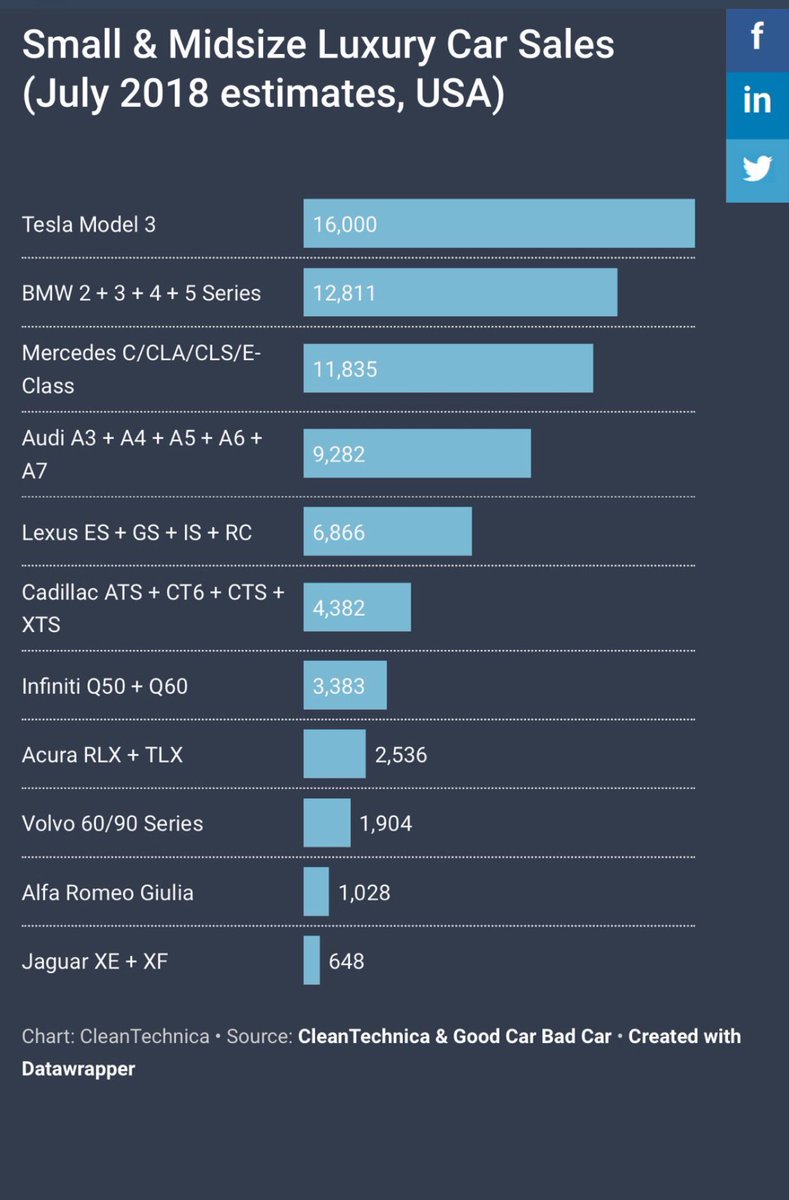

CleanTechnica’s Zachary Shahan did some number crunching that lead him to a surprising find, Tesla Model 3 is crushing it’s competition in the US Small & Midsize Luxury Segment.

According to his estimates, Tesla Model 3 sales in July will hit 16,000 units. A formidable number as no other car maker sells that many cars in the US Small & Midsize Luxury Segment.

Car makers have plenty of models competing within the same segment and comparison will be a bit unfair to the competition as Tesla has only one model. So Zach combined sales of multiple models in the small and midsize luxury car classes and compared them to Model 3. The result is this

Zach’s estimates look fairly reasonable because in the last seven days of June, Tesla manufactured 5,031 Model 3. According to Tesla’s Q2 2018 Vehicle Production and Deliveries report 11,166 Model 3 were in transit to customers at the end of June.

Even if production pace was pulled back in July, Tesla had enough inventory on hand to deliver more than 16,000 Model 3s in July.

One of the famous negative theory that has been spread around is Tesla Model 3 sales is weak and cars are baking in many different lots in California. Though it’s not unusal for automakers around the world to park cars in a holding area before shipping them to customers, Tesla shorts have fell in love with this lack of Model 3 demand theory.

