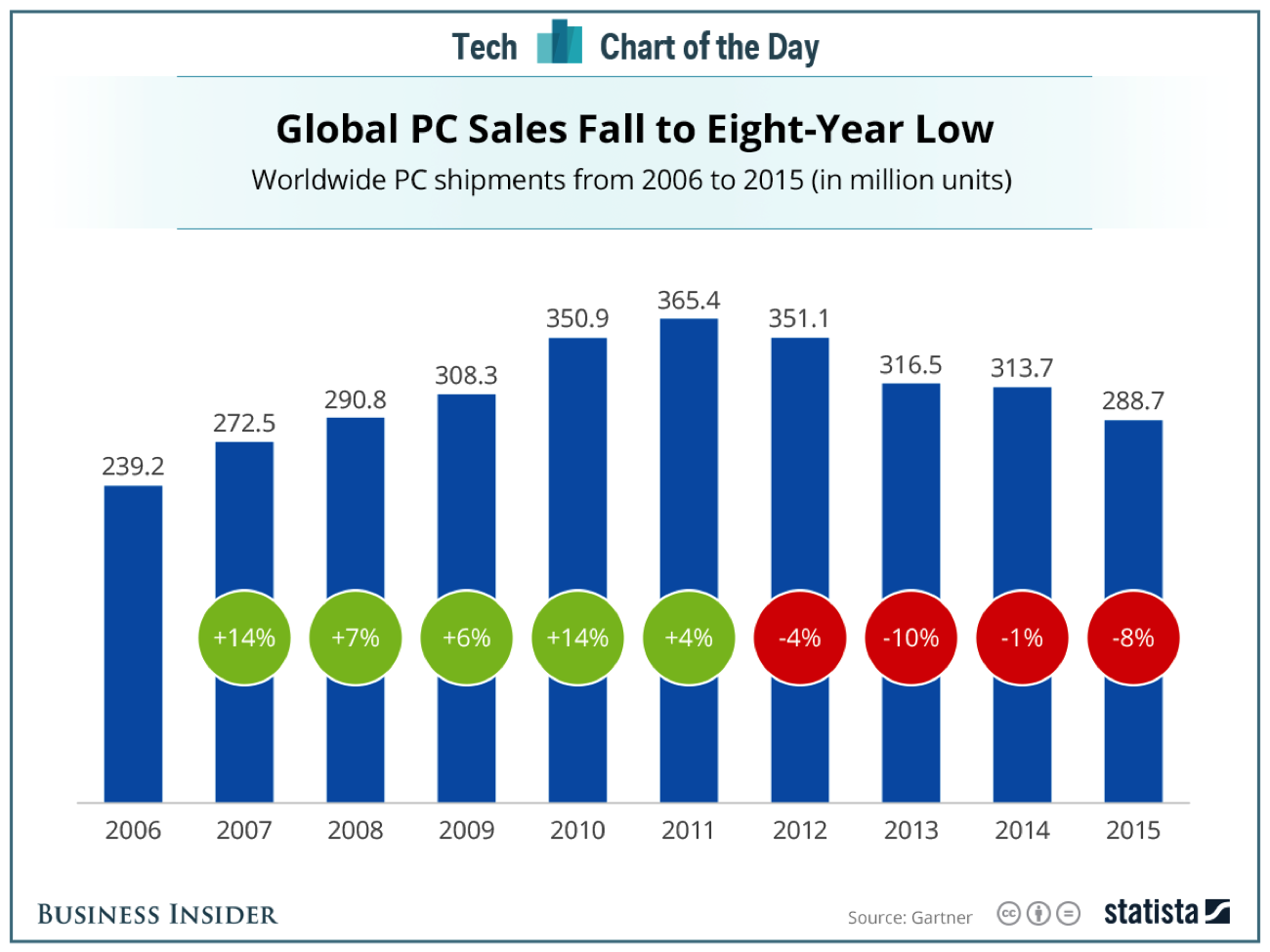

The last year that PC sales registered growth was in 2011, when global PC sales grew by 4%. Since then, PC sales have declined and declined, and are still declining. Worldwide PC shipments totaled 61.1 million during the second quarter 2017, a 4.3% decline and a solid follow-up to the 2.3% decline we witnessed during the first quarter. If first quarter numbers and the trend of the past few years is anything to go by, PC sales will make a record this year by declining for 6 years on the trot.

“Worldwide PC shipments totaled 61.1 million units in the second quarter of 2017, a 4.3 percent decline from the second quarter of 2016, according to preliminary results by Gartner, Inc. The PC industry is in the midst of a 5 year slump, and this is the 11th straight quarter of declining shipments. Shipments in the second quarter of this year were the lowest quarter volume since 2007.” – Gartner

No one knows when the decline will end, and it looks like the trend will continue for some more time before finding the bottom; and there is a very good chance that once we find the bottom, PC sales might well stay at those levels. The growth of smartphones and smart devices such as Amazon Echo and Google Home has only rendered PCs even more meaningless in our homes. We might still need them in our offices, but not so much in our homes.

That brings us to the whole point of this article: what does the current trend mean for the world’s number one desktop operating system, Windows? Clearly, it indicates a bleak future, but let’s explore that in a little depth.

During the recent fourth quarter earnings report, Microsoft let loose its revenue numbers from Windows. They didn’t provide the number in a direct way, but gave us the percentage growth of Windows revenue as well as the increase in absolute dollars which, of course, we can use to find their total revenues from Windows.

“Windows revenue increased $103 million or 2%, mainly due to higher revenue from Windows Commercial and Windows OEM.” – Microsoft Q4-2017 Earnings Release

If 2% growth is $103 million then Windows revenue must be around $5.16 billion. That’s a sizable revenue for the quarter because it accounted for nearly 22% of Microsoft’s overall revenues of $23.317 billion during the fourth quarter. The slight uptick in revenue is only a bonus because the long term, the future of desktops is already on a slippery slope.

Microsoft, therefore, will be looking to its software portfolio to provide the fallback for Windows in the future. The Productivity and Business Process segment, which holds Microsoft’s revenues from Office 365 and Dynamics 365, posted $8.4 billion in revenues during the fourth quarter and grew 22% compared to last year. The high margin level of this segment – during the fourth quarter the segment had an operating margin of 32.60% – will only help Microsoft further offset any future decline on the Windows front. In comparison, the operating margin of the More Personal Computing segment that holds Windows revenues was only 20%, a full 12 percent lower than the Productivity segment.

The growth in cloud computing has helped Microsoft move into a position where the further Windows revenue declines, the more it can be offset by growing parts of the business, especially through their Software as a Service (SaaS) products.

The result: with or without Windows, overall growth is going to happen moving forward.

Source: Microsoft Q4-17 Earnings