The Action

After expressing his disappointment over the endless list of contracts, sub-contracts and sub-sub contracts extracting a toll on costs in April, Tesla CEO Elon Musk has finally decided to do something about it.

“I have been disappointed to discover how many contractor companies are interwoven throughout Tesla. Often, it is like a Russian nesting doll of contractor, subcontractor, sub-subcontractor, etc. before you finally find someone doing actual work. This means a lot of middle-managers adding cost but not doing anything obviously useful. Also, many contracts are essentially open time & materials, not fixed price and duration, which creates an incentive to turn molehills into mountains, as they never want to end the money train.” – Elon Musk

Tesla confirmed to WSJ that the company is “seeking price reductions from suppliers for projects, some of which date back to 2016”.

The Reaction: WSJ Article

WSJ Author Tim Higgins, writes “Tesla has asked some suppliers to refund a portion of what the electric-car company has spent previously, an appeal that reflects the auto maker’s urgency to sustain operations during a critical production period.”

urgency to sustain operations?

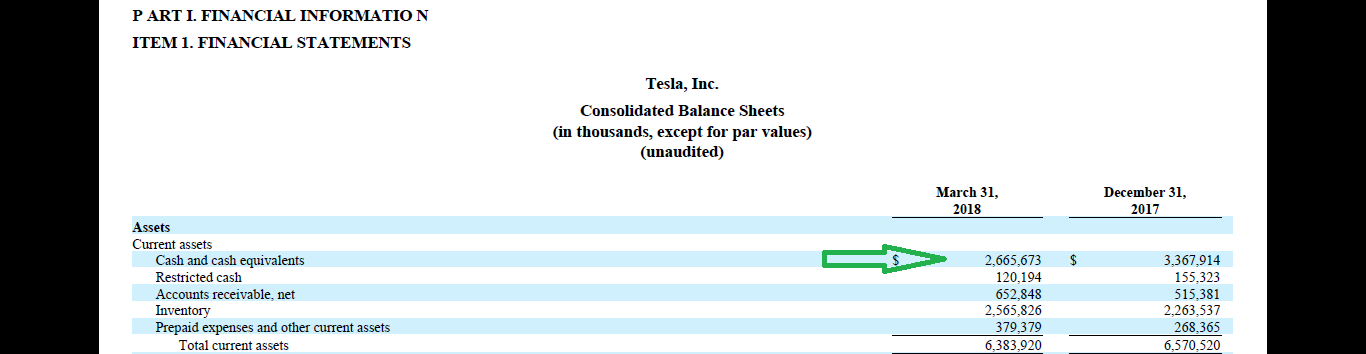

Tesla reported cash balance of $2.665 billion at the end of first quarter 2018. They are yet to release their Q2 reports. As of now, Tesla’s Cash Balance is Insider Information.

According to the author, “Tesla requested the supplier return what it calls a meaningful amount of money of its payments since 2016”. Unfortunately he did not explain, how Tesla expects the “meaningful amount of money” to be returned.

Is it a straight forward cash deposit or a pricing discount applied to future orders based on the size of historical order volume?

A commentor on Electrek clearly explained how cashback/volume incentives work in the manufacturing industry.

“Cashback (rebates/incentives) agreements work as follows: upfront negotiations agree on a price for the first, say, 50k parts, since the supplier will be spending on R&D, they will need to negotiate for a higher price upfront. Once the 50k units have been shipped, a cashback then comes into effect, say 10% reduction in the amount that was paid, because the upfront costs are now shown to be spread over a large production base, and hence the gross margin can be dropped. Tesla is simply asking for the cashback negotiations to be honored at this time – they are essentially reminding suppliers of this agreement and asking for the payment to be made at this time. This is very common in OEM industries.”

Elon’s statement makes it clear that they are asking for cuts in costs going forward, not backwards.

Only costs that actually apply to Q3 & beyond will be counted. It would not be correct to apply historical cost savings to current quarter.

— Elon Musk (@elonmusk) July 23, 2018

If you run a manufacturing company and decide to ask for volume discounts to your suppliers, will you not talk about how much you have paid them in the past and your future plans. How else will you negotiate?

If you are talking to your current suppliers, what is the point in asking for discounts to be deposited in cash, when you can generate the same cash by reducing the price on current/future orders?

“America will never be destroyed from the outside. If we falter and lose our freedoms, it will be because we destroyed ourselves.”

-Abraham Lincoln

Here is small list of companies with an urgency. Tesla – the Retailer

Walmart:

Reuters (Feb 27, 2017): “The big box retailer also held meetings last week in Bentonville, Arkansas with food and consumer products vendors, including Procter & Gamble, Unilever PLC, Conagra Brands Inc, and demanded they reduce the cost they charge the retailer by 15 percent.”

WSJ ( March 31, 2015): “A team at Wal-Mart closely monitors commodity prices and asks suppliers to reduce costs when it observes downward trends in ingredients prices.”