But a quick visit to Reddit, Twitter and Tesla forums will show plenty of customers taking delivery of their Model 3 and some even complaining about the agonizing last few weeks of waiting.

I literally check my #Tesla account 10x per day to see if it’s closer to delivery- like thousands of others. The short thesis that $tsla staging areas are a means of hiding cars because nobody wants them is a lie that takes a great deal of will to believe.

— alpha_nerd (@ron_kerensky) July 29, 2018

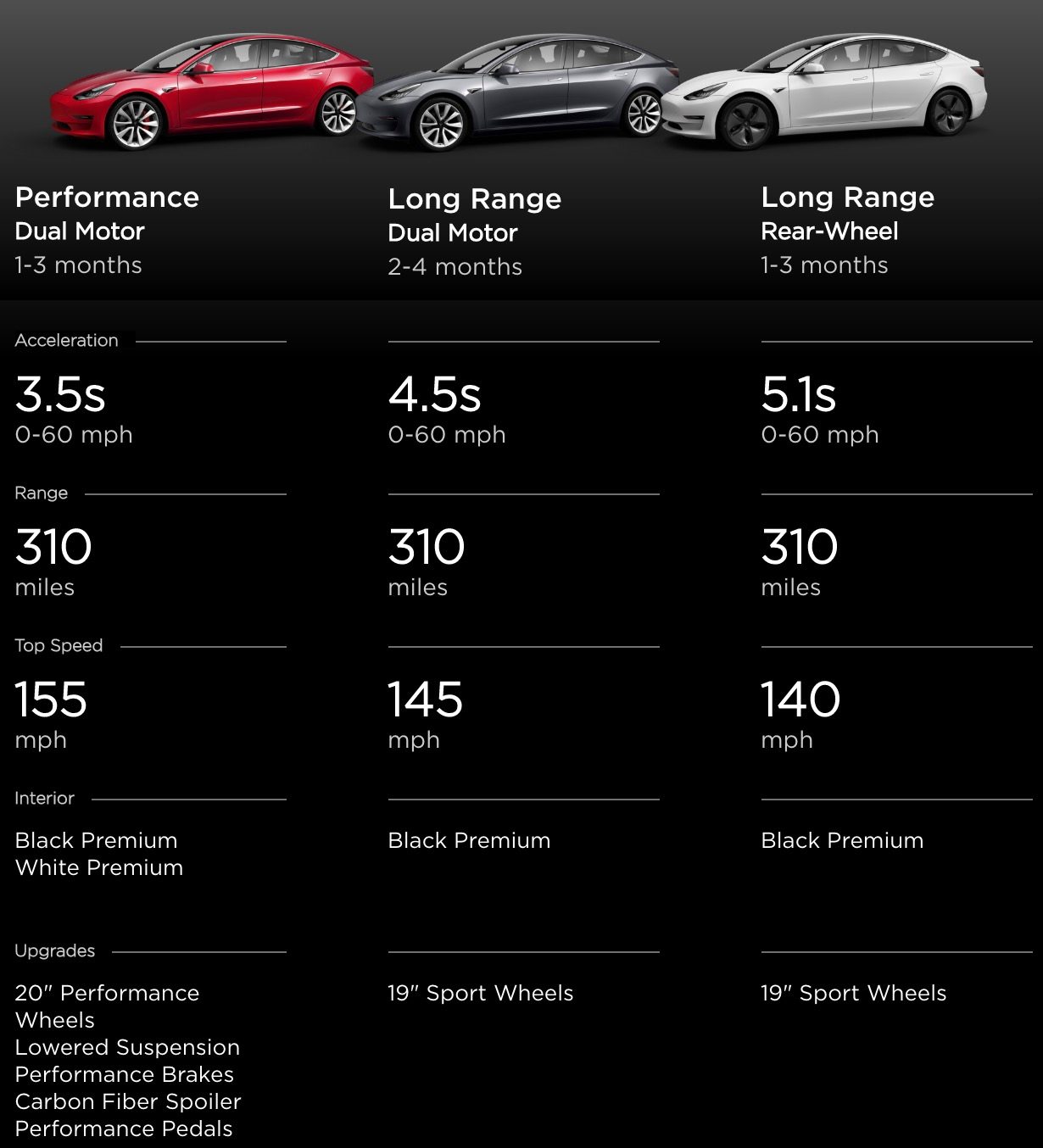

Customer who took delivery of Tesla Model 3 Performance Version on 7/26/2018, “The store was very busy; multiple other people taking delivery at same time and a ton of foot traffic with lots of people crowding around the showroom cars”

Another customer who took delivery of Rear Wheel Drive Model 3, ” I was glad the cars were outside as it was easy to inspect. Our friendly Tesla staffer found us after about a 10 minute wait. He was working with two groups at a time, which worked very well as it gave me enough time to inspect.

