Alibaba (BABA), the Chinese e-commerce giant who we cannot stop comparing to Amazon (AMZN), has done one thing much better than Amazon this year – send their stock price soaring way higher than what Amazon could manage. Alibaba’s stock has surged by more than 90% since the start of the year, making Amazon’s 27% increase look like below-par performance.

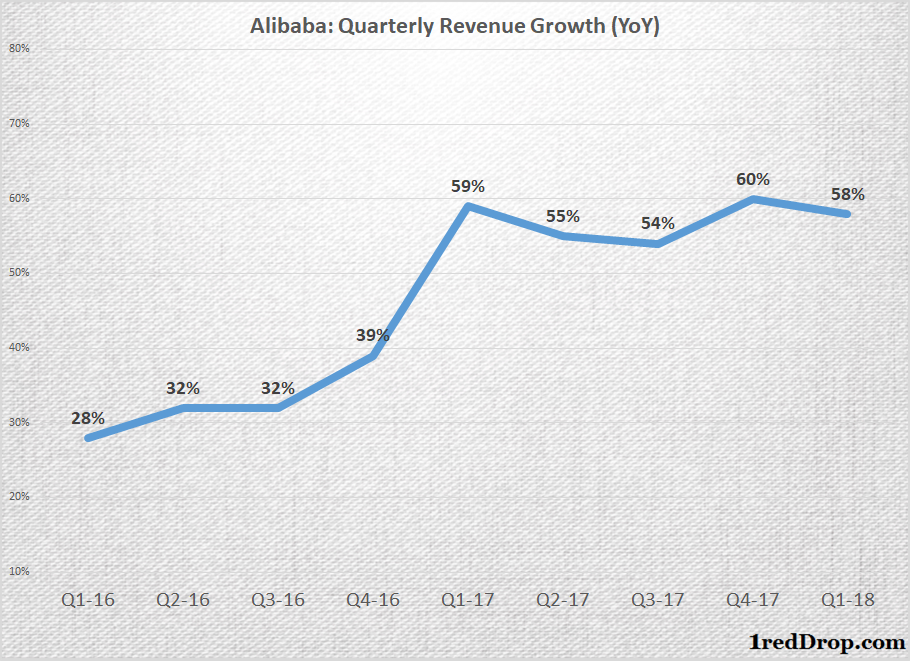

The disparity in the growth rates can be directly linked to the way revenue has grown for both e-commerce giants. Alibaba’s revenue growth accelerated from less than 35% in Fiscal 2016 to the current easily-above-50% levels. Amazon’s revenue has been growing in the 20% to 30% range in the last six quarters, a great number when looked at in isolation, but less than half the speed that Alibaba has clocked in the last five quarters.

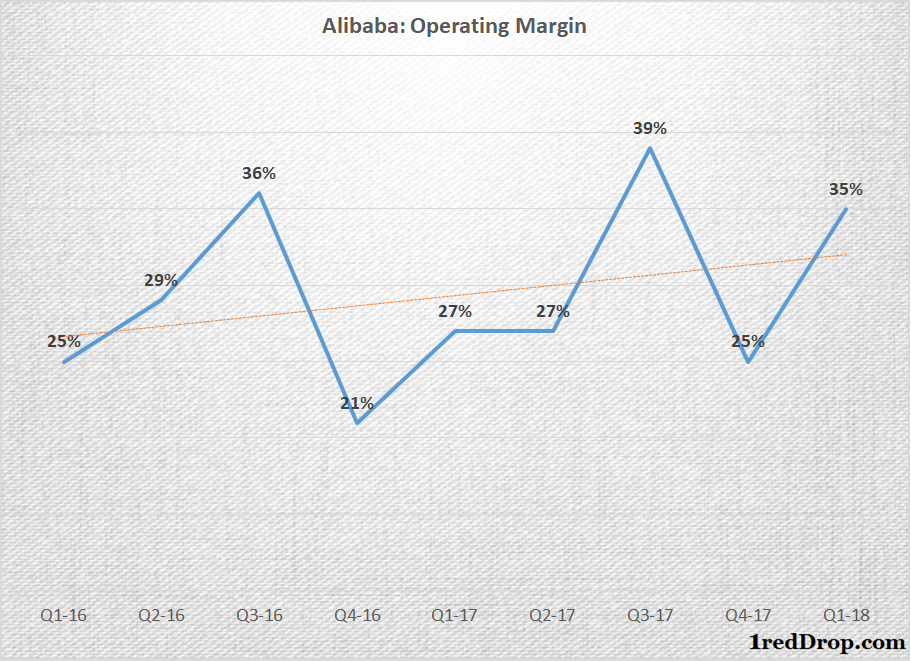

As is the case with our hyper-reactive market, the strong revenue growth has sent the stock price soaring by nearly 90%, and I guess it will only be a matter of time before that number hits triple digits. But there is one more factor that has worked in the Chinese e-tailer’s favor as well: their slowly increasing operating margin levels.

It is never easy to keep improving your margins while your revenue is expanding, and it is even more difficult to achieve that if you are operating in the retail sector. But Alibaba has done exactly that.

One more major factor that is possibly influencing market sentiment in a positive way is that much of Alibaba’s current growth is actually coming from their core commerce retail segment, which accounted for 73% of Alibaba’s revenue during the recent quarter and grew 57% compared to last year. If your core bread and butter operations are leading the growth charge and your operating margins are expanding in the process, then there are plenty of reasons to believe that such growth didn’t happen by accident. And its also not a surprise that the market expects that growth to continue in the future.

Source: Alibaba Quarterly Filings