Tesla is “Structurally Unprofitable”, that’s the term often used by Tesla shorts to brand Tesla as a cash guzzling company with no remorse.

“Three years ago, this company was supposed to be making money now,” Chanos, who’s betting against Tesla shares, said in an interview on Bloomberg Television. “Now it’s supposed to be making money by 2020. And I’m guessing by 2019, we’ll hear about 2025.”

But how much truth is backed into Tesla will never make any profits theory?

Why are automakers competing with a “Structurally Unprofitable” company?

Automakers around the world are rushing to build electric cars. General Motors, BMW, Mercedes-Benz, Ford, Volvo and the list is endless.

General Motors

With respect to Tesla’s competition, General Motors has stayed a step ahead of the crowd. It’s never easy for any company to change directions and its even more difficult for large companies with established markets. Despite that, GM moved very quickly, spending billion dollars to buy Cruise Automation, an autonomous driving technology company, built Chevy Bolt with a stunning 238 mile range. Stunning because they got it right at the first time and priced it squarely at $37,000.

GM is not the most profitable auto company in the world. They had to exit India, the fourth largest auto market in the world, sold off Opel and Vauxhall after accumulating billions of dollars in losses over the years in Europe. But went ahead and built an electric car, knowing fully well that margins are non-existent due to high battery costs and priced it squarely at 37,000. And that had nothing to do with Model 3’s price positioning?

In my opinion, GM did the right thing. They cannot let Tesla walk all over them. Though I like Tesla, I hate monopolies and GM has thrown a solid challenge to Model 3 in the form of Chevy Bolt – without worrying about how much hit their bottom-line will take.

Diamler AG/Mercedes Benz/

In his 2017 letter to shareholders, Dieter Zetsche, Chairman of Daimler AG and Head of Mercedes-Benz Cars writes..

“We are making use of our technological expertise and the profitability of our core business to vigorously tackle the major future issues of our industry. We summarize them under the acronym CASE. It stands for a combination of connectivity, autonomous driving, sharing and electric mobility. So it’s about nothing less than the reinvention of individual mobility.

We showed what that could look like at the Frankfurt Motor Show in the fall: The smart vision EQ fortwo concept car that we presented there drives to you autonomously and emission-free whenever you need it. Along the route, it suggests ride sharers with similar destinations. It is constantly in contact with the other cars in the fleet. Thanks to artificial intelligence, it drives in good time to where it will be needed next. That might sound like science fiction. But in the early 2020s, we at Mercedes-Benz want to put the first self-driving taxis on the roads.”

The science fiction Dieter Zetsche, Chairman of Daimler is talking about is exactly What Tesla is already doing with Tesla Auto Pilot and Neural Net. Tesla’s fleet is already accumulating millions of miles every month. When one car learns, all cars do.

Current Estimated Autopilot Miles: 1.2 billion

BMW

BMW went a step further. They used Elon Musk’s photograph to scare their employees into reality.

“We’re in the midst of an electric assault, the presenter intones as the Tesla chief’s photo pops up. “This must be taken very seriously.” The audience is composed of BMW AG employees flown in for a combination pep rally/horror film intended to make them afraid — very afraid — about the future of the industry.” – Australian Financial Review

So the truth is, short sellers seem to a know a lot more than what GM’s CEO, Diamler/Mercedes Chairman and BMW know about their own industry.

Why do well financed, profitable auto companies even bother about a company that is structurally unprofitable and worth a big ZERO? Wouldn’t a structurally unprofitable company go bankrupt soon?

Three years ago, Tesla was supposed to be bankrupt. Now it’s supposed to be bankrupt by 2020. And I’m guessing by 2019, we’ll hear about 2025. Dah!

How unprofitable is Tesla?

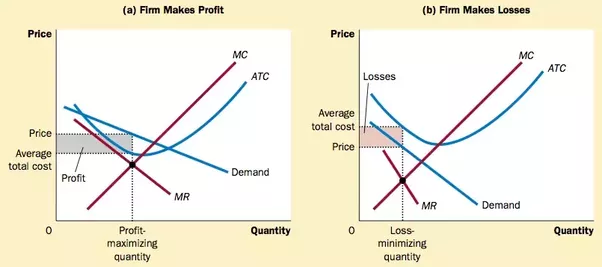

To be exact, Tesla has accumulated a mind boggling operating loss of $4.187 billion from 2008 to 2017, when the company went from there is no Tesla on the road to more than 300,000 Tesla on the road.

During this period, Tesla brought in $28.87 billion in revenue, while spending $4.276 billion in research and development. When calculated as % of revenue, Tesla’s accumulated R&D expense stands at 14.80%.

In 2017, Volkswagen spent 6.67% of its revenue on R&D, General Motors 5.01%, Mercedes-Benz 7.01% and BMW 6.19%. So irrespective of their earnings, Mercedes-Benz at €94 billion and Volkswagen at €196 billion, auto companies spend around 5% of their revenue in R&D.

In 2017, Volkswagen spent 6.67% of its revenue on R&D, General Motors 5.01%, Mercedes-Benz 7.01% and BMW 6.19%. So irrespective of their earnings, Mercedes-Benz at €94 billion and Volkswagen at €196 billion, auto companies spend around 5% of their revenue in R&D.

What will be Tesla’s operating income or loss, if the company re-adjusted its spending to industry standards. When R&D spending is capped at 5% of revenue, Tesla’s accumulated ten year operating loss will be $1.354 billion. If we exclude 2017, operating loss was just $512 million.