The facility was busy! Lots of families and excited folks waiting or inspecting their cars. This was definitely not the experience of picking up an S a couple years ago (my guest with an S told me so), but I thought it was efficient and comfortable. There were couches, water, coffee, pretzels and yogurt. There was also a stand selling Tesla swag and accessories. Paperwork took about five minutes.”

Tesla Delivery Center in Fremont, CA

As you can see from the picture, there is not much space to park new cars for delivery. Delivery center is packed to the gills. It takes time when you have to deliver hundreds of cars every day. Even if you manage to keep your scheduling perfect, you will still need a large parking lot to hold cars and move them batch by batch to the delivery center. It’s logistics 101, but somehow got lost in Twitter.

Now that we have addressed the “Tesla Cars are baking in the Sun” theory, let us turn our attention back to Tesla’s performance in the US Small & Midsize luxury segment.

In 2017, the US Small & Midsize luxury segment had 42 different models reporting combined sales of 755,782 units. An average of just 14,532 monthly units. Tesla may have sailed over the monthly average in July, thanks to the backlog of an estimated +200K customers in the country.

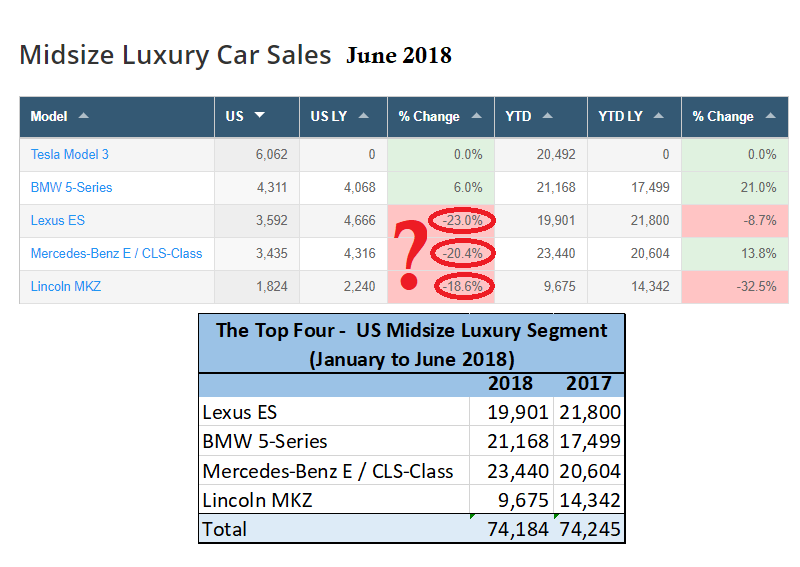

But can someone explain the weird phenomenon of the top four dogs of US Midsize Luxury Segment, BMW 5, Mercedes-Benz E/CLS, Lexus ES and Lincoln MKZ reporting sales growth of 6.0%, -23%, -20.4% and -18.6% in June while the group had near flat growth in the first six months of 2018 when compared to last year.

Tesla delivered 8,180 and 18,440 Model 3 in Q1-2018 (Jan to March) and Q2-2018 (April to June).

Why did Jan to June Midsize luxury segment sales increase from 129,855 units last year to 142,193 units this year? A growth of 9.5%. But the US small size luxury segment sales drop from 227,257 units last year to 203,737 units this year. A decline of 10.3%.

-

Tesla Model 3 has pulled customers up from a segment below.

-

If the trend of top four losing orders in June continues in July, it’s clear that Tesla’s new reservations are continuing to grow at a brisk pace. (We don’t have to wait that long for confirmation because we only have two more days left in July and sales numbers will roll in next week)

If Zach’s estimates get closer to reality, which I believe it will, Tesla will further dent sales of last year’s top ranked cars in the US Midsize luxury segment. The unusual trend of new customers walking away from well known luxury brands can be directly attributed to Tesla’s shrinking delivery timeline.

And we don’t even have the $35K model yet.

Sources:

TMC Forum: Customer 1, Customer 2

US Small & Midsize Sales in United States: Jan 2018 to June 2018