AT&T, the world’s largest telecommunications company, lost 90,000 video subscribers in the third quarter in what can be termed as the clearest signal yet that cord cutting, customers choosing internet streaming over traditional TV, is accelerating.

In a recent SEC filing the company said that it expects to report the following for the third quarter:

Nearly 300,000 DIRECTV NOW net adds with total U.S. video subscribers down about 90,000.

The video net losses were driven by heightened competition in traditional pay TV markets and over-the-top services, hurricanes and and our stricter credit standards.

The decline of traditional video subscribers negatively impacts our Entertainment Group revenues and margins, resulting in an adjusted consolidated operating income margin that will be essentially flat versus the year-ago third quarter.

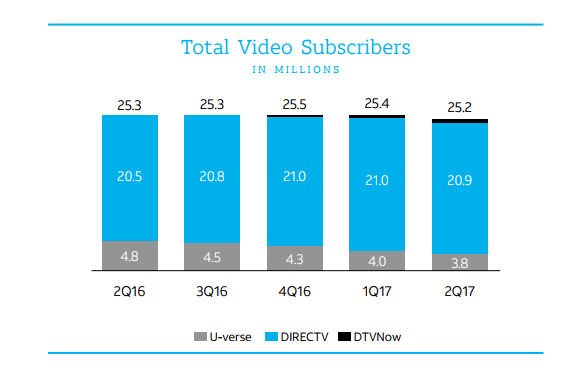

Though the loss of 90,000 customers may look small for a company with 25.2 million subscribers at the end of the second quarter this year, the problem of cord cutting runs a lot deeper and has the potential to play out over a long time.

Customers are clearly moving away from the company’s satellite TV service, while things are picking up speed on the streaming TV. At the end of the second quarter AT&T said that 85% of the traditional video base was on the satellite platform, and that this number was going to come under serious pressure over the next few years.

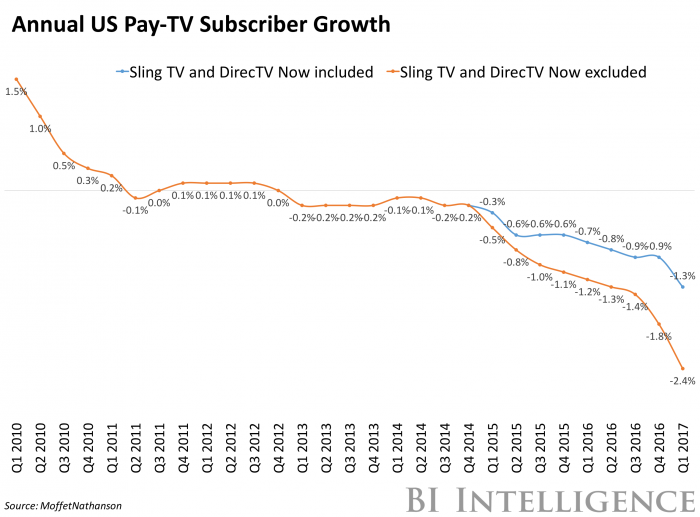

Subscriber numbers for pay TV have been declining for a while now, but the pace of decline has clearly accelerated in the last few quarters. Though large players like Comcast and AT&T point their fingers at recent storms in Southern United States as one of the causes, which is true in a way, the problem started much before the storm hit our shores, and its only going to get worse from here.

UBS gave a few potential reasons for the acceleration of subscriber losses:

- Price increases on traditional services could be causing more people to cancel.

- “Promotional intensity” could have gone down, especially on lower-end tiers.

- Perhaps some of the early sign-ups to new streaming TV bundles were doubling up, and keeping their traditional TV packages. Those people could now be canceling. – Business Insider

UBS was correct in its assessment about the price increases helping fuel subscriber losses. ESPN has actually lost 12 million customers in the last six years, but rode out the losses by increasing subscriber fees by 53%, from $4.69 in 2011 to $7.21. As a result, ESPN’s revenue grew, masking the thinning user base, but what it would have also done is to help those who were thinking about cord-cutting make a firm decision against ESPN’s favor.

With customers finding other avenues to spend their time on, such as paying for a streaming video service like Netflix or Hulu, or watching sports telecasts on Facebook, YouTube or Twitter, the incentive for cord cutting gets stronger by the year.

Competition in the streaming world is intense, and US customers are, in a way, spoiled for choice. Both free and paid streaming services are constantly trying to up their game, which increases their value in the eyes of the consumer while having the exact opposite effect on pay TV.

Pay TV has stood for so long, and still stands, because the large players in the market have bundled it with Internet and other services, but even that is not going to save them in the long run, and the glut may have already started.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter