After playing hide and seek with 200,000 EV sales in United States during the second quarter, Tesla has made it unofficially-official that they have crossed the 200k milestone some time in July, 2018.

Tesla updated its support page (link), with a clear timeline on Federal Tax Credit phase out.

The following federal income tax credits are available to anyone who purchases a new Tesla Model S, Model X or Model 3:

Federal Tax Credit: Once an EV manufacturer sells 200,000 units in the United States, vehicles sold during the quarter that happens as well as the following quarter get the full tax rebate of $7,500. The credit is reduced to $3,750 for the next 6 months, then to $1,875 for the next 6 months and then it expires completely.

Tesla customers in United States have been worried for a very long time whether they will be eligible for Federal Tax Credit. The announcement now clears all the confusion and will be of great help to customers sitting on the fence about ordering their cars.

The 200,000 milestone is still guesswork as there is no official release from Tesla. But being a public company Tesla will never take the risk of announcing the federal tax credit phase out timeline before reaching the milestone. I could be wrong and look like a fool for saying Tesla crossed 200k cumulative sales in United States in July. But I am confident that I am correct.

“Automakers other than GM and Tesla, such as Toyota , Nissan and Ford , are nowhere near the 200,000 vehicle limit. For example Nissan has sold 115,000 of its all-electric Nissan Leaf in the U.S. since it went on sale in 2010.” – CNN

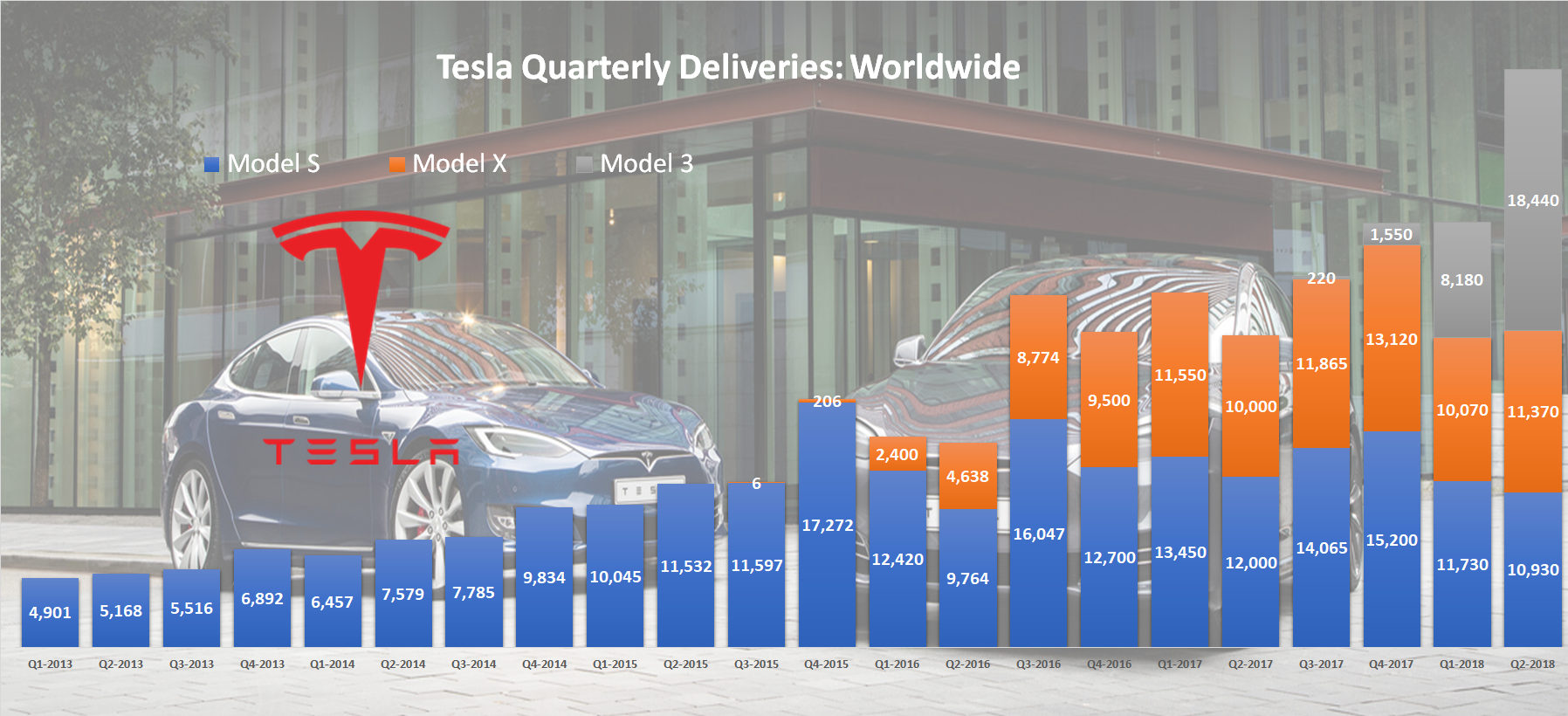

Tesla’s worldwide sales crossed 100,000 units in Q4-2015, 200,000 in Q1-2017 and 300,000 in Q1-2018.

Update 14.July.2018 – Tesla confirmed to cleantechnica and other news sites that they have crossed 200,000 unit sales in the United States.