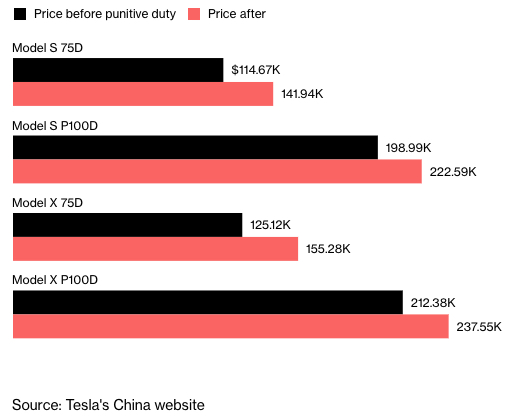

Tesla Motors’ plans to build a Gigafactory in China have a challenging environment to deal with. Notwithstanding the fact that Tesla – with only $2.7 billion cash on hand as at the end of the first quarter of 2018 – needs to pay a yet-to-be-revealed sum (current estimate is $5 billion) to build the Lingang facility, the company now has to deal with the effects of the trade stand-off between the US and China. Here’s a look at how much their models cost after punitive tariffs have been applied (source: Bloomberg)

With the additional 10%+ load on the price of its EVs, sales in China will inevitably take a hit, however small. The only way to deal with the problem is to generate more funds outside China, and that’s what the company is doing as it shuts down the reservation system in the US and Canada and throws open the “configurator” to everyone. A non-refundable down payment of $3,500 and a Model 3 can be yours. Of course, you’ll have to wait a couple of years until all reservations have been fulfilled, and that’s a tall order in itself.

Tesla could potentially offset its China factory costs by partnering locally with a battery maker. Panasonic wouldn’t be in the running, of course, being a Japanese company, so it would have to be someone like Contemporary Amperex Technology Ltd, or CATL. But at least it would give Tesla some leverage in negotiations with the Chinese government if they went that route.

The most important aspect of this delicate balancing act for Tesla is that Model 3 production must be kept at the 5,000 cars a week level in a sustained manner. They hit that goal at the end of June and have sustained it during early July, and it’s critical that they maintain that pace.

The new configurator ordering system that launched this week should give some breathing space in the short term, but the question of how Tesla will pay for the Chinese Gigafactory is still under a cloud. The most likely route will be a phased approach with “modules” that can be added to the base production capability over time. The final capacity goal is 500,000 cars a year and production start is expected in 2020. By then, Tesla will have fulfilled all of its current global reservations and, hopefully, stabilized its cash flows based on ongoing Model 3 sales.

Tesla already has huge cash requirements. The Nevada Gigafactory itself is a $5 billion project, and there are lots of others waiting in the wings, like the Tesla Semi, the new Roadster, the Model Y crossover SUV and possibly even a pick-up truck, not to mention what it’s already spending on the Fremont factory modifications.

The China Gigafactory is merely another speed bump in Tesla’s road to creating a world of mass-produced EVs with the range and cost to rival smaller ICE (internal combustion engine) cars. Help in China could come from Tencent, an existing stakeholder that bought a 5% stake in TSLA last year, or it could come from the Chinese government itself, which is keen on growing its leadership position in the EV space. Whatever the case, Tesla is working on the ground in China to make sure that any ill effects of Trump’s actions against China are minimized by going local.

There’s no doubt Tesla is going to be doing a financial balancing act for the next several years, and the negative media coverage about Musk and Tesla isn’t going to stop. It’s probably going to get worse before it finally fizzles out and major media brands jump over the wall to Tesla’s side. This is a company that cannot afford to fail. And if Musk has his way, it won’t.