If you want to really understand how stupid financial markets can get, all you have to do is just rewind your clocks to early 2016 and take a look at how auto stocks performed. That was a period when nothing went in favor of companies like General Motors and Ford.

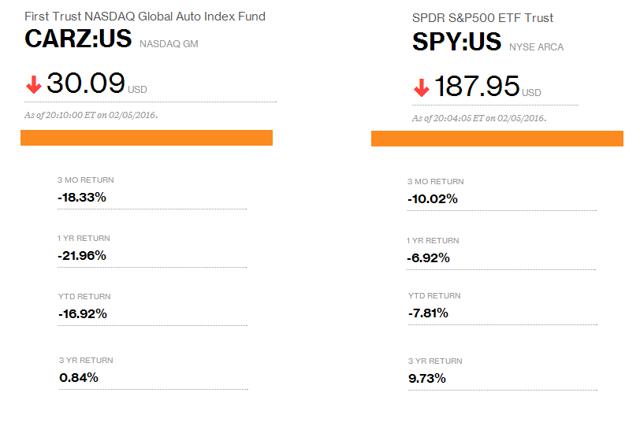

This is how the charts looked in February 2016. Between November 2015 and February 2016, Ford and GM lost their valuation in double digits, and the market was filled with news about “How U.S. Auto Sales have peaked” and the only way to go from there was down.

Source: Bloomberg

In an article written for Seeking Alpha in February 2016, I voiced my concerns about why I thought auto stocks were getting beaten badly using wrong assumptions. You can read my article here.

The key points I made were:

-

If 17 million is the peak (U.S. auto sales) and 14.5 million the average, we’re going to see sales dipping from 17 million to 14.5 million and then trending upwards in an ever-higher orbit as the economy keeps growing.

-

We are NOT going to see a 10-million sales month (SAAR) unless another major recession hits.

-

Don’t expect automakers to hit record sales month after month in the next two years unless the Real Household Median Income dramatically starts growing beyond the current range. DO expect car sales to be at least above the 14.5 million range during that time.

-

Unless we’re hit by another major recession, I believe the market will realize this and start valuing GM, F and other stock higher over the coming quarters.

The case against auto stocks was built on the premise that U.S. auto sales were at their peak, and there was no chance of them going higher. Naturally, what that implied was that auto stocks needed a downward correction, at least that is how most investors reacted.

But the problem was that nobody was talking about a period of stable sales. If the economy keeps chugging along at a decent rate and credit is available for buyers, there is a very good chance for car sales to be stable. And that’s exactly what has happened in the last 24 months, and investors are now slowly getting back into the auto sector.

GM’s stock is up by 43% in the last one year, while Ford has moved up by 14%. U.S. auto sales did not plunge after hitting 18.051 million units (Seasonally adjusted Annual Rate) in December 2016, but stayed in the 16 million to 18 million range throughout the subsequent period. And the best part is that numbers have gone above 18 million in September 2017, and now everyone is talking about a strong 2017 finish.

“Auto industry publication WardsAuto put the seasonally-adjusted annualized rate (SAAR) for light vehicle sales in October at a robust level of 18 million units.

The U.S. auto industry posted record sales of 17.55 million vehicles in 2016. New sales received a strong boost in September as consumers replaced vehicles damaged in southeast Texas by Hurricane Harvey the previous month.

Full-year 2017 sales are expected to be slightly lower than 2016.” –Reuters

Well, there you go. Slightly lower than 2016 is what we are expecting now, not an apocalypse.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter