Tesla has been living off of debt for a while. That’s what happens when you start spending more than you make. Which means you will be bankrupt sooner or later, right? Bullsh*t, actually!

That’s the load of crap that has been peddled time and time again by innumerable articles recycled by my fraternity: The Media.

That’s the load of crap that has been peddled time and time again by innumerable articles recycled by my fraternity: The Media.

I’m not going to talk about other articles, but rather get to the point immediately: why it’s foolish to think Tesla Motors will go bankrupt. Bear with me while I walk you down this financial trail.

First of all, how does anyone or any company go bankrupt?

-

You can go bankrupt if you are not in a position to pay back your loan/interest.

-

When your debt overwhelms your assets.

Assets Vs Liabilities: The GM Case

Three years before GM filed its Chapter 11, the tell tale signs of bankruptcy were quite visible. GM’s total liabilities raced past its total assets. In fiscal 2006, GM carried $186.192 billion in assets against $190.443 billion in liabilities.

As losses mounted due to a sharp decline in sales in 2007 and 2008, the difference between assets and liabilities kept widening, pushing the company into bankruptcy. By the time it filed its Chapter 11 on June 9, 2009, GM’s assets had shrunk to $82.29 billion, while debt stood at $172.81 billion, or more than double.

During the most recent q,uarter Tesla reported total assets of $27.27 billion and total liabilities of $21.551 billion. GM carried on for two years before it was forced to file for its bankruptcy, despite not having enough assets to cover for its liabilities. So then, how much time will Tesla have?

The Case of Cash

Tesla has $2.665 billion in cash according to its recent quarterly filing. Tesla paid $149.54 million as interest expense during the quarter.

No one in their right mind will raise more debt or use all their cash for ramping up operations if they are on the verge of bankruptcy. The current level of cash will allow Tesla to pay its interest for 17 quarters, or more than four years. But Tesla does not need that much time; just two more years will see them through.

What about the Mounting Losses?

Yes. Operating loss is never a good thing. Sustained losses will certainly push any company underwater. Tesla’s operating loss was a staggering $3.623 billion between 2013 and 2017. You must have read about this so many times because this is one factor that will surely find its place in any article talking about the demise of Tesla. But what they will not discuss is the $2.931 billion Tesla spent on just Research and Development.

In fact, 2017 was the first time Tesla’s operating loss was more than what the company spent on R&D. If you are going to be bankrupt, then will you be spending so much money on R&D?

R&D expenses mount during new launches and then typically move lower. If Tesla is going to go bankrupt, then this is one line item that can easily be scaled back to improve operating numbers – or even push the company into profitability. Yes, it will require letting go of employees, shutting down a few projects and so on. But it is an easy way out if needed.

