T-Mobile US, Inc., one of the fastest-growing and third largest wireless carrier in the United States, and Sprint Corp, the fourth largest wireless carrier backed by Japan-based SoftBank, have been talking about a merger for a long time. But cracks appeared in the negotiations and it looked as if Sprint’s chairman was ready to call off the talks.

But according to reports from the Wall Street Journal and The Verge, the talks may have resumed:

“T-Mobile US has restarted talks by presenting Sprint with a revised offer, and it’s still possible that a deal could be struck “within weeks.””

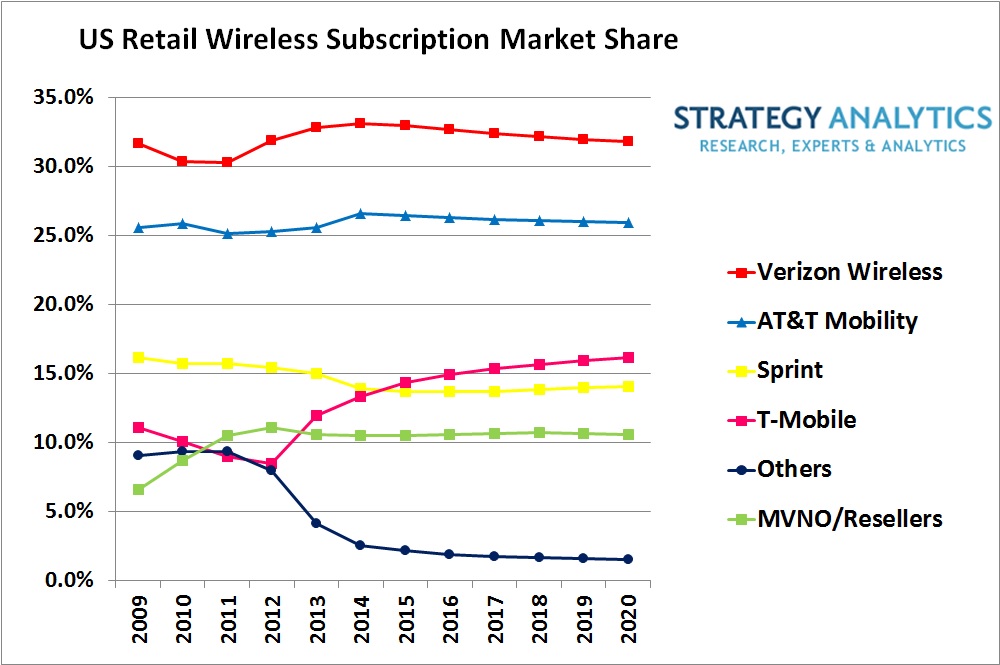

The wireless carrier market in the United States is one of the most mature markets in the world. It’s just another way of saying that growth is not going to be easy, because prospective customers have already become customers, and there is very little room for additional customers to be brought into the net.

If we look at the data from FierceWireless, the top five wireless carriers in the United States – Verizon, AT&T, T-Mobile and Sprint and US Cellular – had 416.8 million subscribers at the end of first quarter. The subscriber number is higher than the US population because there are a lot of people who own multiple subscriptions, and it also includes business customers.

The population is certainly not going to grow really fast and keep bringing in more and more customers to the pool, and with subscriptions already staying north of 100% penetration with respect to the population, growth is going to be really hard to come by.

The US wireless carrier market is dominated by Verizon and AT & T, and both companies have more than 130 million subscribers each, followed by T-Mobile with 72 million and Sprint with 58 million. Moreover, it’s an extremely capital-intensive business requiring billions of dollars of continuous investments to keep the technology and infrastructure up to date. So if you are not going to grow, things are going to get difficult really soon.

That’s the spot Sprint is sitting at right now. Sprint’s net operating revenue declined from $34.5 billion in 2015 to $33.3 billion, while total debt pile increased by nearly $7 billion. And for all this, Sprint reported a decline of 993 thousand average retail subscriptions during the period.

T-Mobile, on the other hand, has been growing at a breakneck speed, adding customers in the millions. Sprint certainly does not have huge leverage in the discussion except for the pool of customers it can bring to the table, its existing infrastructure and its spectrum holdings. Besides, it also carries a boat load of debt to go along with it.

T-Mobile, on the other hand, has been growing at a breakneck speed, adding customers in the millions. Sprint certainly does not have huge leverage in the discussion except for the pool of customers it can bring to the table, its existing infrastructure and its spectrum holdings. Besides, it also carries a boat load of debt to go along with it.

Naturally, T-Mobile is going to do its best to squeeze Sprint during the talks because they don’t really need the merger to happen as much as Sprint would want it to. So it’s not really a surprise that Sprint’s chairman wants to portray his willingness to walk away from the deal and extract some benefits or, more importantly, have some control over the newly formed entity if and and when the merger does happen. That’s likely why T-Mobile made the move this time and presented Sprint with a revised offer.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter