Nearly 18 months ago, my fellow author Shudeep Chandrasekhar made a bold statement that Walmart will hold its own against Amazon. In an article for Seeking Alpha, he wrote:

“The biggest advantage that Wal-Mart has over Amazon et al is not its money power. It is the fact that its online presence is now being supported by a backbone of new Neighborhood Markets. – Seeking Alpha

As I’ve said before, I believe NMs are their key to America’s back doors the way Supercenters were to people’s front doors when they first started becoming popular.

NMs are the only way to keep competitors at bay and keep Walmart healthy for a long time to come. It is the format of the future, and the sooner they recognize it the less pain they’ll be in over the next few years from competitors all vying for the urban market. – Seeking Alpha“

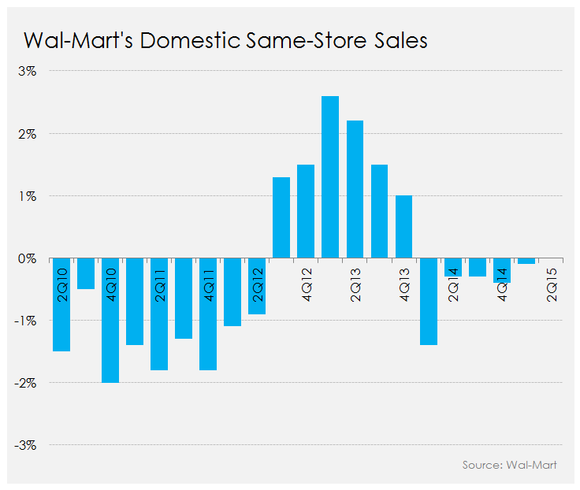

It was, indeed, a bold assessment at the time, because that was the period where nothing really worked in their favor. Comparable store sales for the year ended January 29, 2016 were only 0.5% in the United States, slowing down sales along with it and forcing Walmart to re-think its store formats. This eventually led to the company shutting down its smaller format Express stores and push harder on the Neighborhood Market store format.

Now, fast forward 18 months, and Walmart has not only emerged as a credible competitor to Amazon, but is also showing the way retail is going to be conducted in the future. Its multiple store formats – a robust online store, backed up by hybrid delivery options such as store-pickup, direct home delivery or just walk-in purchases – are all components of the retail model of the future.

For Walmart, that’s extremely good news. Neighborhood Market sales comps have stayed in positive territory for the past several quarters, and Walmart only had 698 stores across the country by the end of April 2017, so there is huge potential for store expansion.

Source: BusinessInsiderIn fact, you’ll probably be surprised to know that comparable store sales for the Neighborhood Market store format are looking much better than even Walmart’s overall U.S. numbers, having grown by 6.5%, 5.2%, 5.3%, 6.2%. That’s much higher than the 1-2% that Walmart U.S. reported during those same four quarters.

It’s very clear that the NM concept is working very well for Walmart and has started to show meaningful results. Combined with their other sales channels, Walmart is redefining the future of retail, and even setting benchmarks for Amazon to follow in the physical realm, while at the same time using Amazon’s own strategy in tandem with its own physical store presence to keep the e-commerce giant at bay.

Walmart has entered a new phase of growth, and other retailers would do well to take a page out of what this retail giant has done despite earlier mis-steps in Germany, Japan and elsewhere.

Incidentally, this ‘secret formula’ discovered by Walmart could help Amazon grow even faster. With its rapid expansion of fulfillment centers focusing on improving its 1-hour and 2-hour delivery capabilities, Amazon is looking to compensate for its lack of physical presence. And the ultimate goal is the $600 billion grocery market in the United States. That’s what Walmart is up to its neck in, and that’s what Amazon wants a slice of.

Thanks for visiting! Would you do us a favor? If you think it’s worth a few seconds, please like our Facebook page and follow us on Twitter. It would mean a lot to us. Thank you.