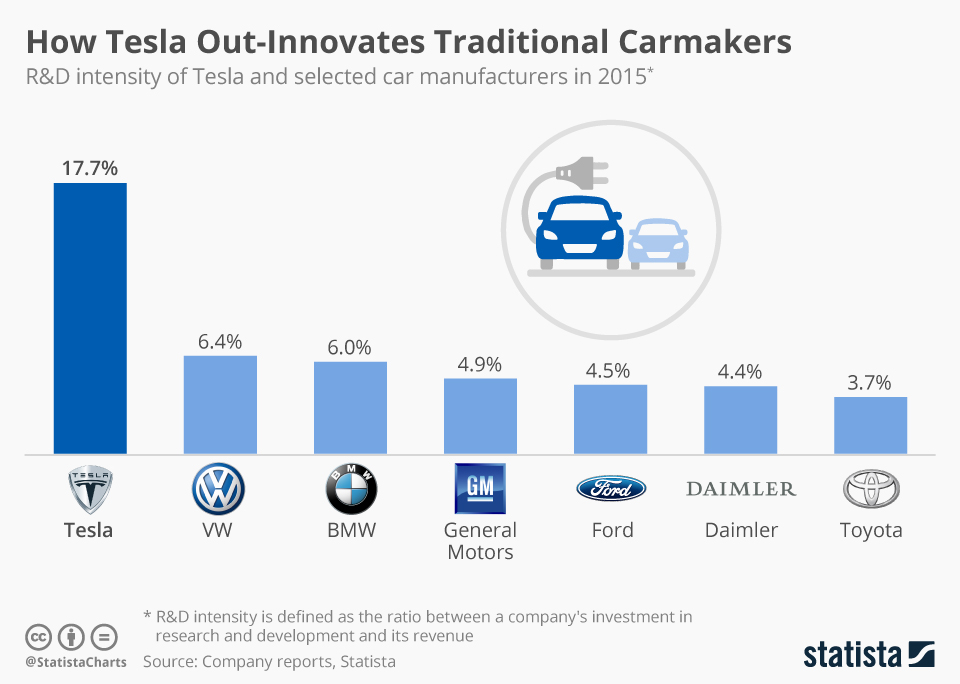

Tesla spent nearly 12% of its revenues towards R&D for the last two years, and nearly 18% in 2015, which is way more than other automakers. Imagine how much can they save by bringing it down to industry standards. But that’s not the way Tesla operates.

But There is Truckload of Debt

Yes. Long term debt has exploded from just $1.818 billion in 2014 to $9.415 billion by the end of 2017. Wouldn’t that be enough to sink the company? Maybe, but what about Tesla delivering 31,800 cars in 2014 and raising it to 103,184 cars by the end of 2017, boosting their revenue up from $3.198 billion to $11.758 billion?

Long term debt went up by 5.17 times, revenue up by 3.67 times and the number of cars delivered by 3.2 times.

Tesla Motors crossed the car production capacity milestone of 100,000 cars by the end of 2017. Divided by 54 weeks, that’s a weekly production capacity of around 1,900 cars. But the question we need to ask is: how much more debt+cash does Tesla need to burn before it starts to yield results to the bottom line?

It’s a difficult question to answer, but we don’t need to be rocket scientists to know that the higher the volume, the lower the average cost will be. So the more the volume moves, the better the operating results will be.

By April, Tesla had hit a production capacity of 2,270 Model 3 and 2,024 Model S and Model X cars in a week. That’s 4,294 cars a week, a bit more than double the capacity of what Tesla had at the end of 2017.

The damage was that Tesla’s cash holding reduced from $3.367 billion in December 31, 2017, to $2.665 billion by March 31, 2018. So, how much higher can production capacity go if Tesla burns another two billion dollars in the next six months? 7000+ cars per week now look within reach over the next couple of quarters.

But I don’t think Tesla will be in such a tearaway hurry to increase production to that level.

My guess is Tesla will start building it slow after crossing the 5000 cars per week (Model 3) production capacity. Because at that point, Tesla will be hitting an annual production capacity of over 250,000 cars, covering well over half of their current Model 3 reservations. Why burn through cash so hard and fast when growing incrementally will allow them to preserve cash.

The point is, Tesla has enough cash to push Model 3 production capacity to over 5,000 cars per week. There was one item I kept reading over and over again, and that was that Tesla burns $6,500 every minute.

Assuming $35,000 as the lowest price of Model 3 would mean Tesla will be bringing in $175 million every week. Which means Tesla will be making at least $17,361.11 every minute from just the Model 3. Not bad for a company that’s burning $6,500 every minute, right?

Ok. That $6,500 spent every minute is something that I read in lots of articles. It was a good way to make the articles deliver the Oh my God! moment. Irrespective of whether that’s the case, I have shown you clearly that Tesla spent less than a billion dollars during the first quarter of 2018, but was able to increase production by more than 2000 cars per week. They have enough cash to hit 5000-7000 car production per week and, at that level, the cost is going to be much lower than what it is now.

So, yes, Tesla is definitely going bankrupt. That’s the obvious story, right?