Financial institutions have been encouraging people to stop using cash for the longest time, but so far nothing has worked. Now, it’s time for major retail and tech players to step in and try and change the game, with Amazon being the latest to join the anti-cash revolution.

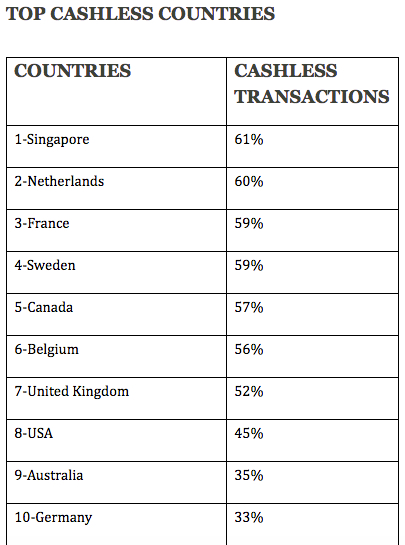

A cashless world is something we’ve been dreaming of for a long time. While that’s not practically possible in most economies, you’d think that markets like the United States would have a high level of cashless transactions. Surprisingly, that isn’t so.

That means the majority of transactions in the United States are still based on cold hard currency – also known as cash.

Can companies like Amazon or even Apple really change the way people shop, when the biggest card companies have failed, the world’s banking systems have failed and even retail conglomerates led by the likes of Walmart – and its CurrentC – have failed?

They certainly seem to think so.

This is what Apple CEO Tim Cook said: “We would like to be a catalyst for taking cash out of the system. We don’t think the consumer particularly likes cash.”

Of course, he was talking about Apple Pay, a venture that is yet to gain enough traction to make any meaningful difference to Apple’s overall revenues. But Apple hasn’t given up on Apple Pay yet, expanding into no less than 9 more countries in 2016 alone.

As for Amazon, the company is experimenting with several cashless initiatives, such as its Amazon Go test store that’s currently open for employees. Using sensors and AI, customers are required to swipe their app at the entrance, and they’re automatically charged for whatever they take out of the store. There are some hiccups with this system, but the concept has tremendous potential.

There’s also AmazonBooks, which is now open in about seven locations and doesn’t accept cash – just cards or the Amazon app.

Let’s not forget that Amazon made $79.785 billion just from its retail business in North America, and 100% of that is from cashless transactions, obviously. Another $43.983 billion came from overseas, mostly cashless except for where they accept COD, or cash on delivery, which is presumably a marginal portion of their revenues.

With nearly all its income being the result of cashless transactions, there’s every reason Amazon would want to move to a cashless society.

And they’re even attacking cash, directly, with something called Amazon Cash. Basically, if you are “unbanked”, meaning you don’t have access to financial services for whatever reason, you can top up your Amazon Balance using a fee-free system that is widely deployed across thousands of retail outlets across America. You can then use that Amazon Balance for shopping on Amazon.

Obviously, Amazon couldn’t approach large brick and mortar stores to offer the Amazon Cash service, so they used the back door method and reached out to convenience stores, drug stores and other store types against which they don’t directly compete, in order to deploy this system.

But even with all these initiatives, can companies like Amazon and Apple wipe out cash transactions in the United States? Most emphatically, NO. What they can do, however, is reduce cash dependency for the “underbanked”, those with access to financial services like credit cards and checking accounts, but who, nonetheless choose to use cash to transact.

At best, these efforts can slightly reduce their user base’s reliance on cash, but it can never wipe it out. That’s not going to happen for a long time, possibly never.

That said, these companies can certainly grow their digital revenues by piggybacking on the drive to promote a cashless economy. For Amazon, moving people to a cashless mode of transaction means a more convenient way to move product.

Brick and mortar retailers typically rely on cash, with Walmart even going so far as taking Visa head-on. But for e-commerce players like Amazon, COD (cash on delivery) is a highly undesirable form of transaction because a lot of things can go wrong.

As such, it’s in Amazon’s best interest to attack the cash segment and try to eliminate it from its own circle of influence, which is getting bigger by the minute, incidentally. But there’s no way that even all the retailers and all the tech companies in the world can ever get rid of cash.

Thanks for visiting! Would you do us a favor? If you think it’s worth a few seconds, please like our Facebook page and follow us on Twitter. It would mean a lot to us. Thank you.