“I’d be disappointed in a business of our scale and size that’s not on top of that—reaffirmation of everyday low prices—I’m a very strong support of that… and ensuring that we negotiate the very best price and then pass it on to our customers.”

– Greg Foran, Walmart US CEO

Amazon:

WSJ Feb 8, 2018: “According to a letter Whole Foods sent to some suppliers in December, vendors selling an annual $300,000 in products in stores will be required to pay a fee each time their products are reorganized on shelves or added to new stores, starting in April. Grocery suppliers will pay a fee of 3% of the cost of goods delivered, and beauty suppliers will pay 5%.”

Bloomberg, March 2018:” Amazon.com Inc., locked in a margin-crushing price war, is offloading costs onto suppliers and limiting the number of single, low-priced items shoppers can purchase in an effort to offset rising shipping costs.

In a marked shift in strategy, the e-commerce giant is raising transportation fees for suppliers of beverages, diapers and other heavy, bulky products that are expensive to ship, say two people familiar with the matter”

“Amazon’s push to cut costs and foist them on suppliers — a tactic Walmart has been using for decades.” – Bloomberg

Walmart reported cash balance of $6.8 billion and $6.9 billion in 2018 and 2017. While Amazon reported cash balance of $19.334 billion and $15.890 billion in 2017 and 2016. Both the retailers who are flush with cash, stayed aggressive about pricing and the statement by their executives show that they want to pass on the benefit to the customers, by driving the costs down.

Apple, a company with hundreds of billions in cash:

“We think Apple has been pushing for price discounts from multiple suppliers as a way to dampen foreign-exchange headwinds Apple is facing on their own P&L heading into the iPhone 7 ramps,” – RBC analyst Amit Daryanani

Tesla a Real Car Company

After years of ramping up and spending billions of dollars in building capacity, Tesla is fast approaching max production capacity in its Fremont Factory, California.

The transition from a car manufacturer building few thousand cars every year to nearly 7000 cars every week, prompted CEO Elon Musk to say that “I think we just became a real car company” in July, a statement that reflects the automaker is fast approaching economies of scale.

Tesla has been extremely aggressive in the last few months about its spending. The company slashed 9% of its workforce in June. Elon Musk in an email to employees specifically noted that any expense that crosses a million dollars needs his approval.

“A fair criticism leveled at Tesla by outside critics is that you’re not a real company unless you generate a profit, meaning simply that revenue exceeds costs,” Musk wrote in his email to employees in April this year. “It didn’t make sense to do that until reaching economies of scale, but now we are there.”

Apart from cutting its workforce, tightening its spending, Tesla is now taking a leaf out of big retailers playbook and pressuring its long term suppliers to help improve its bottom line.

Is Tesla Cutting Costs to help it launch $35,000 Model 3 as quickly as possible?

Big retailers keep suppliers under pricing pressure so that they can hold their own margins intact, while transferring some of the cost benefits to customers.

Tesla has been long criticized for delaying the launch of $35,000 Model 3.

Tesla, has been slowly bringing down the cost of Model 3 variants that are available on sale. When launched, Tesla’s Model 3 Performance edition carried a price tag of $78,000. Tesla unbundled the options and brought the price down to $64,000. The price of Long Range Dual Motor variant dropped from $55,000 to $54,000.

Two different reports from Model 3 teardown, have already made it clear that Model 3 enjoys a healthy gross margin.

As production ramps up, the per unit cost of production will keep falling and the further Tesla pushes the cost down, the easier it will be for the company to pass on the benefits to the customer.

By slashing costs aggressively, Tesla could be inching closer to $35,000 Model 3.

Here is the Timeline of Tesla’s Cost Saving Measures and Some Recent Developments:

Tesla has repeatedly made it clear that the company will not need additional fundraising this year. The company has taken it upon itself to restructure and improve operational as well as cost efficiency.

17 April 2018: Elon Musk says All capital or other expenditures above a million dollars, should be considered on hold until explicitly approved by me.

12 June 2018: Tesla announces a 9% workforce reduction. Hits salaried positions and not production associates.

12 June 2018. Ends its partnership with Home Depot. Announces that Solar offerings will be sold through its retail locations.

22 June 2018: Tesla cuts nearly 20% of its Solarcity installation locations.

27 June 2018: Invites all Model 3 reservation holders in North America to order after slashing Model 3 price

9 July 2018: Drops reservation system and allows anyone to order Model 3

17 July 2018: Sandy Munro, president of Michigan-based Munro & Associates says “Model 3 sedan is the most profitable electric car in the automotive industry”

19 July 2018: Dan Neil (WSJ) Calls Tesla Model 3 Performance: A Thrilling, Modern Marvel.

22 July 2018: Tesla tells WSJ that the company is “seeking price reductions from suppliers for projects, some of which date back to 2016”.

Please take a minute to share the article with your friends and followers.

Important Sources:

Forbes: Greg Foran

Walmart: 2018 Annual Report

RBC Analyst: Investors.com:

Elon Musk: Real Car Company: