The last time Walmart reported a Same Store Sales drop was nearly three years ago. For the last 12 consecutive quarters, Walmart has watched its stores sell more than what they did a year ago, an impressive feat for a company with $78 billion in quarterly revenues from the United States.

During the second quarter of 2015, Walmart’s US sales were just a tad more than $70 billion; three years later the company has raced past $78 billion. Eight billion might look a bit small, but remember we are taking about quarterly revenues just from the United States.

When it comes to retail you just cannot avoid comparing every other company with Amazon, and it is inevitable that we look at what Amazon did during this period to understand the magnitude of Walmart’s performance in that time.

During the comparable period, (for Amazon it was the second quarter of 2014 to the second quarter of 2017), Amazon’s sales in North America increased from $10.994 billion to $22.370 billion. So on a head to comparison Walmart increased its revenues by $8.137 billion while Amazon added $11.376 billion to their top line. Not bad for the company that had the most to lose against Amazon due to their number one position in the market.

Now the problem for other retailers is, the combined force of Amazon and Walmart is going to eat into their share of market. In a short period of three years, Amazon and Walmart have snatched away $20 billion worth of the market, and remember we are only using a single quarter to analyze these numbers.

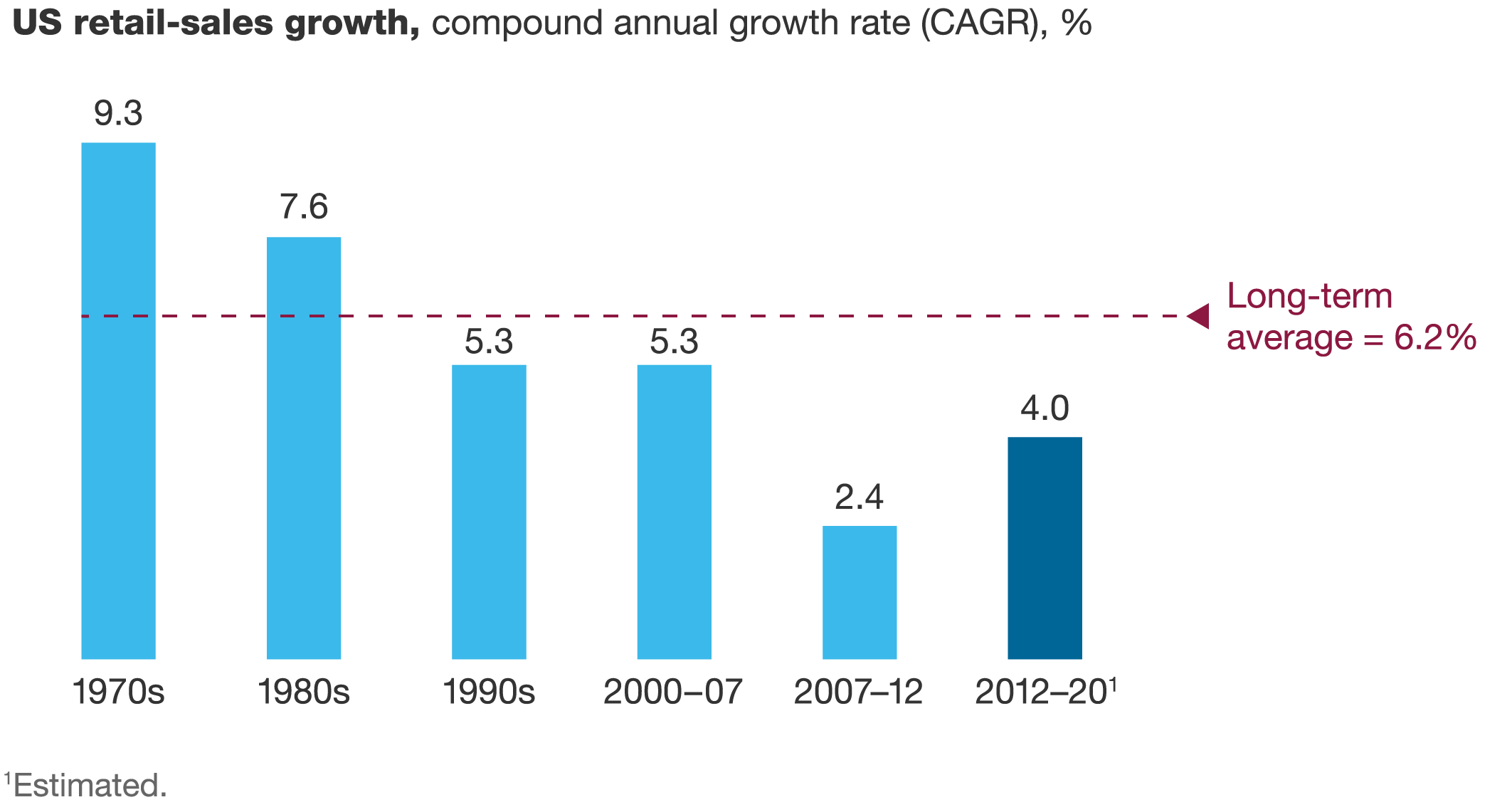

If the US retail market were growing at a fast and furious pace, that kind of growth wouldn’t be a big surprise for the top two companies to walk away with. But unfortunately, that is not the case. According to data from the US Census Bureau, the US Grocery Market grew 1.6% in the first seven months of 2017 to hit $368.251 billion, while the retail and food services market grew 3.9% to hit $3.256 trillion in size.

The retail market is growing in mid single digits, and with the US economy expected to keep expanding in the 1 to 2% range, there isn’t too much room for retail sales to accelerate. As a highly mature and highly developed market, the 4% rate at which the US retail industry has expanded over the last several years is as good as it gets.

The issue that I have been trying to get at in a round about way is this: adding eight billion on top of $70 billion is much harder than adding $11 billion on top of $11 billion and that too in a slow growth market such as United States. But the 312.37-ton gorilla (Walmart’s US sales in the last four quarters, in billions) in the house has done just that in the last three years.

The combined weight of Amazon and Walmart’s growth is eating into the retail market, leaving hardly anything for other retailers to capture. If this trend continues, which looks extremely likely, things are only going to get worse for all other big box retailers, especially the ones that does not offer solid, noticeable difference in value and able to stand out in the crowded place.

This is the one time where the adage “if you are not growing then you are dying” is going to come true, and its going to come true sooner than a lot of us think. The next five years is going to be a tumultuous period for all the US retailers, where only the fittest are going to survive. Smaller and weaker one might have to make way for the larger and stronger ones, while some may have to join hands to stay alive.

But there is one person that is going to keep smiling at the obscene, kill or get killed competition, and that is the end user, or people like you and I. We are all going to be spoiled for choice, with better prices and enjoying it all from the comfort of our homes. Get ready for the “Great Retail War” for our time and money. In fact, we are already in the middle of the war.

Source: Mckinsey

Source: Mckinsey