarter of 2015.

Size has a role to play in this. As companies get bigger and bigger, the growth rate has to naturally come down. Doubling your revenues when you have a billion dollars in sales is not the same as doubling them at $50 billion or $100 billion.

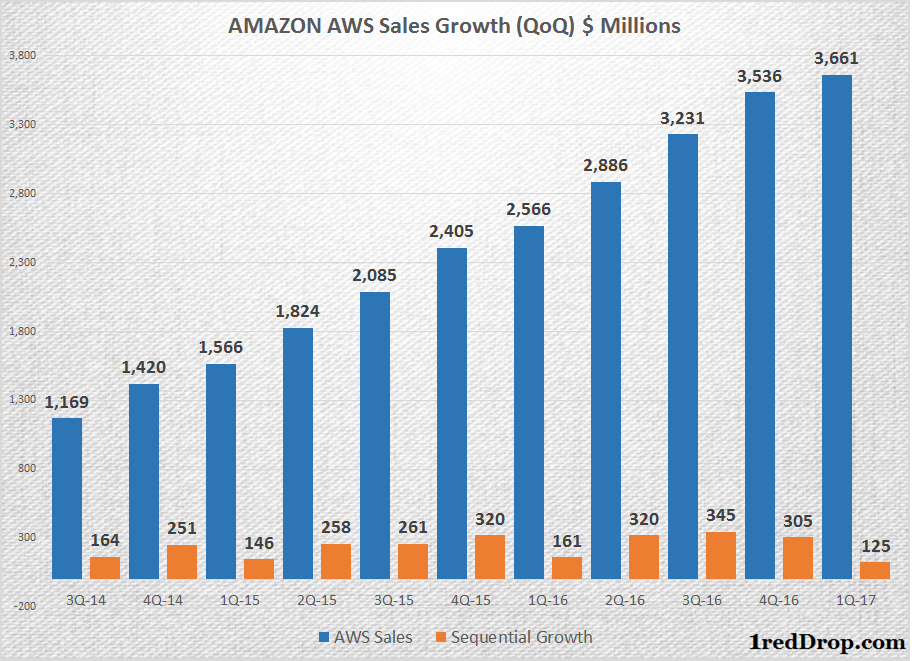

To understand that the growth rate in a better way, let’s take a look at how sales have been growing sequentially for Amazon Web Services against their year-ago growth rates – basically, quarter-over-quarter vs year-over-year.

On a year-over-over year basis, growth was $125 million during the quarter compared to $161 million during the first quarter of 2016 and $146 million during the first quarter of 2015. Things have come down, but not by much.

Now look at it from a sequential growth perspective, and you may notice what looks like a slowdown – $345 million added in Q3 2016, $305 in Q4 2016 and it suddenly dips to $125 million in the final reported quarter.

So things are still growing sequentially for AWS despite the heavy competition and Amazon’s own size at the current $3.661 billion level of quarterly revenues.

The sudden sequential dip in Q1 2017 is not something to be alarmed about, since the first quarter of their fiscal typically shows the slowest growth. That’s where the year-over-year analysis helps: from $146 million in Q1 2015 to $161 million in Q1 2016 to $125 million in Q1 2017 shows a slowdown, but not a significant drop.

On a TTM (trailing twelve months) basis, revenues have exceeded $13 billion. Since sequential growth is still relatively strong, Amazon should easily be able to see $15 billion from AWS over the next four quarters.

In short, despite competition from Microsoft, Google, IBM and Oracle nipping at its heels, AWS continues to grow sequentially, therefore they’re also growing year over year.

Now let’s look at it purely from a quarterly revenues angle.

AWS took five quarters to move from $1 billion to $2 billion in revenues, four quarters to move from $2 billion to $3 billion, and the move from $3 billion to $4 looks set to be done in four quarters.

In summary, growth rate has come down, but Amazon Web Services has been chugging along steady as a locomotive despite the much higher competition today than a few years ago.

We do think that AWS revenue growth will maintain its gentle downward slope that has been set over the past two years, but that’s got more to do with its own increasing size and scale rather than the effect of heightened competition.

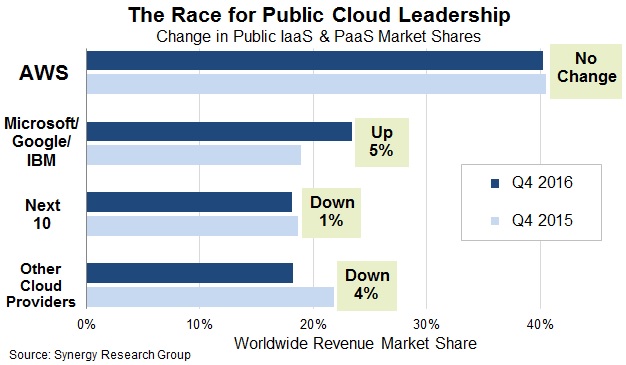

The graph above makes it look like things are on the wane for Amazon Web Services, but looks can be deceiving. According to fourth quarter data from Synergy Research Group, Amazon held on to its marketshare during 2016.

Maintaining marketshare in a growing segment is nothing to be ashamed of, to put it simply. Amazon Web Services is still very strong in the IaaS segment, and that’s going to stay that way for quite some time.

That said, Amazon seems to have recognized that the first mover advantage is losing some steam after more than a decade in the cloud computing business. That’s why we’re now seeing feverish activity on the AI and devices side. Both of those components eventually lead back to AWS because they’re interconnected – inextricably so, in fact.

Amazon Echo is expanding into products like the Echo Look; Amazon Alexa is getting integrated into products from multiple industries including appliances and automobiles; and their respective technologies have recently been thrown open to developers and device makers to use in their own products. All of that is nothing more than a conduit to bring in additional revenues to AWS.

Amazon’s AWS will keep growing, there’s no doubt about that. But the effects of scale and size are starting to show up in their growth rates of late. That’s definitely something Amazon needs to address sooner rather than later, and we’re already seeing abundant evidence of that. All that remains to be seen is how those efforts bear fruit in the quarters and fiscals to come.

Thanks for visiting! Would you do us a favor? If you think it’s worth a few seconds, please like our Facebook page and follow us on Twitter. It would mean a lot to us. Thank you.