$512 million in nine years, an average of $56.6 million per year. Now I can understand why Tesla is a structurally unprofitable company.

How Unprofitable is Tesla then ?

Ever heard the term sub-letting.

If you have rented a 100,000 square foot office and you are using only 24,000 square feet, then you will certainly look to sub-let the unused office space. Why? Because you are paying rent for the entire property, not for the portion you are currently using.

So, unless utilization gets closer to maximum capacity of the commercial space, you are leaving money on the table.

Manufacturing plants are no different. That’s why in Economics there is a term called Optimum Capacity.

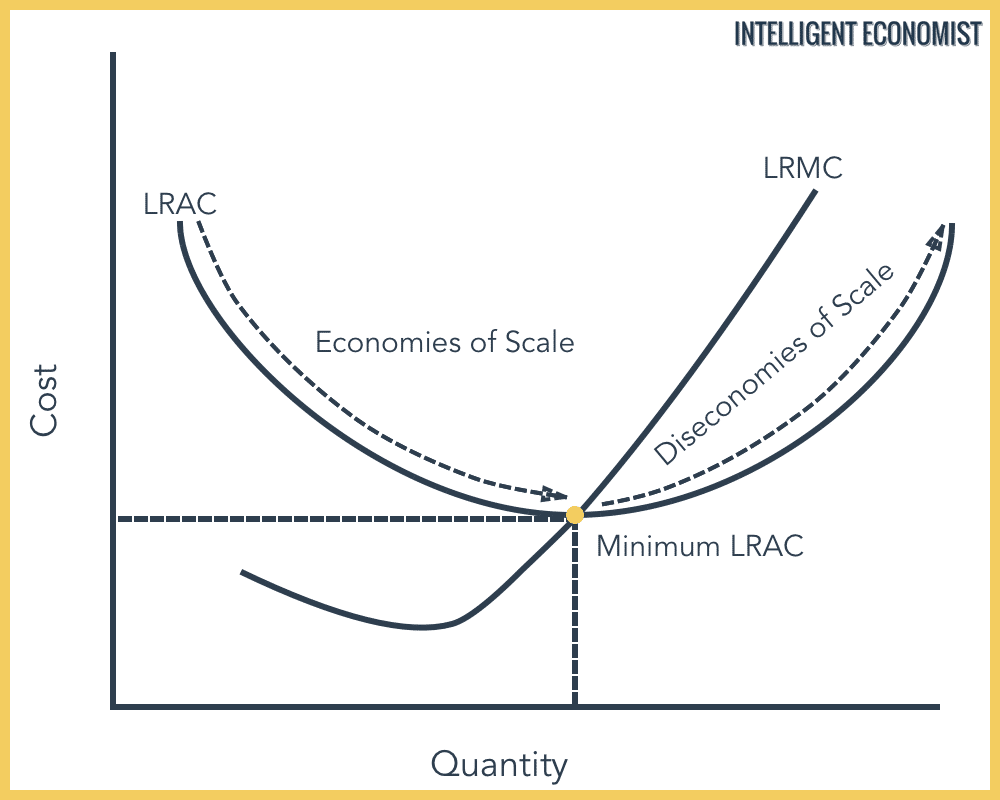

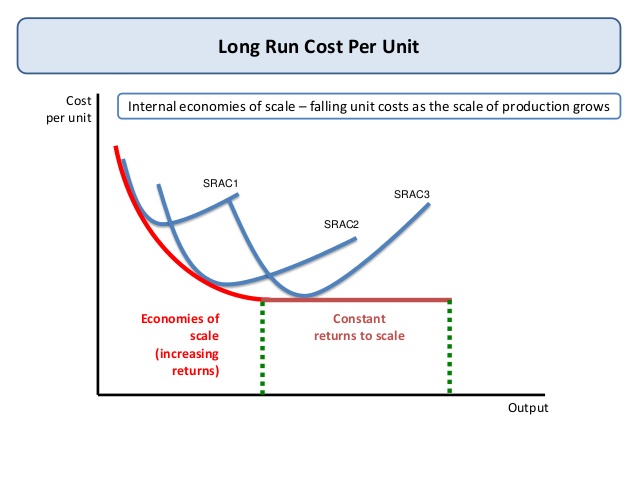

optimum capacity – “The production capacity at which cost per unit is minimized. For a production system that shows economies of scale, this is usually the point at which the marginal cost of producing one extra unit equals the average cost of producing one unit.” – Investorwords

Any manufacturing plant that is sub-max output is leaving money on the table and their per unit margins will have to pay the differential price.

What is the planned capacity of Telsa’s Fremont Factory and Gigafactory 1?

Gigafactory 1: 500,000

Fremont : 428,633 (L)

Both Gigafactory 1 and Tesla’s Fremont Facility are nowhere near these levels. They are getting closer only now and might reach their optimal production capacity later this year or early next year depending on their production ramp.

Tesla delivered 103,020 vehicles in 2017.

So Tesla was at (less than) one fourth of its max production capacity by the end of 2017 and we are talking about structural profitability. (Max Capacity will be closer to Optimal capacity and not far away from it)

When was the last time you came across an article that spoke about by how many factors Tesla’s per unit margin will expand when the company reaches optimal production capacity?

Can you please share the name of a wall street analyst who discussed it? Where do you think Tesla is in the LRAC (Long Run Average Cost) curve below?