Elon Musk promised a few weeks ago that the short burn of the century is coming soon. I was expecting it to happen after Tesla’s second quarter earnings call, but it arrived a bit sooner than expected. Tesla shorts just burned $1.1 billion dollars in a single day. But they are just not going to stop.

Oh and uh short burn of the century comin soon. Flamethrowers should arrive just in time.

— Elon Musk (@elonmusk) May 4, 2018

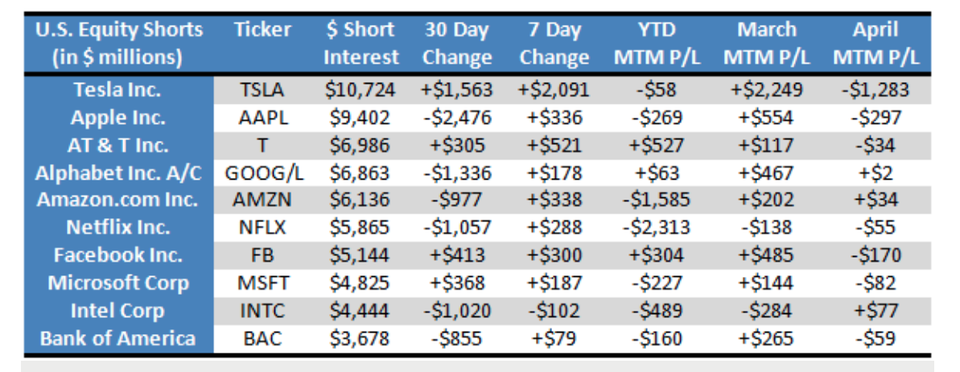

Before Tesla’s annual shareholder meeting this Tuesday, Tesla shorts had nearly $11.4 billion riding against the company. Elon Musk told investors at Tesla’s annual meeting that they are already building 3,500 Model 3s per week and may exceed 5000 Model 3s a week by the end of June.

As optimism surged in the meeting, Tesla share price surged by 9.7% the following day.

According to S3 partners, Tesla’s surge on Wednesday tripped short sellers by $1.1 billion.

#Tesla Shorts Down $1.1 billion in Mark-to-Market Losses on 9.74% Price Move. Year-to-date mark-to-market P/L is now in the red, down $754 million. $TSLA short interest is $11.0 billion, the largest U.S. equity short and largest short in the Auto Sector. https://t.co/lKZPJ3MrGQ pic.twitter.com/DHZ2kMLOWq

— Ihor Dusaniwsky (@ihors3) June 6, 2018

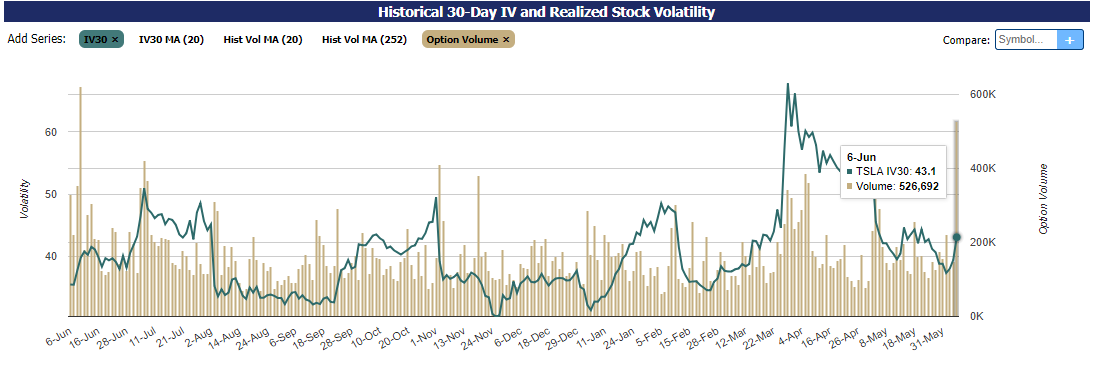

I thought Tesla shorts were piling up because they were singling out Tesla due to bad press, financials and so on. But it looks like they just love the volatility Tesla presents.

It’s high risk – high return trade. A trade that traders love.

But so far, things haven’t worked well for the shorts. Ihor Dusaniwsky, S3’s head of predictive analytics told CNBC that Tesla bears have lost nearly $5 billion in mark-to-market losses since 2016. And the odds are quite high for that number to pile up over the course of next six months.

Despite initial struggles, Model 3 production ramp up has gone well in the last few months. If Tesla breaches the 5000 Model 3s per week production target in June, things are only going to get progressively easy for Tesla and harder for Tesla shorts.

Source: Forbes (April 15, 2018)

But the shorts are not going to stop. Tesla is still the best risk vs reward candidate for them. Because Tesla moves big on news.

Source: Marketchameleon

Source: Marketchameleon