Facebook bid $600 million to acquire digital media rights for the Indian Premier League (IPL), a popular professional cricket league in the Indian subcontinent. Facebook eventually lost to Star India, which won global consolidated IPL media rights for $2.55 billion.

Summary – @starindia wins @Vivo_India #IPLMediaRights Invitation to Tender for INR 16,347.50 Crore (US $2.55 billion) pic.twitter.com/WSKyYh9xeF

— IndianPremierLeague (@IPL) September 5, 2017

Why on earth would Facebook be ready to drop $600 million for live-broadcasting a sport that is only popular in India and a few other countries around the world? In reality, it kind of sums up the two focus areas Facebook wants to conquer: one geographic – the Indian Subcontinent – and the other an online medium – video.

India is already the second largest user base for Facebook with 201 million users, while the United States is number one with 214 million users. It’s only a matter of time before the two countries swap their positions. The US population is just a tad more than 350 million, while India’s population is nearly a billion more than that.

“Buoyed by Internet penetration in rural areas, the number of web users in India will see a two-fold rise at 730 million by 2020 against 350 million at the end of 2015 ” – EconomicTimes

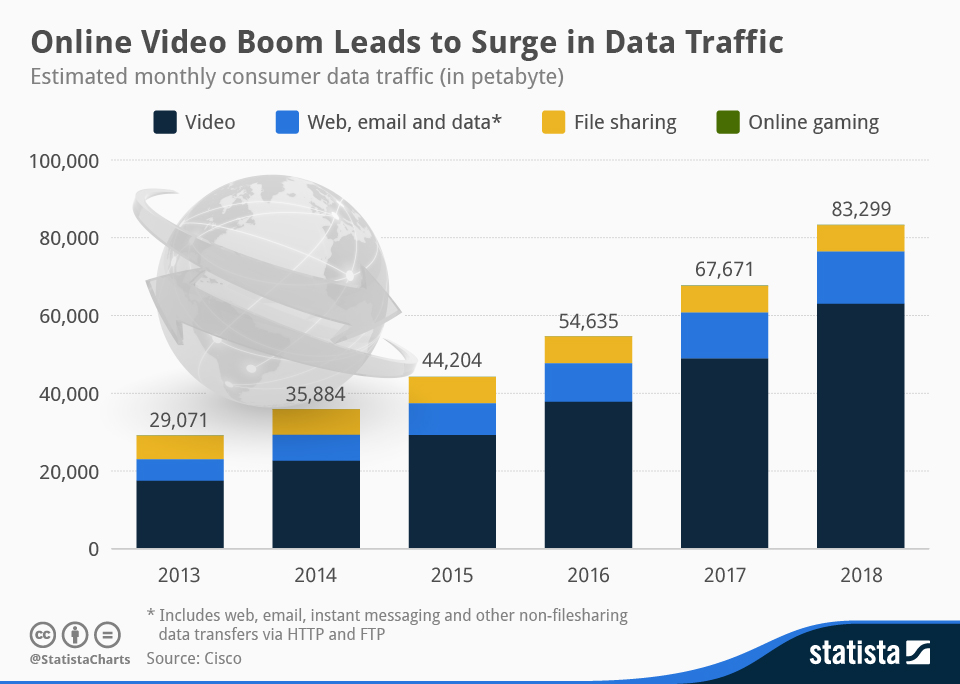

“We’re entering this new golden age of video,” Zuckerberg told BuzzFeed News. “I wouldn’t be surprised if you fast-forward five years and most of the content that people see on Facebook and are sharing on a day-to-day basis is video.”

But knowing what to do is one thing, and doing it is another. Facebook wants to build itself as the go-to destination for video, but unfortunately, they are up against a formidable and well-respected opponent in the form of Alphabet’s YouTube. The world’s number one public video platform is so big that only Facebook has more users than it does.

During the third quarter 2017 earnings call, Google CEO Sundar Pichai told analysts that YouTube had 1.5 million monthly viewers spending an average of 60 minutes a day. Growth has been phenomenal for YouTube, and the race from 1 billion to 1.5 billion took just four short years. In comparison, Facebook took three years to move from one billion to 1.5 billion, from the third quarter of 2012 to the third quarter of 2015.

Though Facebook’s numbers look a bit better than YouTube’s on the user base growth front, don’t forget that Facebook is a social media platform and YouTube is just a pure-play video platform. In other words, there is no public video platform as big as YouTube and growing as fast as YouTube, not even Facebook.

The value YouTube offers to its content creators and content consumers is unique, and that’s why most people keep using the platform. The size and scale do help a lot as YouTube becomes an automatic choice for any one who is just starting off on the video front. The more the content creators, the more the content generated, and the more the number of consumers coming in.

YouTube has nurtured content creators for so many years, and now the scale is slowly tipping things in YouTube’s favor. Facebook knows it will be a time-consuming process to build its video profile, and the company seems to gearing up for a long-drawn fight for video viewing time.

If Facebook’s management were to create a list of top priority items, then expanding in India and pushing into video would be very close to the top; honestly, these two would the number one and number two priorities for Facebook over the next five years. And when you look at it that way, being ready to spend $600 million in that pursuit is just a small drop in the ocean.