Tesla Model S is not just dominating its segment; its expanding it.

Model S pricing starts at $75,700 and goes as high as $136,200. From a pure price perspective, that covers competitors like BMW 5 series M550i (lower end) and Mercedes Benz S Class (higher end).

The price stretch opens up the possibility of attracting customers from multiple segments.

-

Luxury sedan segment customers

-

Large-size premium sedan customers upgrading to luxury segment

-

Luxury and premium SUV customers

We don’t really know how many low end Tesla Model S were sold and neither do we know how many high end Tesla Model S were sold. This makes it a bit difficult to clearly pin down which segment customers are buying Model S. But let’s give it a try.

Let’s simplify things a bit.

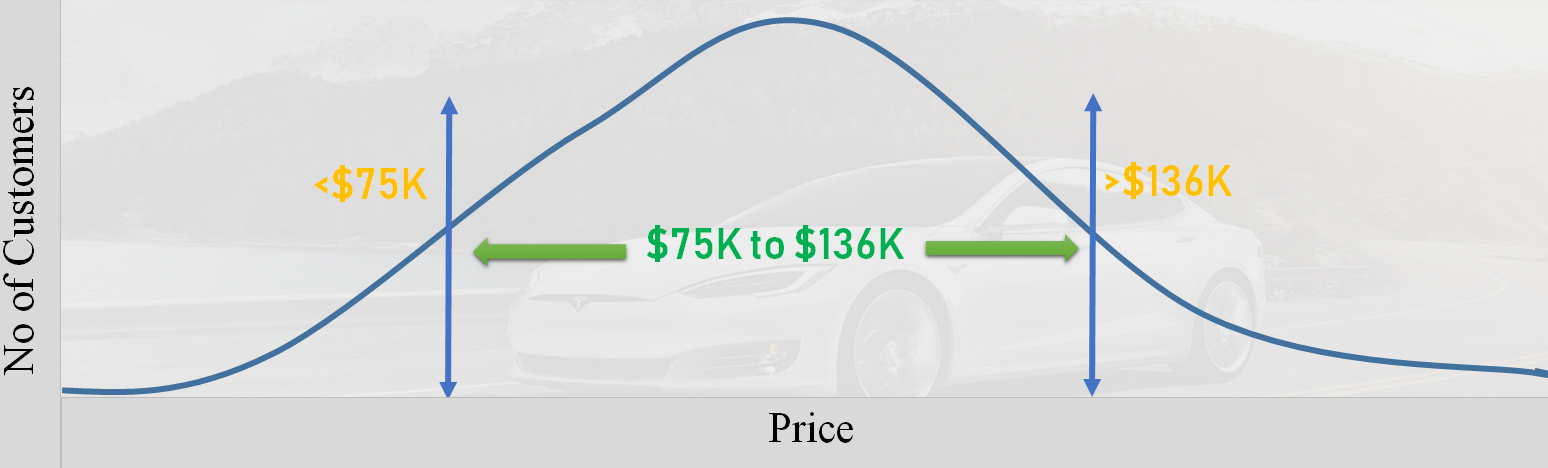

Tesla’s potential customers are the ones who are ready to shell out $75K to $136K. As a disruptive product with an aura around it, Tesla can convince customers who were planning to spend less than $75K, to upgrade themselves to a Tesla. Same goes for customers who are ready to spend more than $136K.

The further the price moves away from the median price of Tesla Model S, the lower the odds of a customer buying the electric sedan.

If I were to draw a chart, it will look like this.

The potential pool of customer base increases due to customers who fall outside the range. In case of Tesla, these are customers in the less than $75k and greater than $136k price point.

How many customers a car draws from outside the range depends on many different factors. Disruptive products always pull customers who fall outside their core market.

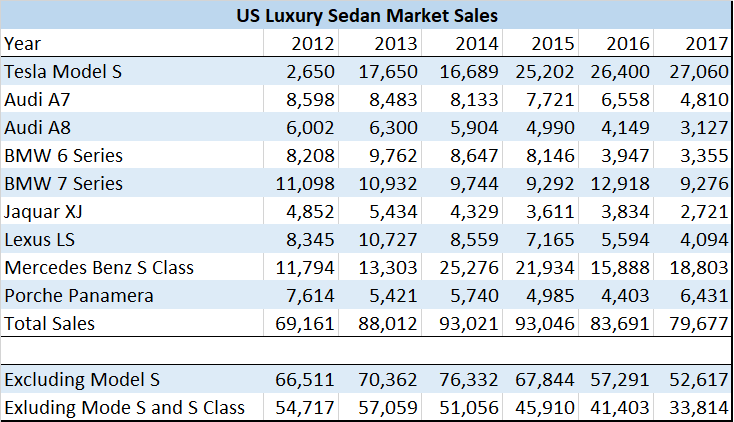

Tesla Model S competes with Audi A7 & A8, BMW 6&7 Series, Jaguar XJ, Lexus LS, Mercedes Benz S class and Porsche Panamera. In 2012, when Tesla Model S was launched, the luxury sedan market sold over 69K units.

The segment expanded to +93K units in 2015 before declining to +79K units in 2017.

Did US Luxury sedan segment enjoy favorable market conditions and a stable economy?

Little bit.

Between 2013 and 2016, the number of households making more than +100k has gone up from 22.6% to 26.2%, while median income increased by 6.9%. Decent growth but not spectacular enough to drive double digit growth in luxury sedan market.

If we exclude Model S and Mercedes Benz S Class, sales drops from +54K units in 2012 to +33K units in 2017.

-

US luxury sedan segment has expanded over the last five years.

-

If we remove Model S , market has shrunk.

-

If we remove Model S and Mercedes S class, market has shrunk sharply

Conclusion:

Tesla has drawn customers from other segments to expand US luxury sedan market.

Tesla is also taking customers away from existing players in the US luxury sedan market.

Tesla’s competition has been losing market share for the last four years and the slide is yet to be arrested. The slow growth in sales since 2015 shows that Tesla Model S is closer to its peak sales performance in United States. Further increase will only come at the cost of competition. And the odds are high for the current trend to continue.

You lose, I gain.

Other Sources: Goodcarbadcar, Forbes